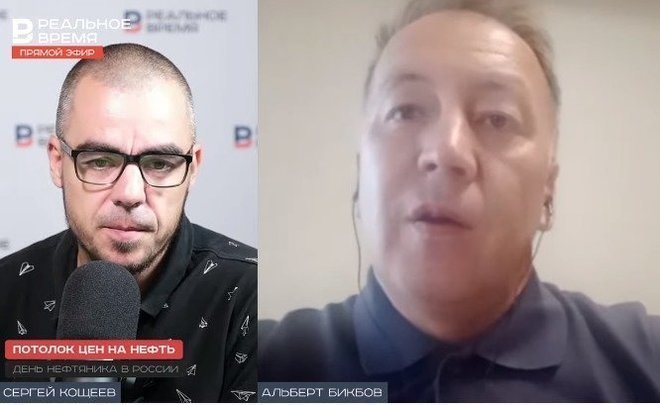

Albert Bikbov: ‘The oil price cap is absolute lawlessness’

Economist and blogger Albert Bikbov thinks that “the price cap” on Russian oil G7 members agree on is nothing but an instrument of psychological pressure on Russia. He shared this opinion during a live with Realnoe Vremya.

“This is an instrument of psychological pressure”

Here this instrument can be interpreted ambiguously. First of all, it is an instrument of psychological pressure because clearly Russia isn’t the only country to sell oil and oil isn’t purchased only from it. In other words, there is no market where the same Russia with its oil production can be cornered and conditions can be dictates. What’s the problem? The problem is that it is an instrument of psychological pressure. How will it work? They are starting to push even now, though the G7 will fully work when such countries as India and China join. But the case is that firstly our authorities immediately demonstrated a harsh response and [Dmitry] Medvedev did a good job, said it right away. Like in a joke — the one who will get a pack of tickets will get waterworks. They will take, we will switch off gas.

To start with, there is still some times because they claimed only this but in reality this will be approximately only 5 December regarding oil and approximately on 5 February 2023 for Russian oil products. The terms for gas are same, they are elaborating it now. But what’s the issue? They say they create such a cap and hope that other countries buying oil from Russia will hit this ceiling. It doesn’t matter what countries it is — China, India, Africa, some Asian countries where our commodity traffic is now redirected. They think they will join this game right now because the country has been cornered — others can join the hunt and press Russia, precisely prices for Russian oil. This is why a cap is needed. They set a diapason of $40-60 per barrel and therefore want to punish Russian well.

The problem is that India and China despite the alluring possibility of buying oil from Russia cheaper if they now join the price cap, they risk losing oil and gas because Medvedev clearly said who will set the cap won’t be supplied oil. Russia will survive. There will be some serious shortage of currency supplies, but our suppliers already collapsed twofold and the currency is not topical, to put it mildly. We see this in the exchange rate and other things — imports colossally plunged. Consequently, the pressure and demand for the currency are low now. If India and China don’t receive hydrocarbons from us, they won’t be able to replace it all with other states’ volumes.

Secondly, there is other serious power that doesn’t stand low prices — it is Saudi Arabia and Near Eastern countries that are outraged that some politicians are trying to influence their oil sale incomes. All this is absolutely lawlessness. Two for flinching — such a light feint hoping that ours will shiver or oil purchasers will shiver that will be happy with the chance of pressing Russia with prices. But this won’t happen because the market is narrow — nobody will manage to replace Russian oil and gas no matter how much they talk there. Winter, autumn, I think this initiative will die on its own when cold winter comes and they start using everything from oil and gas reserves twice as more. I think all this initiative is only verbal, only a verbal attack.

“This is happening amid the West’s pressure to make us change our stance on Ukraine”

When you try to play the global state plan, fix a state market price, you must have monopoly in the market either as a purchaser or seller. Then one could think about oligopoly. Sadly, even in the USA with the other G7 countries, these aren’t the leading oil market players. Though yes, America is an undoubted leader, we understand it, both in oil and gas. But anyway the problem is that logistic, transport, technological difficulties require costs. The world oil market was created for decades, and it is simply impossible to break it all overnight.

Now Europe is hurriedly buying LNG in China — liquefied gas of Russian origin, and there is a roundabout bypassing Africa — it is huge expenses. How are they in general going to refuse it all? My only explanation is that it is purely psychological pressure, the pressure hoping that somebody will buy it — India and China, for instance. If they are not interested in Russian gas, they wouldn’t be buying it now. And they doubled the purchases, even tripled at times. Our logistics is operating to the full to redirect these flows for our new partners, Russia’s friendly countries, those countries with a neutral position. And you are welcome to press Russia in this respect that can easily switch off and don’t supply.

