Fast sale of Rosneft: above the target, sold too cheap and whether they should be afraid of Tatneft

Will the 2014 currency destabilisation come back?

A headline-making big deal on the sale of 19,5% of shares of Rosneft and a simultaneous backstop deal on bond placement, at first sight, should not destabilise the currency market. But economic reviewer of Realnoe Vremya online newspaper Albert Bikbov found here several pitfalls: a possible threat of the currency market destabilisation, cheap sale and high demand for Tatneft shares that accompanied the deal, which makes us think about its possible merger.

And hello again!

We all do remember how Rosneft got a loan of 625bn rubles from the state in 2014 and spent it on currency purchase having downed the ruble's rate (to 80 rubles per dollar). As a result, the Russian economy received so powerful blow that it still can't recover from it. Whether it is a joke or not, even the Central Bank's key interest rate, which was increased to 17%, reduced to only 10% two years after those events. ''And hello again'' – on Wednesday, Rostov completed the placement of 10-year-old bonds 001Р-01 equal to 600bn rubles. The rate of the first warrant will be 10,1% per year. In addition, market players are sure that it was a non-market transaction, that is to say, one or two state banks financed it (probably Gazprombank). In the market, it is impossible to borrow 0,6 trillion rubles because the base of Russian investors is limited, short-term liquidity of Russian banks and sanctions. And very state banks got one-time huge money for this transaction, perhaps from the state.

Curiously, this deal on 600bn rubles will be a backup if Rosneft did not manage to find purchasers for the big deal of the year – privatisation of 19,5% of Rosneft PJSC's state stake on time set by the government (until 12 December 2016). If the purchasers were not found, buy back would come into effect (purchase of Rosneft shares from the state for 600bn rubles by the very company). Then the budget would get money to patch holes in the budget, and Rosneft would find purchasers in the first quarter of 2017 without hurry.

A miracle happened: on 8 December, Rosneft announced that 19,5% of shares of the oil company would be sold to Glencore and Qatar Investment Authority for €10,5bn, according to the Kremlin. Igor Sechin managed to jump into the footboard of the leaving train and sell the shares to the investors. It is unclear who was the seller: state Rosneftegas or Rosneft itself through an interim purchase of the stock from the shareholder.

We won't root in the moral and historical portrait of the purchaser. What will happen to the market? It is the most important thing for us.

So, there were two simultaneous deals:

The major deal (sale of the state stake for €10,5bn, €10,2 of which is the currency, and €0,3bn – Glencore's shares). The backstop deal (sale of bonds by Rosneft itself for 600bn rubles) for buyback, which was not taken into consideration because the major deal took place.

What do Russian participants of the deal have?

Rosneft has a great deal of rubles, 600 billion, which, in general, it got ''just in case'' (in other words, if the purchasers are not found till the end of the year). The budget has a great deal of currency, €10,2 billion. But the budget doesn't need the currency. It needs rubles to patch the holes in the budget. This is why the budget needs to sell the currency for about 688,5 rubles (if today's currency rate is 67,5 per euro). But such a big currency influx can destabilise the situation and strengthen the ruble. What should we do then?

Our product – your merchant! A deal that will ''pass the market by'' is suggesting itself. The point is that ''easy rubles of rosneft will be exchanged for easy currency of the budget'' at once. The budget will get rubles till the end of the year, and Rosneft will purchase the currency. The most important thing is that this deal won't affect the market, which, in turn, means there won't be any acute fluctuation of the ruble to this or that side.

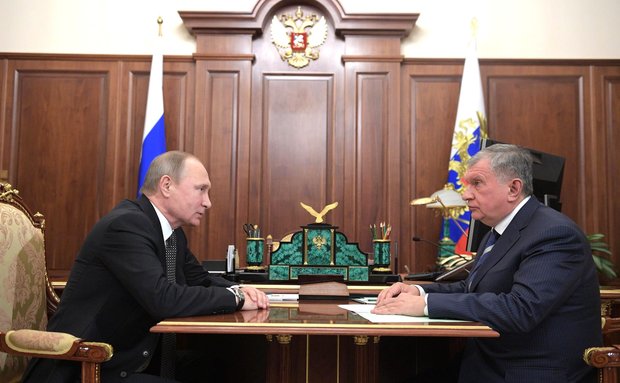

Vladimir Putin: ''We should plan a system of measures for currency conversion that would prevent market hikes.'' Photo: kremlin.ru

At a meeting dedicated to the results of the big deal on Wednesday, President of Russia Vladimir Putin met with Igor Sechin and publicly made a correct focus:

''A large amount of foreign currency will be supplied to the financial market, but the budget must receive the full sum in the ruble equivalent, in rubles. Therefore, we must devise a method that would preclude a negative impact on the market and prevent any hikes on the exchange market.

