Automotive Forum TIAF: 'We are condemned to friendship with the EU and others...'

Daimler about the exit from Russia, new ‘secret’ Ford models in Alabuga and about that falling wages – it is good

Automobile market in Russia fell by 35% in 2015. According to the government, without government support the decline could be much stronger, so they are ready to continue supporting in 2016. However, the industry does not fear of such figures: the manufacturers believe that the market won't continue falling, and for this purpose they need to shift to export abroad: KAMAZ has aimed at the markets of Iran and the Far East. Concern Ford Sollers is preparing to launch new models in Tatarstan. Read more – in the report of Realnoe Vremya from TIAF.

In 2016, the automobile market may fall by another 5%, but government support will remain

This discussion on the situation on the Russian automotive market and plans for 2016 was held in Kazan within the framework of the Tatarstan International Automotive Forum (TIAF). At the end of last year, the situation was disappointing: the fall was more than 35% on 2014, the production in Russia amounted to 1.7 million units. Thus, according to the Director of the Department of transport and special machinery construction of the Ministry of Industry and Trade of the Russian Federation Aleksandr Naumov, if there had not been state support, this amount would have amounted to only 1.1 million per year, and if these measures will not be continued in 2016, the market decline can be to 800 000 cars per year.

'We mean to continue state support measures. First of all, the renewal of the fleet of wheeled vehicles, the programme of preferential leasing, lending, boost to a demand for buses for utilities that run on natural gas, subsidies for the purchase of city electric transport. As for industrial subsidies, this year a new measure in upgrading of fleet of ambulances is added. The mechanism to stimulate demand for equipment of public utilities run on gas fuel will change,' he said.

Today, the capacity utilization of the industry is around 40%. 'It shouldn't decrease in no circumstances. For that, it is necessary to keep the demand at vehicle market at least at the level of last year. Our aim is to optimize the production capacity due to the concentration of support measures around industries with a high degree of processing and, of course, to create conditions for the growth of production and export of automotive vehicles,' said Naumov. According to him, due to the devaluation of the ruble and the organization of deep processing, Russian products become very competitive in the international markets, as a result, there are prospects for partnership with Europe and Asia, Latin America.

'We are condemned to friendship with Europe and other countries, because today every single car in the world is produced with the participation of several countries, even Germany purchases Chinese and Turkish components,' he said.

The Chief Executive Officer of the Association of European Businesses (represents about 600 European companies) Frank Schauff confirmed that last year the market declined by almost 36%, and since the beginning of 2014 the demand for cars fell by almost 50%. He thinks that 2016 will be no less complicated: the Committee of automobile producers predicts a reduction in market by about 5% under the condition of state support. 'Nevertheless, even during such a large drop, Russian market remains important and interesting in the long term. During a crisis, there is a chance to develop new contacts and when the economy rises, to work profitably,' encouraged the audience Schauff.

It is no coincidence that Kazan hosts the forum for the second time: the machinery industry is 20% in the economy of Tatarstan: from 1.856 trillion rubles of GRP the industry manufactures products at 370 billion rubles. Only in the automotive cluster of Tatarstan there are more than 200 enterprises, which produced at more than 34 billion rubles last year. The situation in Tatarstan is also a difficult one, admitted the Minister of Industry and Trade of the Republic of Tatarstan Albert Karimov. 'But those who start new projects, they will get into the growth phase. Because the fall will inevitably be replaced by the rising trend,' he turned to the audience and, as usual, called to invest in Tatarstan.

