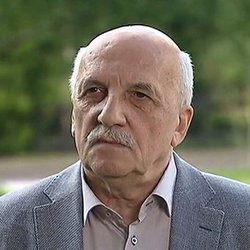

Nikolay Kolesov purchases KETZ from Rostec for nearly 600m rubles

Rostec sold 42,6% of shares of Kazan Electrotechnical Plant due to the impossibility of getting control in this enterprise

Rostec state corporation sold 42,6% shares of Kazan Electrotechnical Plant (KETZ) PJSC, which got them a year ago as a result of an exchange deal with the government of Tatarstan. As Realnoe Vremya found out, Elekon Plant PJSC was the purchaser that bought these shares at an electronic auction for nearly 600 million rubles. The sources close to the financial and industrial group of famous businessman Nikolay Kolesov claim that the deal with RT-Kapital was a necessary legal formality, as the enterprise had long been working under its informal patronage, and “nothing will change now”. It is noteworthy that Rostec sold the asset almost without an award, it almost sold it for the price it bought the plant from the Tatarstan government. The end client must transfer Rostec the full sum of the purchase within two weeks.

Not a stranger?

RT-Capital completed the sale of 42,6% of shares of Kazan Electrotechnical Plant PJSC, which were at an auction in February on the instruction of Rostec GC. According to the official message, Zavod Elecon PJSC from Kazan, which is under Nikolay Kolesov’s financial and industrial group’s control, was recognised the winner of the auction. The Kazan enterprise purchased the shares for the initial price of 588,8 million rubles (including VAT) without a rise in price at the auction. “Two participants applied for the auction, but the deal was in fact sealed with the only purchaser,” a source at RT-Kapital noted. It remained unknown who was the second player. “The asset has been sold,” reads the information card of RT-Capital.

The coronavirus pandemic didn’t impede the participants from going to auction. KETZ was sold strictly on time — on 29 May. The organisers didn’t have to postpone the auction, as it often happens in RT-Capital’s experience. So Nikolay Kolesov’s group, which includes Elecon, KOMS, Stella-K from Kazan, now obtained an enterprise making identification systems.

KETZ is a profitable enterprise. In 2019, the revenue totalled 4,1 billion rubles, while net profit is over a billion rubles. After the deal. Elecon will become the biggest shareholder of KETZ. According to SPARK-Interfax, the other owners are KOMZ factory (14,03%), High Technologies — 19,13%, MACRON-ST — 19,13%, River-park — 10%.

KETZ no more under Rostec’s control

As RT-Capital explained, Rostec continues its policy on increasing the effective management of non-core assets. In February, the organiser of auctions published an announcement it was receiving applications to purchase 716,684 common shares of the enterprise in whose assets Rostec wasn’t interested any more. Why?

“The shares were purchased within a deal with the Republic of Tatarstan on the exchange of minority shares of KAMAZ PJSC for shares of some organisations that belong to Svyazinvestneftekhim JSC, including 4,6% of KETZ JSC,” Realnoe Vremya was explained earlier in the press service of the company. “However, nowadays it is impossible to increase the share of RT-Capital LLC at KETZ JSC to control this is why it was made a decision to sell the shares to a private investor”. In the end, RT-Capital announced an open auction to sale minority shares of Kazan Electrotechnical Plant Joint-Stock Company.

But we can’t say that KETZ is simply ready to be given to private hands. As RT-Capital’s press service said, Rostec imposes certain restrictions on the future purchaser. Together with submitting an application to purchase the shares, a candidate is obliged to sign a declaration on conservation of the profile of KETZ, which will become an indispensable part of the contract to purchase the shares. “Given the importance of the enterprise for the region, RT-Capital took additional measures to preserve the production profile of business and staff of the plant. Auction documentation envisages that participants in the auction must provide declarations on their intention to meet current contractual obligations of KETZ JSC, including in the State Defence Order and mobilisation task the plant has,” the press service of RT-Capital stressed. The other 58% of shares still belong to the structures that are controlled by KRET’s head Nikolay Kolesov. KETZ Board Chairwoman is his daughter Anastasia Kolesova, and the board chairman of Tatsotsbank JSC. The sources close to the financial and industrial group of famous businessman Nikolay Kolesov claim that the deal with RT-Capital was a necessary juridical formality, as the enterprise had long been working under its informal patronage, and “nothing will change now”. According to them, Nikolay Kolesov isn’t going to change the management of KETZ. However, we shouldn’t wait for the end of the deal. As RT-Capital said, Elekon must send about 600 million rubles within two weeks.

