Tatarstan wind energy gets ‘stuck’ in the turbine

The first wind farm in the republic may appear only by 2030

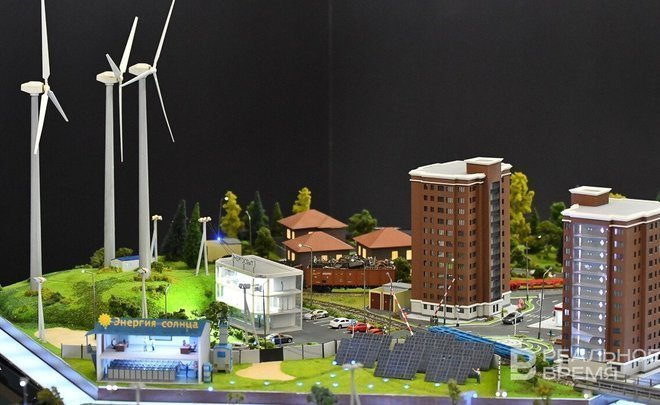

The implementation of large-scale projects of wind farms and wind power plants in Tatarstan, announced several years ago, is stalling. Despite that domestic investors have taken the place of foreign investors who withdrawn from the republic due to anti-Russian sanctions and their number is only growing, it has not yet been possible to solve the main problem with the production of domestic wind turbines or the localisation of production of foreign models. What prevents the republic from making money on the wind and how relevant the “green agenda” is in the region at the moment — in the material of Realnoe Vremya.

“Frozen” wind”

The sanctions put an end to the plans of the Italian energy giant Enel to build the first 71 MW wind farm in Tatarstan. The company already started practical design, and development work on sites and networks was completed by almost 90%. However, the threat of falling out of favour with the West forced Enel, which operates in 32 countries around the world, to abandon the project, and six months later to leave Russia altogether, selling all its Russian assets. Its example was followed by the Danish company Vestas and the Finnish company Fortum.

However, just two months later, information appeared that Turkish and Chinese companies would replace the Europeans. The Ministry of Industry and Trade of Tatarstan told Realnoe Vremya, in particular, about the signing of an agreement with Turkish VTK Global, which intended to build several wind farms in the republic. Moreover, the construction of one of them was supposed to begin in 2022, and the facility was planned to be put into operation in early 2025. They also discussed the supply of equipment for wind turbines from the Chinese manufacturer Harbin Electric Corporation Wind Power.

More than a year and a half has passed since the big announcements. However, no serious practical progress has been been made over this time.

“The projects have not stalled. They continue, but not very intensively. Technological problems mainly interfere," Nail Timerbayev, the head of the Department of Renewable Energy Sources at the Kazan State Power Engineering University, told Realnoe Vremya.

The thing is that at the moment almost all renewable energy source (RES) projects in Russia are being implemented within the framework of the Renewable Energy Sources Capacity Supply Agreement. However, to participate in it, it is necessary to have a turbine production localised in the country. At the same time, it is necessary that the degree of localisation be at least 80%.

“At the moment, only NovaWind JSC (Rosatom's subsidiary) has it, and they have become monopolists in this process. And the rest cannot localise production in our country yet," Timerbayev admitted.

The Ministry of Industry and Trade of Tatarstan confirmed to Realnoe Vremya that the above requirement was the reason for the suspension of the project for the construction of wind farms using Harbin Electric Corporation Wind Power equipment.

But the Turkish VTK Global Investments and Trading S.A. still could not cope with the fear of sanctions and abandoned its plans before going into something together.

“As a result of the tour of a number of sites, it was envisaged to build a wind farm in the Rybno-Slobodsky district using foreign wind energy equipment. Due to the imposed sanctions, the project has been suspended," the ministry stated.

Money to the four winds

At the same time, according to Timerbayev, there are quite a lot of interested parties, but they cannot yet agree with, for example, Rosatom on specific steps and deadlines.

“At this stage, cooperation with Rosatom is alive, to some extent, and with the Chinese, with other turbine manufacturers, there are talks about possible localisation of production, including in Tatarstan. But it is still being at the stage of a feasibility study. Moreover, this is not so much the development of the feasibility study itself, as that it shows the high economic profitability of the processes, and the currently available ones show an insufficient degree of marginality," the expert explained.

According to the calculations of the head of the department, in general, the market that is needed for the localisation of a wind turbine is from 2.5 GW of capacity.

“At the moment, only Forward Energy (formerly Fortum — ed.) has such a contract, but they are still experiencing difficulties in determining where, what and how to launch," he noted.