We know that Rosneftegaz, which will ultimately transfer the money to the budget, has considerable ruble resources. First, we should use these funds, and second, we should work jointly with the Finance Ministry and the Central Bank to plan a system of measures for currency conversion that would prevent market hikes. I ask you to coordinate these issues with the Government, including top Government executives, as well as the Finance Ministry and the Central Bank.''

In fact, he generally confirmed the gigantic mega conversion ''budgetary currency from the deal for Rosneft's rubles from bonds'. In other words, this conversion won't have any impact on the currency market.

Head of the Macroeconomic Analysis Centre and head economist at Alfa-Bank Natalia Orlova commented on the consequences of these deals in a similar way:

''I think these deals are not linked. Rubles were purchased for Rosneft's future liabilities, and Glencore and Qatar Investment Authority's currency is designed to pay the budget that needs rubles. This is why probably Rosneft will give the rubles, which were borrowed on the domestic market, to the budget and use the currency to pay its external debt. For this reason, in general, I think that the negative effect for the currency market can be equal to zero. Even if the currency will directly go the budget, anyway, it won't affect. If the borrowing through ruble bonds for Rosneft were a backstop deal, it is probable that such bonds can be paid off in advance because bond holders will receive interest.''

Business à la Russian: expensive purchase and cheap sale?

Everything seems to be fine except one ''but''! Clearly, the budget will spend the received rubles and get rid of its deficit. But what should Rosneft itself do with a big New Year bag of currency at €10,2bn? To tell the truth, Rosneft doesn't need the currency. By the beginning of October, it accumulated $20,2bn on its accounts. Moreover, Bashneft has about $350m. In October, Rosneft sold its shares in Vankorneft and Taas-Yuryakh Neftegazodobycha for $4bn and is going to get $1,1bn for Verkhnechonskneftegaz's 20% from Beijing Gas Group. Rosneft needs to pay its external debts equal to at least $4bn in the 4 th quarter.

In 2017, Rosneft will have to pay off $12,9bn of debts. As you can see, the company has currency in surplus even if we don't consider export transactions in 2017.

Here additional €10,2 (or $11bn) will fall upon them. What should one do with too many currency? To salt? To pickle? Foreign buying up assets because of sanctions and other nice things of the competitive world investment market is not so attractive. And there are things to buy within the country (for example, Tatneft). They also say about Lukoil, but it is a little hard to believe, given its high level of state support, especially foreign one (mostly American). Why not, Tatneft company is quite attractive, the oil price are still low, and the Russian stock market is very far from world levels. Judge for yourself, 20% of Rosneft were sold for $11bn with all the crazy assets, including Bashneft and TNK-BP. It turns out, the whole Rosneft is worth only $56bn? And it is despite the fact that just a few years ago Rosneft bought TNK-BP for about the same money. But for the Bashneft they paid about $5bn. That is, not including giant Rosneft, about $60bn has been paid for Bashneft and TNK-BP – it is more than all yesterday's assessment of Rosneft. How maddening, because it is very very cheap. We do not even compare with the value of shares of their foreign analogues… Let's not talk about sad things — they sold it as they could. Now in the hands of Rosneft in the near future there will appear a lot of currency, which it needs.

So, there is one way out — to release this huge amount of currency into the market, evoking another monetary Armageddon. Putin has warned Rosneft about a convert ''rubles from bonds in the budget currency''. But what about the reverse conversion (currency of Rosneft — rubles of the market) he said nothing, leaving everything to the discretion of Rosneft. So we can only pray and hope that Rosneft will not collapse the currency market, dropping to it unnecessary currency. Hope for the prudence of Igor Sechin, although 2 years ago Rosneft caused fall of the ruble roughly in the same amounts, absolutely regardless of the consequences for the market.

By the way, the stocks of Rosneft have started to grow sharply. Since the beginning of November until today, the value of that unusual stock has grown rapidly from 332 rubles tp 418 rubles. For almost a month, the stocks price has increased by 26%, which is strongly hints on the interest to it. It would be appropriate to think about that. It is good if it is not Rosneft…

Source: tradingeconomics.com