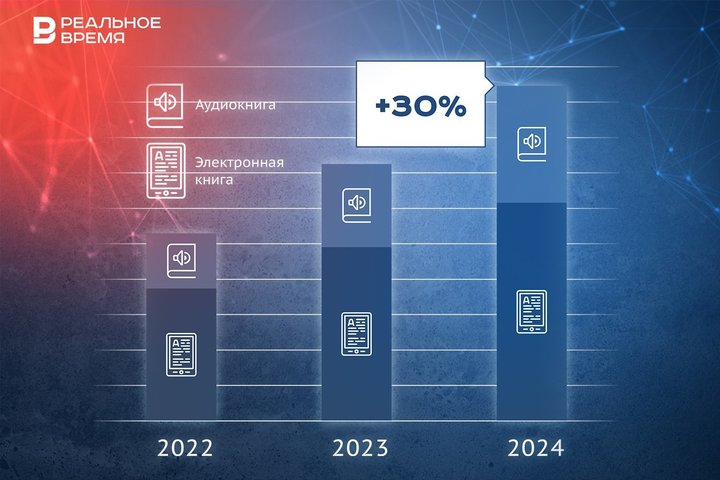

Digital books collect almost 19 billion rubles and grow by 30%

Ecosystems became the main driver of growth in the market of electronic and audio books

At the final conference on the book market from Eksmo-AST publishing group, CEO of the Litres group of companies Sergey Anuryev spoke about the results of work in 2024 and also presented data on the entire digital book market.

“Aggressive” growth at Yandex Books

According to Sergey Anuryev, the digital book market in 2024 amounted to 18.9 billion rubles. Among them, 12.3 billion are e-books, and 6.6 billion are audiobooks. The latter showed the largest growth: in 2024, compared to 2023, the audio segment grew by 40%. This is not a record. In 2019, the growth of audiobooks was 64%. But then the market was actively developing. But in the not-so-distant 2023, the growth dynamics reached 51%. As for e-books, they have shown minimal growth over the past five years — only 26%. The record again belongs to 2019: then e-books grew by 48%. And in 2023, the growth was 31%. Nevertheless, in money, both e-books and audiobooks show stable and good growth. The exception is 2022, when foreign book services left the market. Then the segment of digital books fell by 4%. The absolute leader in the digital book market is the Litres group of companies, which includes the Litres and MyBook book services. They occupy exactly half of the entire segment. The other half is distributed among the remaining players. At the same time, all platforms showed growth dynamics of no more than 1%. The exception is the Yandex Books service. In 2024, its share was 17%, while in 2023 it was only 5.5%. Anuryev linked the “aggressive growth dynamics” of 11.5% to the service joining the Yandex Plus subscription. “Since October 2024, the Yandex Books service has become part of the Yandex Plus subscription, and in fact, 36 million users have the opportunity to read and listen to books,” Yandex Books press service commented on the growth.

In terms of geography, Moscow and St. Petersburg are the leaders in Yandex Books. A representative of the service's press service also noted that “the south is well represented — Krasnodar Krai and Rostov Oblast, Tatarstan and Chelyabinsk Oblast are in the top 10.” According to the service, on average, each reader opens 13 books a year and reads four of them more than halfway. On weekdays, books are most often read and listened to around eight in the morning and six in the evening. “We assume that at this time, users are on the way to or from work. Another peak in consumption is at ten in the evening, but this already concerns e-books. Their users prefer to read before going to bed. Interestingly, the most popular day for reading is Monday,” the press service of Yandex Books commented.

The next three platforms for self-publishing are Litnet (11%), Author Today (7%), Litmarket (4%), as well as the book service from MTS Stroki (3%). All other players account for 8% of the total market share of digital books.

The audio segment may exceed 80%

In 2024, a good trend has emerged for the growth of content consumption by subscription. “The subscription actually opens up simplified access for the client to reading books, stimulates background consumption, and reduces the risk of choosing the wrong book," said Sergey Anuryev. He also noted that Litres Subscription service has seen a “chronological increase in the number of copies read per user.” That is, by paying the same amount every month, users began to read more books in pieces. According to Anuryev, this was also facilitated by the addition of a speed-up function for listening to audiobooks. Previously, Litres could only listen to books at the speed at which they were voiced. Now the speed can be increased in a ratio of one to three.

Another trend is the growth of samizdat. And this is not a trend of last year. Over the past five years, the segment's share has grown from 12 to 33%, and among e-books it was 53%. That is, more than half of the e-books on the market are works written by digital authors. Anuryev called this a positive trend and also noted that many authors from samizdat are moving into the category of published authors. For example, Viktor Dashkevich, who occupies top sales positions at Eksmo Publishing House. Previously, he published his works on the Internet and was not very noticeable. And the promotion from the publishing house brought his books to high sales. Over the past five years, the share of the audiobook segment has increased — from 27 to 37%. According to Anuryev, a pattern of background “reading” has already formed, when a person is busy with other things and simultaneously listens to a book. For example, on a walk, while playing sports or cleaning the house. Sergey Anuryev believes that in three to five years the share of subscription consumption in the audio segment may exceed 80%. According to the Yandex Books service, 86% of users have chosen audio versions of books at least once. At the same time, 17% and use both audiobooks and e-books. And 53% of users combine three formats — audiobooks, e-books and paper books.

In the book service Strok, audiobooks are chosen by both men and women. But among the male audience, the audio format is a priority at any age (except 65+), but among women, audiobooks are preferable among users aged 45 and older. By the way, men are slightly more interested in podcasts. They are especially popular among the audience aged 25-44.

“Ecosystems drive the market”

Last year, interest in short content formats increased, including comics, webtoons and manga. It is curious that in the book segment, comics and graphic novels showed a 3% decline. Sergey Anuryev noted that in the markets of Asian countries, comics and webtoons are singled out as a separate industry. In Russia, only one publishing house specializes exclusively in publishing comics and graphic novels — Boomkniga. Everything else is imprints or separate series within existing publishing groups. “We see a large volume of consumption in this segment. We hope that in the next two or three years we will license this market, structure it, and it will feed the entire publishing segment,” added Anuryev. “Ecosystems drive the market,” continued the CEO of the Litres group of companies. Here we are talking not only about the Yandex Books and Stroki services. E-books are included in Sber and Beeline ecosystems. In addition, collaborations influence the market. For example, the financial ecosystems of Alfa-Bank or T-Bank increase sales due to cashback from subscriptions through banking applications. And Litres itself has teamed up with Chitai Gorod in a joint loyalty programme. “We expect that through this synergy of digital and paper books we will be able to make a competitive offer in relation to Yandex, MTS and Sber,” added Anuryev.

And if the decrease in free income among the population plays into the minus for paper books, then in the case of electronic books it gives advantages. “Inflation is growing at an accelerated rate, which means that the population has less and less money for entertainment. First of all, people strive to satisfy their primary needs, and then pay attention to entertainment. And this encourages ecosystems to provide a single subscription to all services,” Anuryev noted.

According to publishers' forecasts, in 2025, books will rise in price by 15-20%, and this, in turn, will provoke an increase in users of subscription services. In this case, Litres' transactional business model, when the user pays for each electronic or audio book, will suffer. Currently, the monthly fee for the Litres Subscription service and Yandex Books is 399 rubles, in Stroki — from 399 rubles, in MyBook — from 299 rubles, depending on the tariff. At the same time, the average price of a paper book in 2024 was 510 rubles.

Ekaterina Petrova is a book reviewer of Realnoe Vremya online newspaper, the author of Poppy Seed Muffins Telegram channel and founder of the first online subscription book club Makulatura.