''The sector felt much better'': Central Bank helps banks to make money

The profit of the banking sector in 2018 increased by 1,7 times, but in the near future the market is predicted to slow down

The year 2018 was a good year for Russian banks — their profits increased by 1,7 times. However, the reasons for such dynamics were one-time: the passive contribution to the growth of profit was made by the Central Bank — it did without high-profile reorganizations, thereby saving the sector from large losses. In addition, many banks released funds due to provision write-back. This year is unlikely to be as positive, experts warn. Read more in the review of Realnoe Vremya.

Without 'big stories'

Against the backdrop of the failed 2017 year, when the financial result of the Russian banking sector fell by 15%, the previous year looked more successful: the net profit of banks increased by 1,7 times — to the level of 1,35 trillion rubles, the Central Bank reported. In addition to the low base, there was at least one more natural reason for a strong profit dynamics: a decrease in the aggregate negative result of unprofitable players (575 billion rubles in 2018 against 772 billion rubles a year earlier).

But these factors were not the only ones. According to some analysts, the provision write-back, among other things, helped the sector to increase profits. In some cases, this assumption is supported by data on specific banks. At the beginning of October, the three largest players — Sberbank, VTB and Gazprombank — kept in the accounts of the Central Bank a total of 369,2 billion reserves, by 195 billion less than in October 2017 (financial statements of banks under IFRS). The reduction, however, occurred only at the expense of Sberbank — the other members of the 'big three' increased their reserves.

Dmitry Kharlampiev, the director for analysis at investment department in Otkritie Bank, notes that in general the accrual of loan impairment reserves was 'quite modest' — which had a good impact on the financial result.

Dmitry Kharlampiev, the director for analysis at investment department in Otkritie Bank, notes that in general the accrual of loan impairment reserves was 'quite modest' — which had a good impact on the financial result.

''Last year, banks contributed relatively less to the reserves. At the end of 2018, the reserves for possible losses increased by 10%, while a year earlier their growth amounted to 27%,'' says Mikhail Doronkin, the director of banking ratings at Expert RA.

Besides, he continues, a strong acceleration in lending played a role — both retail customers (in this segment, the portfolio of banks increased by 22% against 12,7% in 2017) and businesses (+10,5% against +1,8%). This gave a noticeable increase in interest income at a fairly low cost of funding base, which it was most of the year.

In general, from the point of view of basic banking services the previous year was quite successful, said Kharlampiev. The loan portfolio, with the exception of interbank loans, grew by 13,9%; the retail segment, including mortgage, grew at a faster pace.

''The main factor that led to a growth of profits is that in 2018 there were no such significant losses from the largest banks. The relatively low profit in 2017 was due to large reorganizations — very serious losses were recorded. Last year, there were no such big stories, so the sector as a whole felt much better,'' says banking analyst Alexander Proklov.

''The main factor that led to a growth of profits is that in 2018 there were no such significant losses from the largest banks. The relatively low profit in 2017 was due to large reorganizations — very serious losses were recorded. Last year, there were no such big stories, so the sector as a whole felt much better,'' says banking analyst Alexander Proklov.

Who shared the profits

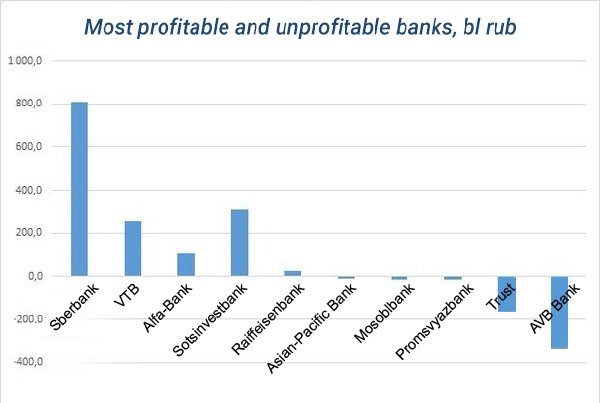

As usual, about 60% of the total financial result of the sector last year was provided by Sberbank, whose annual profit amounted to 811,1 billion rubles, while the share of the five most profitable banks accounted for 9/10 profits of the entire sector.

In addition to Sberbank, the top 5 in terms of profit included: VTB (increased its result by almost 2,5 times in a year), Alfa-Bank (a growth of 2,2 times), as well as Bashkortostan's Sotsinvestbank (owned by Dom.RF Bank) and Raiffeisenbank.

Contrary to the general trend of profit growth, many major players were unable to increase — and in some cases even repeat — the result of the previous year. Thus, the profit of Gazprombank decreased by 47% (to 21,6 billion rubles), of UniCreditBank — by 27% (to 20,4 billion). Moscow Credit Bank reduced the result by 14% (to 11,9 billion), and Tinkoff Bank relative to 2017 lost 2% of profit (it was slightly less than 17 billion rubles).

Among the loss-making at the end of 2018 there were 100 credit institutions, or 21% of market participants; a year earlier they were 140.

The worst result is still shown by rehabilitated Avtovazbank, Trust, Promsvyazbank, which last year received the status of a profile bank in the service sector of the defence industry, as well as Mosoblbank and Asia-Pacific Bank. More than 90% of the negative result of the entire sector (absorbed by the total profit of other players) accounted for exactly these five banks.

In Tatarstan, the dynamics of the financial result in 2018 was even more powerful than in the country as a whole: the net profit of 16 republican credit institutions, including two non-bank ones, amounted to almost 7,1 billion rubles — which is almost 4 times more than a year earlier. The main hero of this occasion was Ak Bars Bank, which increased profits by 3,4 times year-on-year to 2,7 billion rubles. At the end of the year, Ak Bars Bank entered the top thirty most profitable banks in Russia as a whole (if not to take into account the results of non-bank organizations). Next, the best result was shown by Avers Bank, whose profit amounted to 2,07 billion rubles for the period.

Energobank improved its result by more than 2 times, almost the same growth — in Bank of Kazan. The profit of Altynbank grew by 5,7 times, of Akibank — by 14% (although in absolute terms, their result was not so significant to seriously affect the total profit of the republic).

At the same time, half of Tatarstan players reduced their profit figures. For example, the result of Devon-Credit Bank controlled by Tatneft decreased by 38% (to 281,4 million rubles), of Tatsotsbank — by 15% (to 746,1 million), of Kama Commercial Bank — by 64% (to 9,6 million).

''In 2019, it is logical to expect a slowdown''

At the end of 2017 and the first half of 2018, the common place for the market was the reduction in the share of interest income of banks — it fell following the decline in interest rates on loans. Now, when the rates in the economy are growing again, the interest income of banks — and hence the income in general — is likely to increase, says Alexander Proklov.

However, the growth of rates has a downside, which can negatively affect the profits of the sector in the future, experts warn. ''In 2019, it is logical to expect a slowdown of business development due to the tightening of monetary policy, likely slowdown in the growth of final demand and economic development in general, which should naturally affect the profitability of the industry,'' says Dmitry Kharlampiev.

The sector's profit will continue to grow, but not at the same pace as last year, says Mikhail Doronkin. The expected slowdown of the market drivers — consumer lending, including mortgages, as well as the growing cost of funding base — will restrain a growth.

The sector's profit will continue to grow, but not at the same pace as last year, says Mikhail Doronkin. The expected slowdown of the market drivers — consumer lending, including mortgages, as well as the growing cost of funding base — will restrain a growth.