Rising prices for housing and utility services, restrictions on issuing mortgages and social deposits

July novelties in laws and regulations that will change the lives of citizens and businesses in Russia

From July 2025, housing and communal services will sharply increase in price in Russia, in some regions the growth will exceed 20%. Bankers are required to limit the issuance of mortgages and car loans to citizens with a high debt burden and a low down payment. Fines for the transfer of personal data of Russians outside the country will reach half a billion rubles. Read about these and other changes in legislation and new rules from the beginning of the month in the report of Realnoe Vremya.

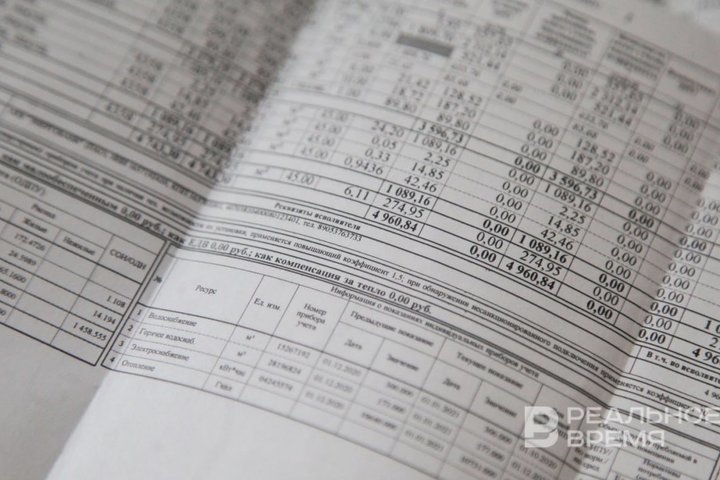

Prices for housing and utility services will increase

From July, tariffs for housing and utility services in the country will increase — electricity, water, heating, gas, sewage and waste disposal. On average, the increase in price across the country will be 11.9%. At the same time, in Tatarstan, the growth of housing and utility services tariffs will be higher than the Russian average, it will amount to 17.5-22.3%. The most noticeable increase will be in heating fees. For example, in Kazan, Tatenergo's heat cost will increase from 2,367.35 rubles/Gcal to 2,895.24 rubles/Gcal, that is, by 22.3%. The indexation will affect all regions of the country, but the growth rate will differ.

Issuance of mortgages and car loans will be limited

From July 2025, macroprudential limits will come into effect in Russia. These are new rules according to which the issuance of mortgages and car loans to borrowers with increased risks will be limited. First of all, this will affect citizens with a high debt burden, low down payment and unstable income. Financial institutions will be able to issue such loans, as before, but only within a certain limit. That is, the chances of loan approval are reduced. The main reason for introducing the new rule is the growth of systemic risks due to the high indebtedness of citizens.

When issuing a mortgage, where the down payment is no higher than 20%, and the debt burden indicator exceeds 50% of the borrower's income, the regulator imposes a limit on the share of such loans in the amount of 2%. The limit is also imposed on mortgages that are issued for more than 30 years. According to the Bank of Russia, the volume of such loans has increased from 10% to 14% over the past two years, which is a concern.

As for car loans, which are issued by citizens with a high debt burden, their share will also decrease and will not exceed 20% of the total volume of loans issued by banks.

The rules for entering into inheritance will change

A new law will come into force in Russia on July 15, 2025, which simplifies the procedure for accepting an inheritance for relatives of those who died in the special military operation and persons who lived or were temporarily in the battlefields, if they died due to circumstances related to this. Their inheritance will open from the date of the death record in official documents — a civil status act. In the event that the date of death according to the certificate or medical certificate is unknown or differs from the date of the record by more than three months, the date of the record will be considered the date of death. That is, the heirs will be able to formalize their rights to inheritance based on this date, rather than waiting for confirmation of death. This will simplify the registration of inheritance in a difficult situation. Previously, this procedure required six months from the date of death.

Control over bank transfers

From July 2025, amendments to Article 86 of the Tax Code of the Russian Federation will come into force, according to which control over banking operations will be expanded. If transfers to a bank card are classified as income, then a new tax liability appears. This applies, for example, to receiving unofficial wages, paying rent, receiving goods or services in the absence of self-employed status, as well as regular large transfers. In all these cases, the Federal Tax Service has the right to request clarification and charge additional income tax or professional income tax. The new rules apply to transactions where sources are not confirmed by official income. Exceptions include transfers as gifts, assistance to relatives, debt repayment or joint expenses.

Social deposits

From July 2025, citizens who receive social support measures from the state will be able to open a social bank deposit and account. The maximum deposit amount will be 50,000 rubles, the interest rate is determined by each bank individually. The main advantage is that the bank does not have the right to charge a commission for opening an account, servicing the card and transfers. However, a citizen has the right to open only one such deposit and one account, and they can only be registered in his own name.

New rules for large investors

The law on the protection and promotion of capital investments came into force on 1 July, 2025. It concerns businesses that primarily develop large projects, such as the construction of factories, roads, and the opening of new production facilities. If previously such companies resolved disputes with government agencies and through arbitration courts, which is simpler and faster, but now it will only be possible to apply to a regular court. In addition, a change comes into force, according to which companies where the share of foreign capital is more than 25% will not be able to receive state support.

Online appeals to the court

A new regulation for filing documents in cases of administrative offenses comes into force in Russia. Applications and other procedural documents can be sent electronically through the State Services portal, regional websites, special online platforms determined by the Supreme Court or the Judicial Department, as well as through personal accounts on the websites of government agencies and the Bank of Russia. To submit documents, an enhanced qualified electronic signature may be required. In some cases, a simple electronic signature can be used. Personal data of Russians can only be stored in Russia

From July 2025, a ban on storing personal data of Russian citizens abroad comes into force. All companies and organizations that deal with such data will be required to collect, process and store it only in Russia, all stages must take place exclusively on Russian servers and data centres. Personal data includes last name, first name, phone number, address, passport details, email and other information that allows identifying a person. Violation of the law provides for serious fines, which can reach 500 million rubles, and restrictions on work.

Labelling of products and cosmetics

From this July, it will be prohibited to sell deodorants, hair products, shaving products and fragrances in Russia, as well as sauces, spices, dry soups, spices and vinegar without mandatory labelling. All these categories of goods will be marked with a special code, which can be used to trace the path from the manufacturer to the buyer. A fine is imposed for selling unmarked goods. For individual entrepreneurs it will be 50,000 rubles, and for legal entities — 200,000 rubles.