'Nobody leathers away on the job day and night yet'

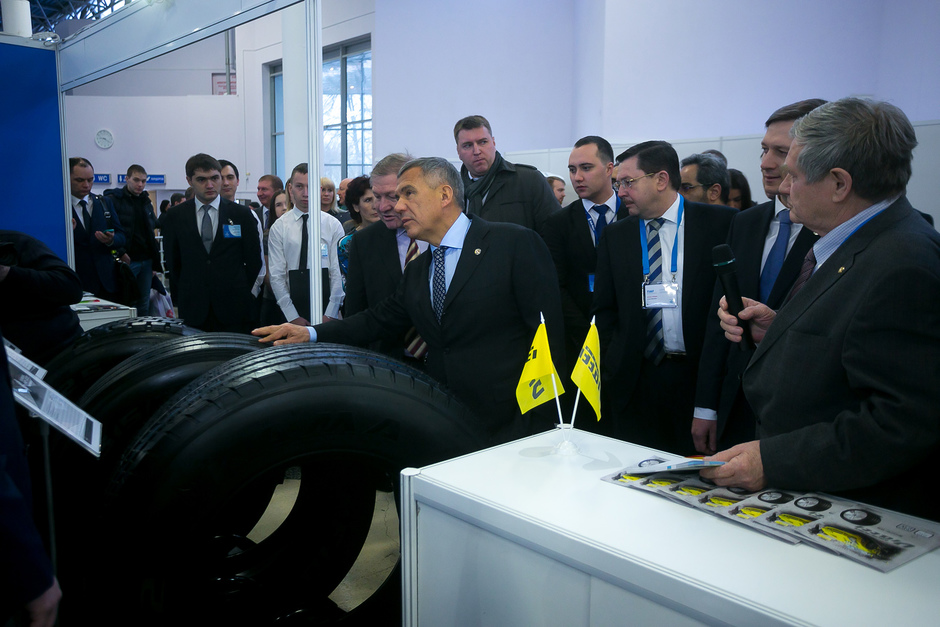

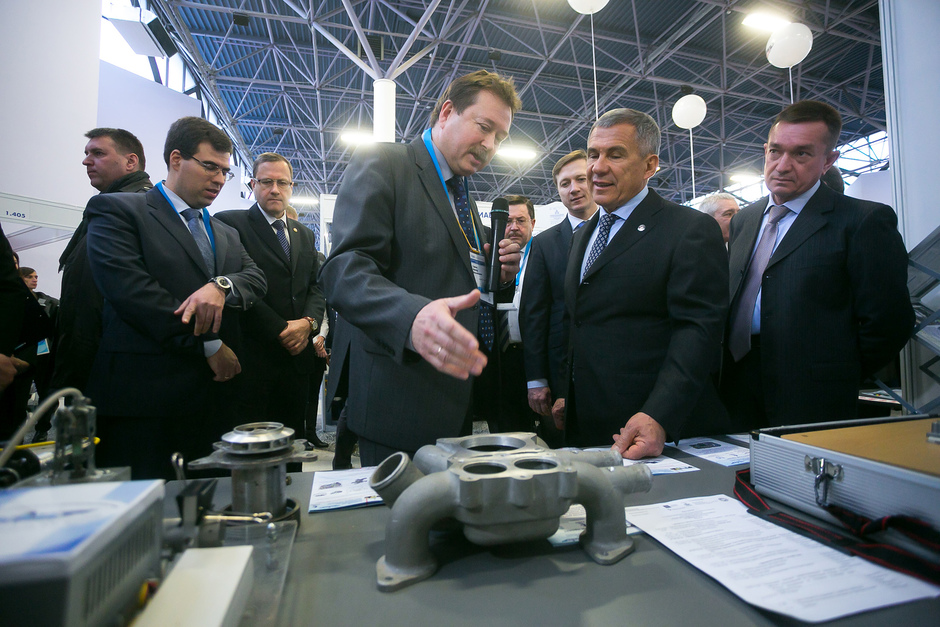

To ensure that to invest in the Republic is necessary, the floor was taken by major automotive manufacturers. So, the Executive Director and the First Vice-President of Ford Sollers Adil Shirinov summarized the words of RT President Rustam Minnikhanov that in the future anyway there will be all right in the economy and 'we need to be ready for this'.

