Who is major usurer: the state share in banking sector reaches 70%

The banking sector has become the most public sector of the Russian economy: by the beginning of 2018, the state's share in it had reached 70%. This threatens to decrease efficiency: resources are distributed in favour of weak players, and the Central Bank of Russia faces the problem of conflict of interest. This is stated in a study published on Monday by the Analytical Credit Rating Agency (ACRA). Read the details in the material of Realnoe Vremya.

More state's participation

The state was increasing its presence in the banking system in previous years as well, but it was not so aggressive. The past year has become special: the share of state banks and quasi-state banks in total assets of the banking system increased by as much as 7% (in 2015-2016 it grew by only 1-2%).

Among the 20 largest banks, the concentration of the state is even stronger — about 83% of their assets fall on state banks and banks controlled by state corporations — Rosneft (Russian Regional Development Bank) and Gazprom (Gazprombank).

The main reason for the accelerated market deprivation in 2017 is the transition of a number of large financial institutions to the Central Bank Fund and the subsequent large-scale injections from the regulator and the Finance Ministry. The withdrawal of licenses from private banks of the third to fourth tens, according to ACRA, had a lesser impact.

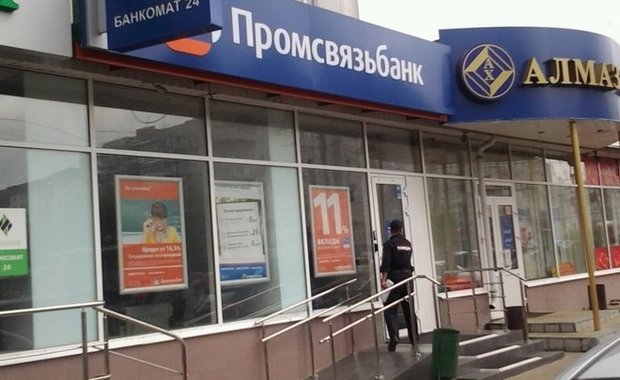

From August to December last year, the Central Bank announced the reorganization of three banks included in the top 10 by assets. We are talking about Otkritie FC Bank, B&N Bank and Promsvyazbank. All of them needed additional capitalization, the volume of which the regulator estimated at 1 trillion rubles. Since then, Otkritie has already received 456 billion rubles, the remaining two banks are waiting for funding within the first quarter of 2018.

As a result, the banking sector has become the most public sector of the economy: at the beginning of this year, the state's share in it reached 70%. For comparison, in the oil and gas industry it is estimated at 66%.

''Up to the privatization of the largest sanitized banks, the share of the public sector will tend to increase further, although this growth will not be as significant as in 2017,'' ACRA's analysts write. There are two prerequisites for this: the continuing shake-up of the market (it can lead to a reduction in the number of private banks) and the outflow of customers to institutions with high credit quality (state banks are considered more reliable).

According to ACRA, the status quo in the banking sector will remain at least in the next 3-4 years — it may take that long to complete the rehabilitation of Otkritie, B&N Bank and Promsvyazbank and to begin their privatization.

It may take longer if the rehabilitation goes according to the scenario of consolidation of these banks, which is now being under discussion. Promsvyazbank, which is planned to reorient on the maintenance of MIC, may remain in the ownership of the state for an indefinite period, the authors state.

Efficiency degradation and fragmentation of Central Bank's functions

The state's expansion involves risks of inefficiency and high sensitivity of the banking sector to changes in external environment. This is manifested in the fact that state resources are distributed not in favor of the most efficient banks, but in favor of those who need to maintain financial stability: ''Thus it is indirectly implemented the principle of saving weak players, including through dividend flow from significantly more profitable and sustainable state banks.''

This sows misunderstanding and leads to a lack of a single and transparent criterion for evaluating the effectiveness, the study says.

The situation is aggravated by the presence of the practice of ''directed lending'' when the resources are provided to companies or industries with notoriously weak position and uncertain prospects of debt servicing. There is a substitution of budget support of individual state-owned companies with bank loans, which negatively affects the banks themselves.

In addition, the Central Bank finds itself in a situation of conflict of interest as it acts both as the regulator and as the owner of the banks being liquidated.

''A high share of the state in the financial sector leads to increased contingent liabilities of the budget and the Bank of Russia to support the banking sector, which in times of economic instability is implemented in significant amounts of actual assistance,'' ACRA sums up.

''Curiously enough, this whole situation has not only drawbacks, but also advantages,'' says Sergey Khestanov, the advisor on macroeconomics to director general of Otkritie Broker. According to him, the strengthening of the state's presence involves fundamental risks, such as reducing competition and flexibility of the banking system. However, the probability of shocks, on the contrary, has decreased, he says.

''Shortcomings and negative consequences are not very pronounced and affect only large time periods. But at the current time, the increase in the state's share has even slightly reduced the risks compared to what was a year ago, there has been a growth in manageability, transparency,'' says Khestanov.

The increase in the state's share erodes the market basis, says Pavel Samiev, the managing partner of the National Rating Agency. ''Some of the state banks are ineffective, and they lose incentives to improve efficiency if they are additionally capitalized in any case. The market of private banks with some financial potential is degenerating, as well as the opportunity to develop further,'' he explains.

''The second point is that the state banks have completely primitivized their policy on attracting customers. Even in advertising, they rely upon the only premise: that they are more reliable because they are state banks. That is, the points have boiled down to the fact that a state bank is better than a private one. And this propaganda is a very big risk for the whole market,'' Samiev believes.