The management of KETZ said they learn about the sale of the former state share from RT-Capital. “Is KETZ a non-core asset? It is the most vulgar joke in Tatarstan defence,” Realnoe Vremya’s interlocutor laughs. “We supply components for the defence industry since the birthday of our factory with password 708. What does a non-core asset mean now?” he doesn’t understand.

Rostec supplies electronic counter-countermeasure to KAMAZ

So how did Rostec get the state stake of KETZ, and why did the state corporation decide to quickly get rid of it?

As Realnoe Vremya already said, Rostec and Tatarstan agreed on parameters of the deal in November 2081: Rostec gave the government of the republic 2,6% of KAMAZ shares and got shares of three defence enterprises of Tatarstan for 2,6 billion rubles in total instead. The value of the deal was “adjusted” to the price of KAMAZ shares. In reply, Tatarstan made an offer with assets whose price was equal to this sum.

So Rostec got the state stake of Radiopribor from Kazan for 1,8 billion rubles, Radiopribor plant from Almetyevsk for 274 million rubles and KETZ for 580 million rubles. The reason for the exchange was unofficially explained as a plant to protect KAMAZ from a possible negative impact of American sanctions against Rostec. So due to the exchange deal, Rostec’s share in KAMAZ capital reduced from 49,9% to 47,3%. The main goal — to reduce Rostec’s share in the joint stock to the level below the controlling interest was achieved.

Not the Ministry of Land and Property Relations but Svyazinvestneftekhim state holding was the agent of the asset exchange. The press service of the latter explained that the deal with cash was impossible because of the peculiarities of the upcoming privatisation, and this is why Rostec would “pay” for the share not with cash but KAMAZ shares. “The exchange of shares is possible only between joint-stock companies,” Svyazinvestneftekhim noted. It is still unknown if Rostec will sell shares of Radiopribor plant in Kazan and Almetyevsk.

Experts think that the price of KETZ shares will be a bit lower. The factory shows notable revenue growth year after year. For instance, in 2018, it was 6,2 billion rubles.

Partner search in Dagestan?

Before the announcement of the auction, a sale to the private holding Kizlyar Electromechanical Plant Concern PJSC was considered. Magomed Akhmatov is the owner, sources in defence circles said. Rostec holds 25% of its shares. It was explained the candidacy of the Dagestan concern was considered because a big programme to develop supplies components for defence enterprises was starting to develop, Realnoe Vremya’s interlocutor said. However, Director General of Concern KEMZ PJSC Ibragim Akhmatov didn’t confirm these talks.

“We made another decision,” Ibragim Akhmatov had told Realnoe Vremya. “We purchase a competence of Podolsk Electromechanical Plant (PEMZ). Two months ago we were given the engineering documentation to make the components of PEMZ. Rostec asked us to get the competence of the Podolsk plant. In a word, there was signed a decision to give the documentation free. New plants will open in Kizlyar and Moscow where we expand the production.” It seems this is why KEMZ left Kazan.

“Handing over these components doesn’t require sacral knowledge or technologies. Hydraulics is a commodity with a wide use that is good to place to both civil dumper trucks and military “caterpillars”, Murakhovsky supposes.

As for KETZ, he noted that Kazan can be considered the only manufacturer of a specific modification that is used in the fleet’s ships. But the nucleus of the state identification system is identical both for aviation, anti-aircraft weapons and the fleet. Demand for them is low, 100 items a year at best.