As you may know, the company has production facilities in the SEZ Alabuga and Naberezhnye Chelny, where 7 models of vehicles are manufactured, as well as the engine plant. He announced that in 2015, Ford Sollers has completed the first phase of the 4-year strategy of the investment programme in Tatarstan at the amount of $1.5 billion. Last year, the company launched the production of 5 new models, 3 of them are in Tatarstan. They are Fiesta, Explorer and renovated Transit. 'We are interested in not only the assembly, but also in the localisation of all stages in Russia'.

According to Shirinov, in 2015 the company almost twofold increased its market share of passenger cars in Russia: from 1.5% to 3.4%. According to Shirinov, this happened due to the expansion of the production line: now, Ford presents models in all segments. At the same time, he admitted that buyers tend to choose cheaper cars: in 2015, this 'migration' was about 30%. But, probably, this year the automobile market will remain at the level of 1.3-1.6 million cars, according to the company. 'We will not stop and will be releasing new products specifically developed for Russia,' said Shirinov. Later, answering the question to Realnoe Vremya, he noted that they were talking about new models of cars and he considers Tatarstan as the most credible region for this.

Shirinov believes that now many manufacturers rely on the state support too much. 'It is not right that the company begs for subsidies. It should be as a bonus. Now, it is a difficult period of time, but nobody leathers away on the job day and night,' Shirinov said.

Ford Sollers intends to increase its localisation in Russia as much as possible: according to the results of the year, it will be a minimum of 45% in both the engine plant and car production. The speaker assured that regardless of the level of state support, the company is not to reduce production while the capacity utilisation rate does not exceed 40%. He admitted that in such circumstances the company considers the possibility of placement of production of other brands of the same capacities.

'We were thinking of closing the company'

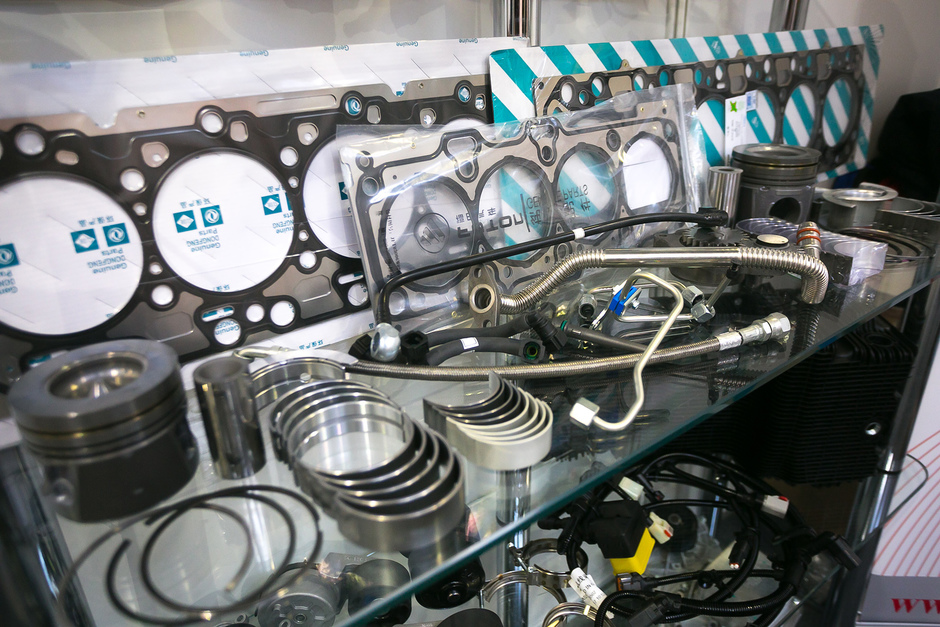

On the market of trucks, the situation is even more complicated. As the CFO of the joint venture Daimler KAMAZ Rus (ex. Mercedes-Benz Trucks Vostok – editor's note) Oksana Karakhova said, since 2012, the market declined gradually, and from 2014 to 2015 it fell by 42.8%. In her speech, she stated that one of the main objectives of the company in the conditions of crisis is the reduction of import of spare parts from Germany and Japan.

