Ministry of Economic Development starts thinking about participation of pension funds in ventures

The Russian Venture Forum organised by the Investment and Venture Fund of the Republic of Tatarstan ends in Kazan

The Russian venture market has grown by almost 64% over the last year. However, the situation in it is far from pre-crisis results. Russia's venture and direct investment market development strategy until 2025, which is now created by the Russian Ministry of Economic Development, is able to improve the results. Director of the Department for Social Development and Innovations of the Ministry of Economic Development of Russia Artyom Shadrin told about this at the Russian Venture Forum held at Kazan Expo. More about the Russian Venture Forum in Realnoe Vremya's report.

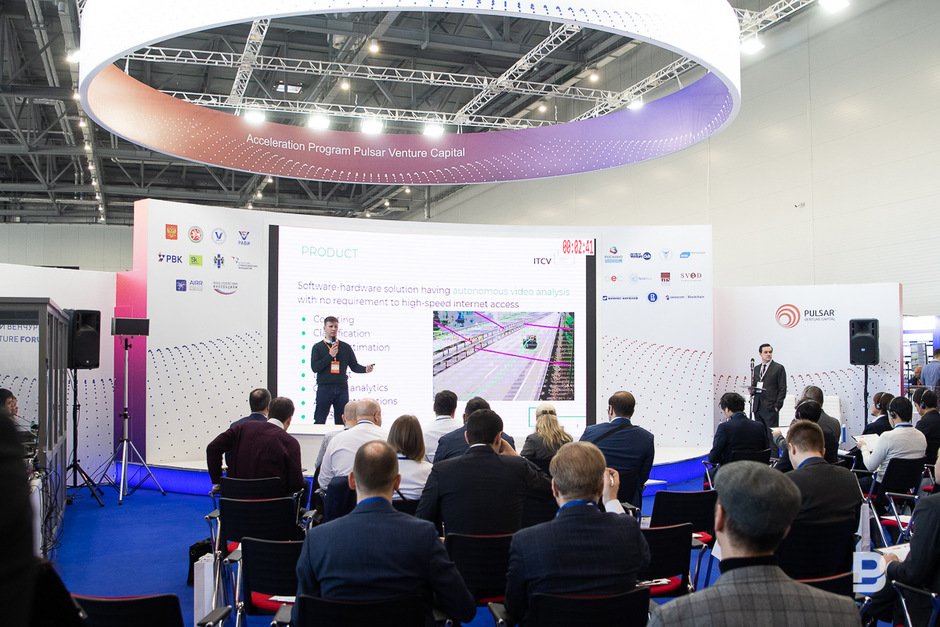

One of the terms of participation at venture forum: finished product and revenue

The Russian president's aide Andrey Fursenko was expected to participate in the venture forum at Kazan Expo, however, he wasn't among the invited guests. Governor of Novosibirsk Oblast Andrey Travnikov, Aide to the director of the Fund for Support of Small Enterprises in R&D Ivan Bortnik, Director of the Department for Social Development and Innovations of the Ministry of Economic Development of Russia Artyom Shadrin, Executive Director of the Russian Venture Capital Association Albina Nikkonen visited the event. The world venture market was represented by Secretary General of the Commission for Venture Investment of the All-China Association for Financial Aid for Science and Technology Xiu Xiaoping and founder of Red Bridge Daniel Kahn.

