Business centre and office market: ‘The demand shifts from the premium segment to low-cost options’

Experts about new trends in the market of commercial property of Kazan

Investors and developers have kept the wait-and-see approach — this main trend of the past year in the commercial real estate market passed to 2023 too. Businesses are concerned about the conditions that changed — higher rates of external funding of projects, notably appreciated construction, lower purchasing power and business activity. At the same time, according to the experts surveyed by Realnoe Vremya, the market is stable, while demand is shifting from the premium segment to low-cost options. Read more in Realnoe Vremya’s report.

“The deficit of good areas is here”

The last year was tough for businesses. However, according to experts, poor quality remains in the office market of Kazan, while rent rates showed growth. Moreover, the market approached the current economic crisis with a deficit of supply of quality areas in Kazan:

“We didn’t see a great outflow of tenants from business centres. Also, a small number of foreign companies that were present in the regional market influenced the stability of the segment. Such company mainly provided services to large businesses and continued working in the market by handing over their assets to Russian representatives,” managing partner of Perfect RED Yulia Prokhorova told Realnoe Vremya.

According to her, despite all the turmoil of the year, the demand for quality offices from IT businesses, the oil and gas sector and companies providing services to state corporations is here. The expert singled out two big deals in the office real estate market of Kazan last year:

- Avito rented 1.500 square metres at Kremlevskaya Plaza business centre;

- SOK co-working space with an area of 4.000 square metres was leased entirely to Sovkombank.

“There aren’t positive expectations in 2023. The Russian economy is dependent on the public budget, while a deficit is expected this year. Therefore we should assume that businesses’ incomes will fall and, as a consequence, demand for rent will decrease like it happened in 2009-2010 and 2015-2016. The quality in Class B and B+ will likely increased in the office market of Kazan where most tenants occupy small areas and easily can leave rent agreements, moving to cheaper offices or reduce rented areas,” Prokhorova noted.

“New business centres aren’t going to appear in the short term”

Rent rates demonstrated 9% growth last year compared to the previous period. As the interlocutor of the newspaper noted, Class A and B+ areas in business centres were growth drivers:

“The high occupancy rate even allowed raising rent rates in current Class A projects. The average rate in this segment reached 1.588 rubles per square metre a month (9% growth against last year); in Class B+ it is 1.158 rubles per square metres (9.3% growth); in Class B it is 837 rubles per square metre a month (5.1% growth). The rate directly depends on the availability of space and demand in the market. This is why one shouldn’t expect a big fall in rates in the deficient quality office market in Kazan in 2023. There didn’t open any quality business centre designed to be rented on market conditions in 2022.

New business centres aren’t meant to open in the capital of the republic soon. They are expected to be delivered by 2024:

- a business centre as part of MFC UNO with an area of 9.940sq m;

- a business centre on 31, Pravo-Bulachnaya Street with an area of 6.580sq m;

- a business centre as part of ART community centre with an area of 7.300sq m.

“Investors and developers’ wait-and-see approach is an occurrence that seized the whole commercial property market in 2022. And this remains a tendency in 2023 in Russia in general and in Tatarstan in particular,” noted head of Strategic Marketing at UD Group Regina Lochmele.

“The wait-and-see approach, first of all, has altered market conditions behind: higher rates of external funding of projects, notably increased construction cost, shrinking market capacity amid decreasing the population’s purchasing power and reducing of companies’ business activity.”

According to her, to save facilities’ investment attractiveness, “it is important for developers to not only sit out but take advantage of a moment and perhaps reconsider a planned product (project), creatively work on strengthening its concept and created values for clients.”

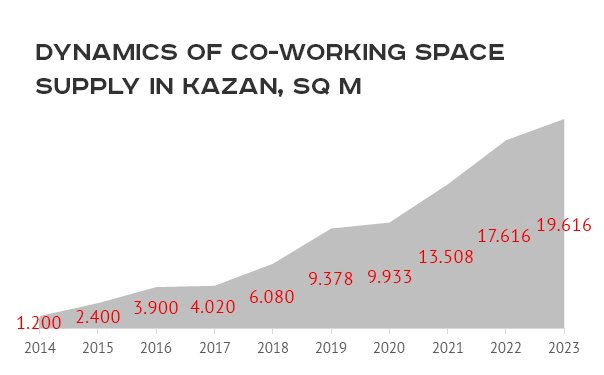

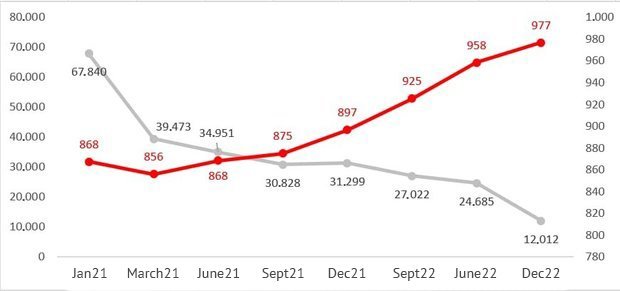

The dynamics of the average gross rent rate (rubles per square metre a month) and vacant areas (square metres) in the office market of Kazan.

“The demand is shifting from premium to low-cost”

Nevertheless, the Kazan market of commercial property remains stable, while its key tendency this year is that “the demand is shifting from the premium segment to low-cost options.” Director of the Regional Development Agency Ilshat Khamitov sticks to such an opinion:

Ilshat Khamitov also noted a change in the vector of the demand for areas for food outlets. According to him, if earlier there used to be demand from premium tenants — restaurants, now it shifted to low-cost cafes and canteens — much more applications are received from them. “The same is happening to offices — there is big demand for low-cost offers. But commerce is like a huge ship that is hard to launch and it is as hard to stop it. Consequently, any moves and market volatility, like in housing, do not work in commerce. It is not a quick-response sector. The industry is very stable, solid, but it hardly changes. Neither the special military operation nor COVID-19 influence it except for some moments,” the expert is convinced.

