Tatarstan compensates drying up of a federal money trickle and disproves the gloomy calculations of Siluanov

The implementation of the consolidated budget of Tatarstan for 11 months of 2016 gives hope for a decent end of the year

Despite the fact that Minister of Finance of the Russian Federation Anton Siluanov has recently discovered the mythical ''hole'' in the budget of Tatarstan at 30 billion rubles, one should not be worry. The controversial methodology of the Russian Ministry of Finance is based on highly averaged nationwide regulatory indicators. In Russia, the absolute majority of regions hardly run their budgets. Therefore, an ''average temperature in hospital'' is quite low, in contrast to bursting with financial health Tatarstan. Its spread in our region leads to absurd estimates in the form of some huge ''holes''. According to the economic observer of Realnoe Vremya online newspaper Albert Bikbov, even traditionally difficult for the budget month, December, with its budget overhang will not spoil all good that has been achieved for 11 months.

11 months — budget is ok!

The revenues of the consolidated budget of Tatarstan for 11 months of 2016 have amounted to 235 billion rubles, increasing compared to the same period in 2015 by 18,5 billion rubles, or by 9%. It is a very good growth for our difficult times. The revenues of the consolidated budget of Tatarstan consists of two main components: own revenues of the budget of Tatarstan and intergovernmental transfers (grants, subsidies, subventions) from the budget of the Russian Federation. Let's start with the latter.

The volume of interbudgetary transfers from Russia has been reduced in comparison with the previous period by 6,4 billion rubles, or -21%. It can be explained by the fact that in the first quarter of 2015 it was made urgent funding for the preparation and holding of 2015 World Aquatics Championships in Kazan. For this purpose, 3 billion rubles were provided from the budget of the Russian Federation. So, after the departure of the ''sports element'' of 2015, a ''trickle'' of federal subsidies has significantly dwindled. The rest economy of the federal budget on traditional inter-budget transfers due to the difficult financial situation in the whole country resulted in savings (without sports component) by another 3,4 billion rubles. However, in connection with holding in Kazan in June 2017 of four football matches of the FIFA Confederations Cup, as well as due to preparations for the World Cup 2018 in 2017, a ''trickle'' of federal subsidies in sport will become again a full-fledged river.

It would seem that such extensive ''drying up'' in the form of a shortage of money 'from Moscow at 6,4 billion rubles in comparison with last year would greatly complicate the life to Tatarstan treasurers, but everything has turned out differently. Own revenues of the Republican budget have demonstrated strong positive dynamics, which more than helped to offset the sequestration of the revenues from Moscow.

Own revenues of the consolidated budget of Tatarstan (without intergovernmental transfers from Moscow) have increased in comparison with 11 months of 2015 as much as 25 billion rubles, or 13%. And this is despite the fact that almost all the budgets of the regions of our country are in a lamentable state.

The main tax of the Republic of Tatarstan, profit tax, has increased by 2,6 bn rubles (+4%) and amounted to 66,2 billion rubles for 11 months of the 2016. The growth of revenues from the profit tax is determined by increase of revenues due to positive exchange rate differences, the increase in production of goods, works and services, including due to the growth of prices in the domestic market, increase of shipments of oil to the domestic market for a number of small oil companies, as well as the development of national companies of new markets. Positive dynamics has been shown by bank sector, energetics, transport, production of radio, optical and measuring instruments, insurance activities.

The revenues from the tax on incomes of physical persons for 11 months of 2016 has increased compared to the 11 months of 2015 by 11% (+ 5,6 billion rubles) and amounted to 55,5 billion rubles due to wage increase in the number of large enterprises of the Republic, and also in connection with the introduction of quarterly tax reporting, disciplining the taxpayers and allowing immediately to apply enforcement action against debtors.

In addition to these pleasant perks, there has been an excellent positive trend for excises, which dramatically pulled up the revenue part of the budget. Here an increase by 13,4 billion rubles compared to the previous period (+71%) is conditioned by a number of factors*:

- The greatest increase in revenues, 26,6 times (+6,9 bn rubles) has been observed for excise tax on middle distillates (incl. heating fuel) and diesel fuel, 1,9 times (+4,0 billion rubles) due to increase in volumes of their production, as well as due to increase from 01.04.2016 of excise tax rates on diesel fuel and middle distillates by 27,5%. In January-November 2016, it was received excises on middle distillates at 7.2 billion rubles, diesel fuel, 8,5 billion rubles.