Karakhova admitted that in the beginning of 2015, no one knew that the company would experience. 'But for us, the crisis was a chance. No matter that the pie we shared decreased, we grabbed the market share. Previously, in the market of the group of seven (Scania, Volvo, Mercedes, MAN, Iveco, Renault, Duff) we were the 4 th, and in 2015 we were the 2nd,' she said.

According to her forecasts, the market of trucks of 'big seven' in 2016 will remain at the level of 2015 – about 9 000 units. 'We, of course, had no idea what would happen. Under these economic indicators, we were thinking of closing the company. But, we are still alive, our company is successful, we have big plans for localisation,' summed up Karakhova.

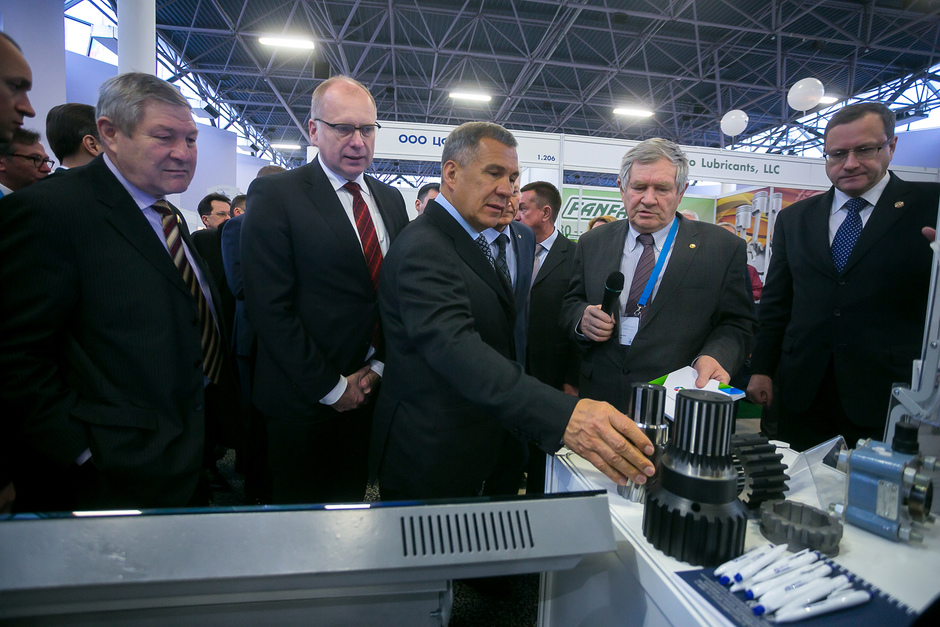

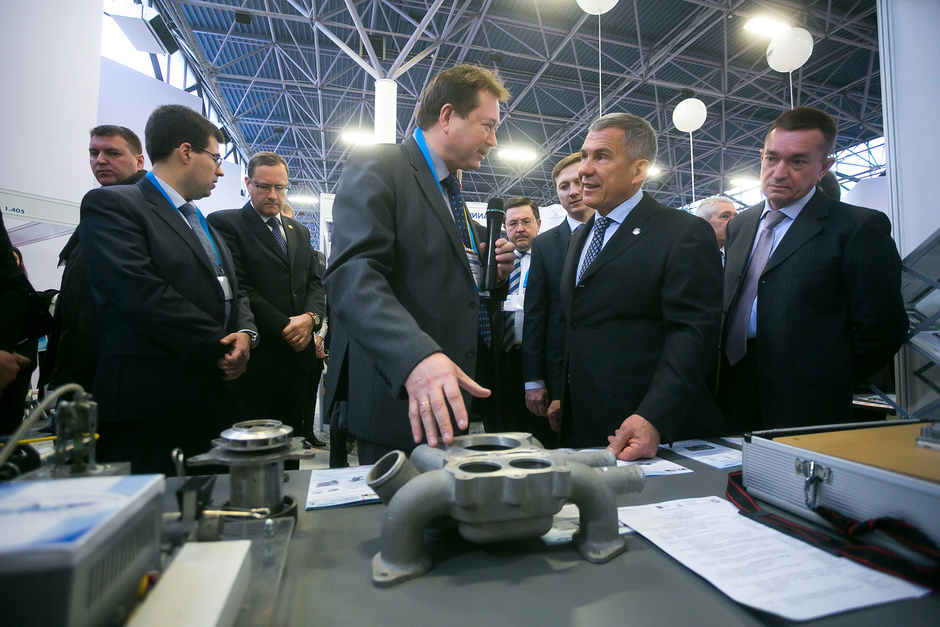

KAMAZ has lost one third of production, but has doubled the sales abroad

The Director of KAMAZ Rafail Gafeev confirmed the trend of declining in sales of trucks. Gafeev called the current situation 'normal', because in the past yearsthe market growth was provided by high oil prices. Despite the overall reduction in the heavy truck market, the share of KAMAZ increased by 10% and reached 51%, and this year the automobile manufacturer expects to raise it to 54-55%. Much of the success is due to the governmental support of the industry: due to the programme of subsidizing of fleet replacement KAMAZ sold more than 6 700 vehicles, due to subsidizing of the leasing – more than 1 700 units. The devaluation of the ruble has allowed KAMAZ to outmarket competitors from abroad in price. 'KAMAZ begins to pay serious attention to corporate clients,' he said.

The change in the exchange rate affected the sales of machinery abroad: last year, real exports grew by nearly 20%, to 6 000 units of equipment. There was almost twofold increase of sales to far abroad, mainly due to the sale with the tools of the Russian Agency on insurance of export credits and investments (over $15 million, or 7% of sales). This year KAMAZ is planning to increase this amount to $33-35 million. 'Recently, my colleague came back with a contract from Africa, and, I believe, we will increase this figure even 6-7 times,' – he told. These tools the company uses in the markets of Latin America, Asia, the CIS and even in Europe. In 2016, KAMAZ intends to increase its exports to 7 000 units.

