What to do if you become a victim of fraud

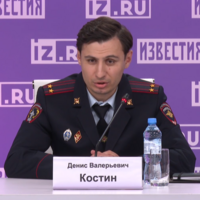

“People like to prey on our greed,” said Police Lieutenant Colonel Denis Kostin, noting that 40% of all crimes are committed remotely. Moreover, Russians are most often called from Ukraine, where around 200 call centres operate with true professionals in their field. On what tricks scammers use to trap gullible Russians and where to turn after such calls — in the report by Realnoe Vremya.

Former law enforcement officers are behind the calls

The most common fraud scheme aimed at stealing money involves calls from supposed law enforcement officers or bank employees. The scheme has evolved to include several characters — the “thief” and the “rescuer.” The latter will quickly offer to help you “recover” your money if you have disclosed certain information. Your funds will then be transferred to a “safe account” or handed over to a courier.

In addition, scammers actively use a flower delivery scheme to extract passwords. Calls allegedly from the Russian Post are also common, where the victim is asked to follow a Telegram bot link and enter a received code.

According to Kostin, the three most common methods of extracting funds are calls from call centres, buying and selling goods via phishing links, and investments. The Ministry of Internal Affairs reported that the organisation of international call centres, enabling scammers to target different countries, is a global trend. For example, calls to India come from Pakistan, from Myanmar to Vietnam, and from Mexico to the USA.

Scammers never stand still but devise new, sophisticated methods of extracting money. For them, this is a full-fledged business, conducted professionally with role distribution and the involvement of former law enforcement officers who know exactly what to say to civilians.

Don’t know how to block your card? Go to the MFC

If you have become a victim of fraud, the first thing to do is not to panic.

“If the citizen is an active user of all internet products, they should calmly carry out operations to block all funds or their information. If not, the best option is to go to the nearest MFC,” advised Solovyov.

The best prevention consists of two key actions: enabling two-factor authentication in apps and constantly reminding yourself never to share your password with anyone.

Forty percent of fraud cases involve not only the loss of money but also fraudulent credit obligations. A self-ban on taking out loans is already in place, but additional support is expected in the form of legislative changes, such as requiring parental consent for teenagers, among other measures.

As Kostin explained, there is nothing inherently dangerous in simply sharing a password from the Gosuslugi portal, because it cannot be used to seize property or steal money directly. However, it can be used to take out loans through microfinance organisations.

“Until they take everything from you, they won’t leave you alone”

The use of SIM boxes effectively makes people accomplices in crimes, although many install them simply to improve connectivity in their region. Despite the law limiting the number of SIM cards per person to twenty, record seizures of SIM boxes containing tens of thousands of cards highlight the scale of the problem.

‘Grey’ SIM cards remain relevant and are often used by contractors of telecom operators.

“There is still the possibility to register them under foreign citizens from post-Soviet republics — Belarus or Uzbekistan. Dishonest dealers working with telecom operators and contractor companies take advantage of this. They register these SIM cards in bulk, and unfortunately, the system that is supposed to verify the data cannot cross-check information for foreign citizens,” Kostin explained.

In addition, the scheme involves “drops” who, for money, register SIM cards on behalf of others.

“Until they take everything from you, they won’t leave you alone,” Kostin concluded, noting that the damages from these crimes continue to grow. Attacks have become more personalised: scammers study their future victims’ data to identify trigger points.

Schemes involving impersonation of organisation leaders remain common, with fake accounts contacting employees to ask for help. Similarly, communications with accountants requesting transfers to new accounts are common. Losses in such cases can reach 20–30 million rubles.