- From excise duties on alcohol and alcohol-containing products the revenues in January-November 2016 has increased compared to the same period in 2015 1,3% times (+4,9 billion rubles) and amounted to 20,9 billion rubles due to the growth of production of alcohol products with a volume fraction of ethyl alcohol over 9%.

* the data taken from the official website of the Federal Tax Service

Will the December's ''budget overhang'' break an ideal picture of the year?

Actual budget expenditures over 11 months of 2016 was slightly more (+2%) than in the same period of 2015 and amounted to 221,3 billion rubles. Almost all major expenditure items were funded at the same level as last year. Only under ''national economy'' item it was initially adopted more stringent budget than in 2015, so there has been some backlog (-6%).

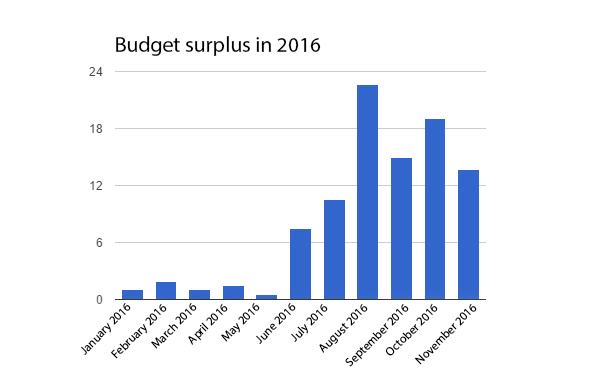

Clearly, if revenues grow at a faster pace (+9%), and expenditure, on the contrary, grow barely (+2%), then an inevitable consequence is a budget surplus. Revenues thus have exceeded the costs.

For the first 11 months of 2016, the consolidated budget surplus amounted amounted to 13,7 billion rubles. The amount of the surplus was considerably less than in August, when it was a record surplus of 22,6 billion rubles. But still it is substantially more compared to the comparable period in 2015, when in January-November it was a budget deficit (-1,1 billion rubles). Do not forget how extremely difficult it was for the economy in January of 2016 when oil prices were falling sharply to $27 per barrel!

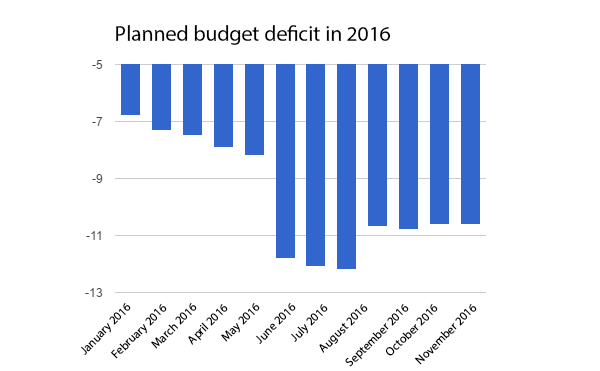

Progress in the budget field has prompted lawmakers to reduce the planned deficit of the consolidated budget of the RT in 2016 year to 10,6 billion rubles. Will there be such deficit in the end of the year? We will see. Previously, during 8 months of 2016, the Ministry of Finance of RT was planning only increase in the deficit of the consolidated budget even up to 12,2 billion rubles!

In Tatarstan, everything is ok so far, but in Russia it is not. In Russia, the deficit of the RF consolidated budget in January-November 2016 amounted to 1,8 trillion rubles. President of Russia Vladimir Putin on 24 November 2016 signed a law amending the federal budget in 2016, in which the budget deficit increased from 2,36 to 3,034 trillion rubles, or 3,7% of GDP.

They will have to close such a huge ''hole'' with reserve funds. As from 01.12.2016 the amount of the Reserve Fund of Russia was 2,0 trillion rubles (a decrease from beginning of year to 1,6 trillion rubles). The amount of funds of the national welfare Fund of Russia amounted to 4,6 trillion rubles (a decrease from the beginning of the year by 0,6 trillion rubles).