“Two areas for Chizhiki rented”

The commercial property market in Kazan is gradually recovering its equilibrium. Investors continue being interested in good offers. Owners, in turn, aren’t ready to reduce prices despite the current economic situation. Director General of A-Development Murat Akhmerov told the newspaper about it:

The demand remains standard — it is the first floors of buildings for small stores, also, there is big demand for small areas on the first floor on an area of 100sq m for 20-30 million rubles. Murat Akhmerov said that Russian low-cost chain store Chizhik by X5 Retail Group finally started to buy areas to rent in Kazan. The chain planned to open stores in the capital of the republic as early as 2022, but now it is going to open the first shop on Arakchino Highway. As Akhmerov said, the second store will be on 6, Said Galeyev Street. The company rented two areas to rent for these stores.

“Even what used to stay idle is sold”

The market of commercial property became more actively earlier this year, Director of DiGroup federal realty agency Diana Nurgaliyev noted.

According to her, they received a lot of requests to rent areas for food establishments — an area of some 100sq m, it is crowded locations that have always been in demand.

Managing Director of UD Group Vitaly Kolegov expressed his confidence that the future of the commercial property market laid with the shift in the focus from mono-functional development projects towards multi-functional complexes:

“Commercial real estate facilities stop being simply physical assets, they become an environment communities of people fit in. Conceptually, multi-functional complexes allow connecting and integrating functions reflecting different needs of clients for products and services, impressions and self-fulfilment. Thanks to such synergy of functions, multi-functional complexes can be more attractive from a perspective of investment and financially stable development projects. We plan to reinforce our project portfolio precisely thanks to multi-functional complexes. Of course, not any multi-functional complex will be successful. A well-considered concept and residents’ collaboration are needed for a project’s true success.”

“Great time to buy real estate property”

Commercial real estate hasn’t run out of its possibilities in price growth, it is still 1.5-2 times cheaper than residential facilities, noted managing partner of Accessible Office Fund Vyacheslav Pimurzin:

“Given the serious deficit of quality commercial areas in cities with a population of a million people (including in Kazan), it has every chance of going up in price. This is why when investing in commercial real estate (especially second-hand one), today an investor can count on both a rent business and price growth potential.

He says that the first half of 2023 is a great time to buy commercial real estate property. However, individuals investing in office property isn’t the most popular strategy today:

“Russians have always tried to invest in square metres and they choose a more clear investment: to ‘hide’ money from inflation by buying flats. It is a tradition, and it never fails: indeed, there hasn’t been a year when flats in Kazan haven’t increased in price by at least 2%. But from a perspective of the business, payback, investment prospects, many private investors miss more interesting opportunities in commercial real estate. It is an investment that will show off right away, provide a stable income source and will appreciate year after year. And it will require less investments than a flat,” the entrepreneur stressed.

Vyacheslav Pimurzin thinks that commercial property should rather be bought before April: “At this moment, the prices are reasonable, that’s to say, the market is stable at the moment, which gives a normal price. There will be some revival from May and it won’t be so profitable to buy. Now demand for commercial property is rising among private investors, in other words, commercial spaces are actively purchased and there can be no interesting areas left to buy in the next six months.”

“Many managed to readjust”

In its integrated territory development projects, the developer firstly focuses on “at hand” commercial areas, which allows not only inspiring active life into a residential complex at the beginning but also creating additional jobs for small and mid-sized businesses.

“At this moment, business representatives have started to consider proposals of commercial property both in projects under construction and the residential complexes of our company that already were delivered,” the interlocutor of the newspaper specified. The expert noted the purchase of areas for retailing among big deals in the commercial property market in 2022 and early 2023.

“Commercial property is different from residential in many parameters, including in pricing. Residential property goes up in prices quicker, but the picture can change. More people tend to rent a non-residential area for a long term buying it for a good rate and investing as little money as possible, really. Tenants often prefer doing improvements themselves and making the space for profitable,” added Aygul Latypova.

As head of Kvartet real estate agency Rustem Safin said, there are many new interesting facilities in the market now. In particularly, non-residential areas in the oldest abandoned construction project of Svey on 57, Dostoyevsky Street are rented. The Fund for Deceived Equity Holders completed the construction of the block of flats.

Warehouse owners keep saleability

There is also big demand for quality areas in the market of warehouse and industrial property in Kazan. As Ilshat Khamitov noted, “the demand for warehouses, especially in Class A, was very high, now it calmed down a bit, but still there is a deficit of warehouses.”

Diana Nurgaliyeva too noted the high demand for production areas:

“Now normal warehouses in Class A and A+, B and B+ can hardly be found. There is a great deficit for them. We can forecast it will decrease a bit with the launch of the second stage of Novaya Tura. The owner has just announced the construction.”

During the talk, Rustem Safin put an example of a number of facilities within the Big Kazan Ring. Here three production facilities for 320 million, 210 million and 105 million rubles are up for sale. It is land parcels with areas of 1.5ha, 3ha, 4.5ha.

“These production facilities have been sold for a bit more than a year because of the special military operation. We had potential interested clients, but somebody left the country, somebody changed his mind to make purchases in a rush or hoped for a significance fall in the price and bargaining, but sellers decided to keep saleability and refused to lower the price, which I consider correct. There aren’t any other land parcels for production near the Big Kazan Ring,” the expert noted.