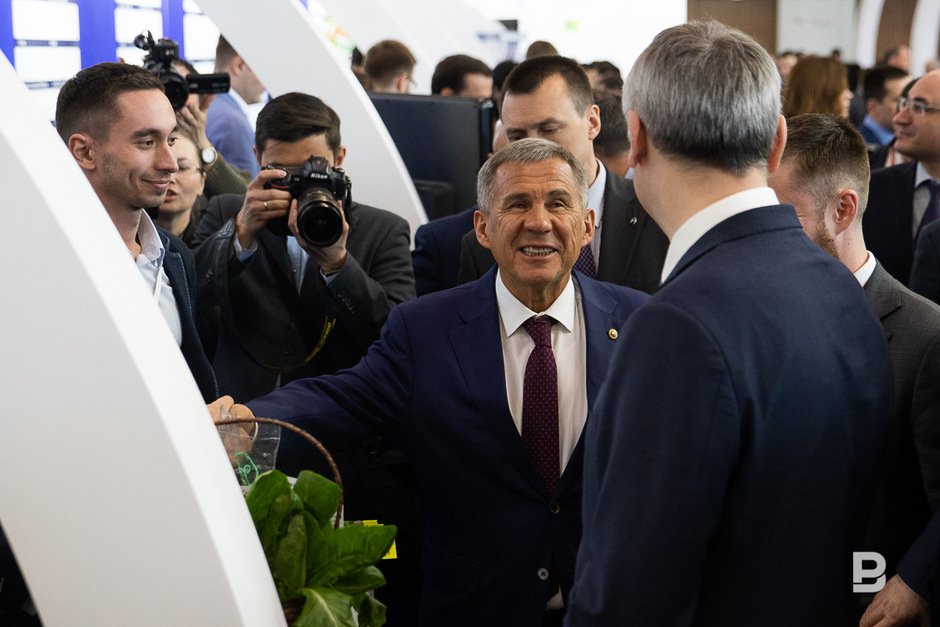

''The Russian Venture Forum is an excellent place that our foreign partners visit. We will see a big exposition of innovative projects – they are over 200, of which 50 are exhibited here. This year the venture fair is held in a new place – in Kazan Expo pavilions. The national and world WorldSkills 2019 competitions will be here soon,'' Tatarstan President Rustam Minnikhanov noted opening the venture forum.

He claimed 10 companies would get investors' support, become participants of an acceleration programme and be able to get up to 20 million rubles to develop projects at the forum's final stage. Training in international innovation centres around the world – from Ireland and the USA to Asia – will also become the winners' prize.

Director of the Investment and Venture Fund of the Republic of Tatarstan, the organiser of the forum, Aynur Aydeldinov said that ten companies from Tatarstan participated in the venture forum's exhibition, they were mainly just start-ups at the moment.

''We were open for all the years the forum was held, we gathered applications to participate from across Russia, this is why their number reached 500 requests. This year the selection of projects has been stricter. One of the terms of participation was to have a finished product and revenue. We eliminated projects that are still at the level of R&D. We also made a focus to have 50% of companies from Tatarstan. If such a 'funnel' had been five years ago, there would have been no company from Tatarstan. Then the applications were projects,'' Aynur Aydeldinov added.

From smart stethoscope to oil well technologies

After the solemn opening of the forum, guests looked the exposition over. The stand of a start-up of Urban Greenhouses from Novosibirsk, which develops a unique technology of ''vertical farms'' attracted Rustam Minnikhanov. It allows producing 2 tonnes a month. The company installs vertical racks and grow herbs under LED lamps next to consumers: the city centre, in the underground, in warehouses. The technology allows to fully automate herbs, vegetables and fruits.

The guests also stopped next to ADL Completions LLC from Moscow. It deals with multi-hole well drilling technologies, which can be interesting for oil producing enterprises. The company's project manager Andrey Fedotov told Realnoe Vremya's correspondent that the project was already making a profit, the company had won tenders to service 62 wells in the Yamal-Nenets region.

''Our technology can also be used in Tatarstan. We have an area that deals with new wells and works with the existing fund. It refers to exhausted wells that need a new wellbore passage. In this case, we save the remaining production from the main wellbore, which is almost exhausted, and give the client a chance to drill a side hole. So we increase the oil recovery rate from the well,'' Andrey Fedotov said.

The proposal of ADL Completions interested Rustam Minnikhanov, and he offered his aide to exchange contacts with the company.

This year 3,000 delegates from nine countries have become participants of the Russian Venture Forum at Kazan Expo: the USA, China, France, Japan and other countries. Applications to participate in the fair's innovation exposition came from companies from 37 cities of seven countries. IT platforms, financial equipment and technology became the most popular areas. Over 200 innovative projects sent their applications, the organisers selected 50 companies. Among companies developing 3D printers, it's stethoscope with AI, IT platforms dealing with a chain of delivery for the seafood market, services for passenger transportation, reactive engines for unmanned vehicles and so on.

Peak of growth of venture market was in 2012

The visit to the exhibition ended with a plenary session at which the forum participants discussed the future of the venture market of Russia. Aynur Aydeldinov said that the volume of investments in the world venture market had grown by 64% in 2018 and totalled $277 billion. Artificial intelligence, digital technologies, health care became the most breakthrough areas for investing. North America was the leader in venture investments in the first half of 2018, in 2017 – it was Asia. Seven of the 10 biggest deals were concluded with Chinese companies. 10 companies from the USA and another five from China are among the most active venture firms.

Later at the press conference, Aynur Aydeldinov explained the phenomenon of the Chinese venture market with the development of technoparks, which amount to over 150 in the country. They account for over 15% of China's GDP. A technology turning an idea into a prototype and making it an off-the-shelf product is created around the technoparks.