The volume of electricity generation in Tatarstan due to renewable energy sources, according to estimates, should not exceed 600 MW.

“If the entire energy sector of the republic is about 4.5 GW of used capacity, then in order not to disrupt or break the network's operating parameters, 10-15% of the total volume is considered normal for implementation, that is, 600 megawatts of such generation can be easily and efficiently placed. The only question is economic efficiency," Timerbayev said.

Everything is fine with the winds in the republic, and in some area, it is even very good.

According to the Ministry of Industry and Trade, as a result of wind measurements carried out at three sites (in Kamsko-Ustinsky district (Krasnovidovo), Rybno-Slobodsky (Sorochy Gory), Spassky districts (Izmeri), it was found out that the wind speed exceeds 7 m/s, ICUF (installed capacity utilisation factor — ed.) ranges from 32.2% to 39%, which characterises the presence of commercial wind and the corresponding energy potential of the sites. There is also a technical potential. However, Tatarstan is not competitive against the background of the rest of Russia. Even the almost finished wind farm abandoned by Enel causes investors, mainly Russian ones, to feel similar to the expression “honey is sweet, but the bee stings”.

“This is the site that is in the highest degree of readiness for construction. There are many interested parties, but it must be understood that this “tidbit” is so against the background of the republic, and all interested parties are federal… It's just that no one needs an image. These are specific economic projects. Accordingly, they must be cost-effective. Image is one of the spurring points, but not the main one to invest so much money, the expert argues.

However, Timerbayev is still optimistic. To the question: “Will wind farms appear in Tatarstan at all and whether there is a foreseeable deadline for this?" he replied: “I think not in the next 2 years, but in the next 5 years, yes.”

According to the expert, only the first step of the most determined investor is needed.

“There are interested parties who want to build a wind farm, but they do not have a localised machine, and there are manufacturers of turbine machines who are interested in localising production but do not have their own market volume. When parity is reached, then everything will break the deadlock and turn upward. While there was Vestas, there was competition in Russia. While there was Siemens, there was competition in Russia. Everyone agreed and found common ground. We need to repeat this picture. The main factor is someone to decide to localise production. The question of eggs and chicken," Timerbayev said.

According to the Ministry of Industry and Trade, according to the results of the competitive selections of projects planned for implementation in 2023 within the framework of the Renewable Energy Sources Capacity Supply Agreement mechanism, the entire volume of support for the construction of wind farms was taken by Uralenergosbyt. The winner received 738 MW, including in the territory of the Republic of Tatarstan with a total capacity of 349 MW with the commissioning of facilities on 01 December, 2028.

“There is also an expressed interest in the issue of wind energy from the Russian manufacturer of power equipment Silovye Mashiny JSC. The company is considering the localisation of wind equipment on the territory of the Republic of Tatarstan," the department added.

Far East is a competitor of Tatarstan

Nevertheless, Timerbayev warns that other regions may be ahead of Tatarstan.

“The Far East can now become our main competitor. If we compare the regions. The Renewable Energy Sources Capacity Supply Agreement program, under which facilities are built, operates only in the so-called price zones. Previously, there was no such zone in the Far East. It didn't cover Siberia. But now they want to introduce such a zone there, and, accordingly, the Agreement can be applied in this region. And there is much higher wind potential and demand," says the head of the Department of Renewable Energy Sources of the Kazan Power Engineering University.

In turn, the deputy director for scientific activities of the Naberezhnye Chelny Institute of the Kazan Federal University, Dinar Fazullin, is confident that in Tatarstan it is preferable to develop mini-hydroelectric power plants, the use of electrochemical generators (ECG) on solid oxide fuel cells that run on natural gas, generating electric and thermal energy, electrochemical generators on fuel cells with polymer electrolyte for vehicles and thermal pumps.

“The development of alternative energy in Tatarstan is at an inchoate level. Despite the efforts of individual companies to build wind turbines, as well as the commissioning of a number of small hydroelectric power plants (for example, the Karabash HPP with a capacity of 500 kW), the share of non-traditional sources in the structure of the total electricity generation of the republic is less than 1%. The applicability of alternative power plants is limited by a number of problems that lie both in the technical and economic plane. Technical issues include the inconstancy of renewable energy sources (irregular flow of small rivers — in our climate, rivers are under ice for a significant part of the year, changes in wind speed and the number of sunny days), as well as the relatively low efficiency of wind and solar installations (although this indicator is slowly but surely increasing). The economic problems include, first of all, the high cost of the equipment itself, as well as the need for regular replacement of expensive batteries included in the power plant," concluded Fazullin.