I even think that the same European — there are a lot of different mechanisms that can easily evade this cap. Yes, oil is sold for $40 per barrel as well as there is a price cap, everything is okay. At the same time, there is some compensatory deal where the difference from the market price goes to the seller, while some commodity can be sold or some services can be provided. Look at what is happening to the Latvian mix — now it is a very popular operation. Oil seems to be from Latvia, it clearly says this, but it doesn’t say that is mixed with Russian oil, but it is sold. Or tankers meet in the ocean, switch commodities and that’s it. In other words, there are a lot of evading mechanisms.

Global oil traders aren’t fools. They will make up a myriad of ways of evading this cap. I mean there will be cap deals, while compensatory deals will be signed at the same time, and in fact it will turn out to be the same trade with world prices, the case is that the difference will be a bit different, in a bit different deals. The history of capitalism, even late ones, oil trading has such examples. There was Marc Richi in the 80s, he is an American businessman who traded with Iran, Iraq, the US embargo was everywhere, he evaded them, sold, made up mechanisms. In the end he was driven out from the country — he became a citizen of Switzerland. Global oil trading originated from his firm, that’s to say, all world leading oil traders are anyway his students or his colleagues.

In practice this measure is impossible. The only thing is that Western countries are trying to depict some pressure now. There is some verbal pressure, but those who understand the situation are laughing. Everything is within the Western pressure to make us change our stance on Ukraine. All these things are conditioned by the special military operation in Ukraine.

“The fridge will always win television”

They are frenzied the unipolar world is over. They are frenzied that there is not one hegemony that can order in any country or any people what to do, how to live. China grew up, it is such a superpower, the second-biggest economy, if not first. They are trying to dictate China what to do with Taiwan. It is the outrage of Western elites because of the loss of their monopolist position in the world order.

The unipolar world collapsed. Now the world is multipolar. They cannot accept it. And these are convulsive attempts to dictate what oil prices to fix. Though I want to note that OPEC, if call a spade a spade, is an international agreement of leading oil exporters and it has hardly handled this price politics in the oil market recently. The OPEC+ deal signed nearly 9 years led to truly good results, prices started to grow. But the problem is different — not even OPEC dictates this but one of the leading gas producers — the USA. It decided that it can replace both OPEC and the world order in the world market oil products. This is the hysteria because the unipolar world is over but they haven’t yet realised it, they haven’t accepted it.

Even selling oil as much as for $40-60 per barrel they want won’t destroy the oil industry because oil production prime cost in Russia is very low. Because of firstly capital investments of the USSR, then were made really huge investments in the development of both oil and gas fields. Now economists calculate according to maximum costs, this can be seen even in reports — it is some $4-5. So we can easily survive even if it will be $10 per barrel, but this won’t happen because there is less and less oil in the world. And thank you Greta Thunberg who should be placed a monument in Russia for this “green hysteria.”

Due to this green energy transition, this green economy, they suddenly cut their investments, leading countries, producers that followed this little girl with a reed pipe sank. They cut expenses on exploration, equipment, investments — and now there is very little light oil in the world, there is almost none. It is necessary to find money and invest, invest, invest to produce it. Thank you Greta Thunberg. Well done, she did correctly. Everything happened there because of an environment psychosis. The role of hydrocarbons was underestimated, their era isn’t over, and it cannot objectively end unless such energy sources that will be cheaper than hydrocarbons are found. And one shouldn’t talk about wind energy here — they stood idle in Germany throughout summer because the summer wasn’t windy. Don’t talk about hydro power plants in German rivers that dried up and everybody walks on them. The hydrocarbon era isn’t over yet. And all these Gretas and her followers made sure that if Russia leaves this market now, there will be a real collapse.

All European laymen sympathise with Ukraine to some extern under the influence of some propaganda, but the fridge will always win television. And they will go out and ask why they need this all. All this price caps, military assistance in abnormal volumes. [President of Ukraine Volodymyr] Zelensky is “does a nice job,” he says give us €7 every month, a Ukrainian’s dream is to sit and receive all these benefits.

Countries’ economy plunged. Now Western partners shouldn’t follow the path of escalation, on the contrary, the path of de-escalation should be taken to survive not only the cold winter but also the starting economic decline of the recession in America, closure of a huge number of plants in Europe. They should think about themselves, their soul, its salvation, about the salvation of their body, people now, not to frighten with oil price caps. This is what I wanted to say. One should think about oneself.