The venture market in Russia also showed growth in 2018: investors ploughed over $415 million into start-ups, which is by $161 million more than in 2017. Compared to 2017, the country's venture market grew by almost 64%. However, there is room for improvement: the 2012 indicators haven't been reached so far.

''In 2010, our venture market developed well, the peak of growth was in 2012. Then the country could not invest. But it turned out that it was early to be glad, and the rapidly achieved results went down in the next several years until 2016. The situation began to bounce back but it's far from what was achieved in 2012. Nevertheless, the venture market grew by 48% from 2016 to 2017 and by 60% from 2017 to 2018,'' said Oleg Fomichev, the director of strategic planning and development at Renova GC.

He said with the proviso that now all specialists agree with the 60%, however, not everybody admits that there is growth. Moreover, it was achieved because the Russian Venture Company JSC State Fund of Funds and the Russian Venture Market Development Institute of the Russian Federation began to play a more significant role.

''We see that the venture market will develop. But if we are talking about the speed of development, it can be different. The dynamics turns on us as well as the on the government because it's not only an increase of the capital volume and the number of start-ups for investing but also constant consideration of the quality of the environment, the ecosystem because start-ups aren't born, and investors have a greater desire to invest in a transparent environment, without pressure of law enforcement agencies,'' Oleg Fomichev claimed.

The Russian Venture Company has ambitious goals: to increase the total capital of funds with the RVC to $3 billion by 2030. Moreover, it's the lowest volume for Russia to remain the small group of countries that can consider themselves leaders of venture capital.

About Russia's venture and direct investment market development strategy

It became known at the plenary session that the Ministry of Economic Development of the Russian Federation was to complete Russia's venture and direct investment market development strategy until 2025 going through 2030 in the next weeks.

''The venture market development strategy was created by our ministry. And these numbers show that we need to reach the level of GDP market volume that's characteristic of leading countries. For this purpose, big businesses, both public and private, should increase investment volumes in the venture system,'' Director of the Department for Social Development and Innovations of the ministry Artyom Shadrin noted.

He also mentioned that pension funds could participate in developing the venture market. However, first of all, it's necessary to solve the problem of the safety of pensioners' deposits. The problem is how to create a system of investments of the pension fund in the venture fund. ''The goal is achievable, but it is not simple. We will certainly lead this work,'' Artyom Shadrin added later at the press conference.

Moreover, the key goal of the strategy created by the Russian Venture Company (RVC) on request of the Ministry of Economic Development of the Russian Federation is to develop a competitive venture capital market and increase in the annual volume of venture deals in Russia many times. The strategy will define the main areas of the state policy to develop the national venture industry in the next 5-10 years, including measures aimed to improve legislation, tax incentives, the attraction of investments to the stock market and so on.

Fire extinguisher and caviar from China

It was also said at the forum about the collaboration of the Russian venture fund with foreign colleagues. Such cooperation is effective when creating joint investment funds of Russian and foreign development institutions. A Russian-Chinese investment fund has been created now where the Fund of Direct Investments is a partner. There is also experience in investing in the Arab region's countries. The trend for the creation of joint funds will only develop.

As an example of such cooperation, a memorandum on creation of Innovations Bridge Japanese-Russian Association of Technological Companies and Investors was signed at the Russian Venture Forum. Skylight consultancy from Japan, Pulsar Venture Capital GC, SAMI LLC signed the memorandum. The association will help develop innovative projects and infrastructure of the Republic of Tatarstan to attract international investments and implement an export-oriented strategy for the republic's technological companies.

The Chinese side is also interested in cooperating with Tatarstan. Xiu Xiaoping said that she brought two projects to Kazan in her second visit: a new generation fire extinguisher and caviar, which is organic. China is also considering interesting projects of Tatarstan entrepreneurs.

''Investing in promising projects isn't divided geographically because if a project is located in the Russian Federation, we also consider its financing. If some Russian companies or projects want to move to China, we also support it,'' Xiu Xiaoping added.

She said that at the forum she liked a project about cancer. The gist is that if one has the disease, it's possible to carry out an examination that enables to make the most effective decision on treatment, and the examination's accuracy is about 99%.

Aleksey Basov, the deputy director general and investment director of RVC JSC, also told journalists about the projects that interested the company. Part of them develops digital technologies in agriculture, the others deal with document management. Aleksey Basov refused to name the projects more precisely not to put pressure on forum participants.