How oil prices' drop makes Russian budget suffer more than oil producers

The petroleum companies revenues have shown a decrease amid the oil market glut, but this decline seems to be even more noticeable for the Russian federal income. The government is looking for a solution by revising the taxes and asking state companies for extra dividends.

The recent oil market stagnation has influenced adversely the Russian budget revenues, but the petroleum companies' income has been affected less, considers U.S. Energy Information Administration. Under the current Russian taxation system, lower crude oil prices mean lower tax rates, so the budget suffers more than oil and natural gas producers do.

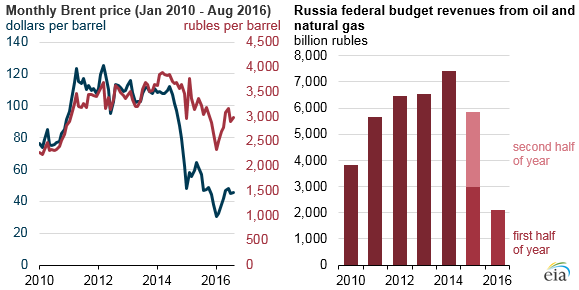

The Brent oil lost 47% in dollar terms in 2015 versus 2014, and an additional 31% in January-June 2016 versus the corresponding period of 2015. The figures measured in the Russian currency are less substantial due to the ruble devaluation: a 16% decline in 2015 versus 2014 and another 16% in comparison of the first half of 2016 with the first half of 2015. The federal budget income decreased by 21% and 29%, respectively.

The national currency's weakness allowed Russian oil companies to increase their ruble investments. For example, Rosneft invested 30% more in new exploration and production projects in Russia in 2015 than in 2014, and 33% more in January-June 2016 than in the first half of 2015. The other Russian oil giant Lukoil (together these two companies provide about 50% of total oil production in Russia) showed an 11% decline in local investment in 2015 versus 2014, but in the first half of 2016, the decline decreased to 2%. Therefore, many new fields are ready to start up or have already started. The Russian crude oil production this September reached 11,11 million barrels per day this September, being close to the Soviet high of 11,42 million barrels per day in 1987.

Meanwhile, the Russian government is working on the measures, that can increase the budget income due to the petroleum industry. Now the oil companies are subjects to three taxes: a minerals extraction tax, an export tax and a less significant income tax. Investing is a way to cut taxation: many greenfields enjoy the reduced tax.

However, the Ministry of Finance and Ministry of Energy are continuing negotiations on a new system designed to fix the budget's deficit. If the negotiations succeed, the changes will be implemented gradually in 2017-2018. In the new system, greenfields are subjected to a higher tax, while brownfields get a substantial tax cut. These changes will probably cause an output growth as the oil companies will need to produce more to keep the revenues.

Besides changing the taxes, Russia is seeking for the other ways to replenish its budget. In April 2016, Russian Prime Minister Dmitry Medvedev signed a decree obligating state companies to pay out 50% of their 2015 net income as dividends (and the state got its income as a stakeholder). This is twice more that the amount they usually pay to the shareholders. A number of enterprises, such as Gazprom, managed to avoid the increase of the payments, but the decision has caused numerous protests of oil and gas companies. They said the dividends increase makes them divertmoney from the investments.