Nail Maganov pulls Nizhnekamskshina out of depression?

Nizhnekamskshina increases tyre production, which was falling since 2013, in the second quarter of the year

Nizhnekamskshina in the first half of 2017 began to overcome a long-term stagnation. It has managed to increase production, along with other indicators. By its estimates, in real terms, the company has grown more than the market. Over six months of this year, Nizhnekamskshina has earned almost as much as in the previous period in total. However, the peak of the profit still remains in 2015. Read more in the article of Realnoe Vremya.

The end of stagnation?

Nizhnekamskshina PJSC (Tatneft group, Russia's largest tyre manufacturer) in the first half of 2017 has grown along with the Russian market of automobile tyres, which had been immersed in depression for several years before. This year by majority of the main indicators, the company shows a positive result and develops faster than the market, as can be seen from its published quarterly report.

About 95% of Nizhnekamskshina's revenue as usual is given from the sales of tyres. In the second quarter and over six months in general they increased. In January-June, the revenue from sales increased by 11,1% and amounted to 7,85 billion rubles against 7,07 billion rubles over six months in 2016. The tyre production is also recovering. In April-June, Nizhnekamskshina produced them by 5,4% more than in the same period last year (the data for six months is not specified). The entire Russian market in natural expression, according to Nizhnekamskshina's data, has increased slightly less — by 4,2%, 7,12 million tyres produced in total.

The growth of production volumes has helped the Tatarstan producer to increase the market share. Nizhnekamskshina estimates it at 32,3%. The relative share of other producers, on the contrary, decreased, the report says. For example, the company Cordiant in the second quarter reduced its share from 32 to 30,9%.

According to Cordiant's estimates, in money terms, the tyre industry in Russia was falling from the beginning of the crisis in 2013, including in 2016 the sales of passenger and truck tyres fell by 2,6%. For a long time the market was depressed by the overall situation in the economy, and in particular by a reduction in demand for cars. According to experts, it was observed for passenger cars (due to falling incomes) as well as in the segment of commercial vehicles (mainly due to a falling in construction).

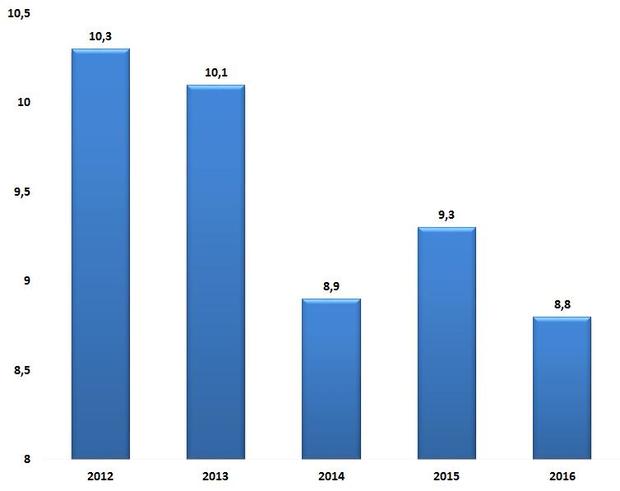

As for the production, at Nizhnekamskshina it began to fall also in 2013, and the drop continued all this time. The only exception was 2015, but then the company also produced by 1 million tyres less than in 2012.

At the end of 2016, Nizhnekamskshina, which previously supplied tyres Kama-Euro for the assembly of Lada Kalina and Vesta, did not extend the contract with AvtoVAZ for another term. Then Director General of Tatneft Nail Maganov said that the automaker disadvantaged Nizhnekamskshina, putting in the ''price formula'' such conditions that could threaten with its decline.

Tyre production at Nizhnekamskshina PJSC, million pieces

According to Rosstat, the production of rubber products in the country in January-June grew by 10%. It is possible that the contribution has been made by manufacturers of tyres and inner tubes, says the leading expert of the management company Finam Management Dmitry Baranov. There can be several reasons for improvement of the situation in the industry, he says. First, over six months there were sold more new cars, and therefore, more tyres were needed. Second, the situation of some consumers partially improved, and they began to buy new tyres. Third, the owners began to take more responsibility for security, which is also, in particular, increases the demand on tyres.

Can't catch up with 2015

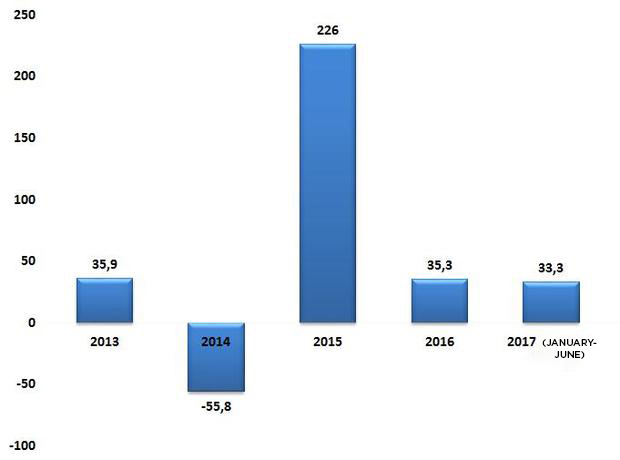

A year ago, Nizhnekamskshina, according to the report, worked almost to zero revenue — its sales barely covered the cost, most of which (56%) is the cost for raw materials. This year by the result of the half of the year, the ratio the revenue-cost rose by 2,9%, according to the report. However, now the revenue also exceeds the cost by only 3,5%. The company's net profit for the first 6 months amounted to 33,3 million rubles, increased by slightly more than 57%. It's almost the same as the amount earned in 2016 in total.

According to Dmitry Baranov, the tyre industry has a tendency to prices raising, ''This may be caused not only by increase in prices for raw materials, but also for other goods and services that are used by manufacturers.''

However, amid the increase in operating indicators the company itself dropped in price: from the end of 2016 to 30 June 2017 the capitalization of Nizhnekamskshin decreased by 1,8%, to 685 million rubles.

An analyst at Alor Broker Sergey Korolev believes that the market price may pressed by a low profit. It has been fluctuating for several years, but has still not returned to the level of 2015 (then Nizhnekamskshina received the maximum profit for a few years — 226 million rubles).

Profit of Nizhnekamskshina PJSC, million rubles

Tyre manufacturers often focus on increasing of production volumes and supply products to manufacturers and large companies almost at cost or with minimal mark-up, says Korolev. This is done in the hope that the next time the buyer will purchase tyres of the same brand. ''Such orders can provide a turnover, but not profit. But investors want to see not so much a record share as a record — or at least gradually, but steadily growing — profit,'' continued Korolev.

However, he notes that today the capitalization at Nizhnekamskshina has recovered. In late January, the government of Tatarstan has included a minority stake of the company in the privatization plan, he recalls, ''Actually, this news very pleased investors, as a consequence, the shares rose by 20%, to 13,8 rubles.'' By July, the price gradually fell to 9,85 ruble, now it has recovered again to 12,85 ruble. Yesterday capitalisation at Nizhnekamskshina was equal to 0,82 billion.