Thus, over 11 months of the current year the volume of funds in our decreased by 2,2 trillion rubles, so the prospects of the Russian budget in 2017-2018 look, to put it mildly, unhappy. Although in the new version of the federal budget the President approved almost complete exhaustion of the Reserve Fund in 2016.

Even at low planned deficit of the consolidated budget of RT we continue to have budget loans from Moscow. According to the debt book of the Republic of Tatarstan, on 1 December 2016 the volume of domestic debt amounted to 94,4 billion rubles (where 84.86 billion rubles of budget credits from Moscow and 9,5 billion rubles, guarantees in foreign currency for KAMAZ JSC).

I want to draw attention to a detail: the debt on budgetary credits to Moscow has grown by 0,8 billion rubles in April 2016 (for the first time since June 2015). And in June 2016 we additionally took another 4,1 billion rubles. However, in August, we payed off 2,2 billion rubles of previously taken federal loans. So, net increase in federal budget loans from the beginning of the year over 11 months amounted to 2,7 billion rubles.

It seems to be not so much, but still the debt has to increase to close the anticipated deficit of the consolidated budget of 2016, and it's big enough — 10,6 billion rubles. It is planned to partially cover it at the expense of budget surpluses in the accounts of the Treasury at the beginning of the year – it is 3,8 billion rubles, but the rest of the amount, apparently, we will have to borrow. The fact that we have such a large budget surplus for 11 months still means nothing. All this idyll may be destroyed in December due to the phenomenon of ''budget overhang''. It is formed because in December the budget assumes virtually double expense on salaries, pensions and other social payments of January issued before the New Year. In addition, they are added the costs of closing government contracts in the last months of the year. So, the end of the year in our Treasury is always hot: the monthly expenses increased approximately 1,5—2 times from the average values.

The increase in the debt on budgetary credits can hardly be regarded as a negative factor because they are taken for 3 years at the rate of 0,1% per annum, which even at current low inflation can be regarded as a gift. So, the sense and logic in the actions of the Tatarstan Ministry of Finance do exist. The main thing is not to approach the limits imposed by the Budget Code of the Russian Federation (no more than 100% of the income). The entire debt of the RT as of December 1, 2016 was 40,1% of the planned annual budget revenues, which is not a critical level.

There is another way to cut costs. But! It is very difficult to do: priority and socially significant expenses that should be funded in full prevent. In the planned budget for 2016 they accounted for 74,7% of total expenditure volume. But, I hope that it won't reach a reduction, and the missing amount will be closed at the expense of loans from the feds or due to the growth of budget revenues of the Republic.

The consolidated budget of Tatarstan for 11 months of 2016 and 2015 (billion rubles) on the actual implementation

ITEM | 11 months 2016 | 11 months 2015 | Absolute change | Relative change |

1. Budget revenues | 235 | 216,5 | 18,5 | 9% |

1.1. Own budget revenues | 211,6 | 186,6 | 25 | 13% |

1.1.1. Income tax | 66,2 | 63,6 | 2,6 | 4% |

1.1.2. Personal income tax | 55,5 | 49,9 | 5,6 | 11% |

1.1.3. Estate tax | 33,9 | 32,6 | 1,3 | 4% |

1.1.4. Excises | 32,2 | 18,8 | 13,4 | 71% |

1.1.5. Tax on gross income | 7,8 | 7,3 | 0,5 | 7% |

1.1.6. Revenues from the use of state property | 3,4 | 3,1 | 0,3 | 10% |

1.1.7. Fines, sanctions | 3,7 | 3,8 | –0,1 | –3% |

1.2. Uncompensated receipts (transfers) | 23,4 | 29,8 | –6,4 | –21% |

2. Budget expenditures | 221,3 | 217,6 | 3,7 | 2% |

2.1. Education | 61,9 | 60,2 | 1,7 | 3% |

2.2. National economy | 58,8 | 62,7 | –3,9 | –6% |

2.3. Healthcare | 31 | 30,6 | 0,4 | 1% |

2.4. Social policy | 22,5 | 22,9 | –0,4 | –2% |

2.5. Housing and public utilities | 13,9 | 14,1 | –0,2 | –1% |

3. Budget surplus | 13,7 | –1,1 | 14,8 |