At the same time, the dollar has led to lower sales in the CIS countries: in Kazakhstan, for example, a decline is more than 30% and only about 2 000 vehicles were sold. In the future, export strategy till 2020 focuses on the Far East. He called the Iran market as 'the closest in terms of implementation', which is growing rapidly after the lifting of international sanctions. Besides Iran, KAMAZ hopes for Indonesia, Latin America, Egypt, Uzbekistan. In addition, KAMAZ has been actively developing gas-cylinder equipment: more than 500 cars and almost 900 buses were sold.

In 2015, KAMAZ produced vehicles by 28% less – more than 28 000 trucks at a total amount of about 80 billion rubles. For all time of operation of the plant, at the conveyor of Chelny's auto giant, over 2 million trucks have been manufactured. Despite the crisis, the company continues to invest in new areas: it develops gas engines, unmanned trucks, electric buses project. This year, the company is planning to produce more than 30 000 units.

KAMAZ continues to keep the lead in the production of heavy trucks in Kazakhstan, Yakutia, Turkmenistan, and overall the company has more than 30 countries of delivery.

The market is waiting that the sinuous line of demand will go up

In conclusion, market participants from the audience told about their new projects. So, the joint venture of RUSAL and Israeli concern Omen High Pressure Die Casting, the company VolkhOR is planning to launch a small factory for the production of automotive components made of aluminium at capacity from 1.2 tonnes per year with plans for further expansion. NPC Pruzhina from Izhevsk plans in 2016 to open a production of spring hangers for automotive industry and sees among its future clients Ford Sollers. The production of steering wheels with a frame made of non-ferrous alloys, mainly from aluminum and magnesium, will open near Kazan. In Innokam there will be the engineering center of prototyping and industrial design, test and certification center of automobile components and heat treatment center.

'More often I face with the fact that in Russia wages compared to the dollar are falling, but Russian products have become more popular in the West. Everyone understands that it is hard, and I'm amazed that some companies actually starts developing its business. Anyway, we all develop according to the sinuous line, and if we are approaching its lower limit, then the business will return,' said the Managing Director of AZ Enterprize Aleks Zaguskin.