The rich also pay: residents of Tatarstan have paid 4 billion under increased tax rates

The first results of the five-tier personal income tax scale have become known in the republic

Nearly 4 billion rubles was the amount of the “wealth tax” collected in Tatarstan in the first quarter of the year, Realnoe Vremya has found. These are revenues from personal income tax (PIT), calculated under the new legislation with increased rates for those whose annual income exceeds 2.4 million rubles. According to the Federal Tax Service for the Republic of Tatarstan, the lion’s share of the funds collected from wealthy residents was directed to the republic’s consolidated budget. Moreover, this amount accounted for more than 10.5% of all PIT collected in Russia under the 15–22% tax rates. More on the effects of implementing a progressive income tax scale, the prospects for growth in related budget revenues, and the potential for citizens to hide income from increased taxation — in our report.

“Wealth tax” recalculated under new rules

As Realnoe Vremya has discovered, in the first quarter of 2025, the amount of personal income tax (PIT) collected in Tatarstan under increased rates (above 13%) totalled 3.9 billion rubles. In response to the outlet’s inquiry about tax revenues following the introduction of the five-tier tax scale in 2025, the Federal Tax Service of Russia for the Republic of Tatarstan also reported that more than 80% of this amount — 3.25 billion rubles — was directed to the republic’s consolidated budget.

These are the first results of the transition to the new system of calculating personal income tax (PIT) under increased rates: in 2024, the rate stood at 15% for annual incomes exceeding 5 million rubles, but as of 1 January 2025, the threshold has been halved, and the scale itself has become five-tiered:

- 13% — for incomes up to 2.4 million rubles per year (less than 200,000 rubles per month);

- 15% — for incomes from 2.4 to 5 million rubles per year;

- 18% — for incomes from 5 to 20 million rubles per year;

- 20% — for incomes from 20 to 50 million rubles per year;

- 22% — for incomes exceeding 50 million rubles per year.

The increased rates apply not to the entire income, but only to the portion that exceeds the respective thresholds. Revenues from PIT at the 13% rate go to regional and local budgets, while those above 13% are directed to the federal budget.

A tenth of all PIT revenues

In 2025, the “wealth tax” accounted for one-tenth of all personal income tax (PIT) revenues in Tatarstan during the first quarter of the current year. As previously reported by Tatarstan’s Minister of Finance, Marat Fayzrakhmanov, PIT revenues to the consolidated budget of Tatarstan and its municipalities amounted to 38 billion rubles — by 16% more than in the same period of 2024 (32 billion), when the “wealth tax” was applied without any form of tiered structure.

These figures are broadly in line with national indicators. According to the Federal Tax Service, in the first quarter of 2025, PIT collections across the country were 1.5 times higher than the previous year, while tax revenues from PIT calculated at rates above 13% amounted to around 38 billion rubles.

The trend towards an increase in budget income from personal income tax has been observed for several years. Thus, by the end of 2024, the consolidated budget of the republic received 191.5 billion rubles — 47.4 billion more than in 2023 (144.1 billion).

The head of the Federal Tax Service for Tatarstan, Marat Safiullin, explained the growth of budget income from personal income tax in 2025 in Tatarstan by three factors:

- salary increase by 23%;

- an increase in the number of jobs in the republic by 23,000;

- improving the quality of tax administration.

“Number of wealthy individuals is constantly growing”

Experts predict a further increase in PIT revenues, particularly from the application of the five-tier tax scale. This is attributed to the expected growth in household incomes, which in turn is likely to lead to an increase in the number of taxpayers with annual incomes exceeding 2.4 million rubles.

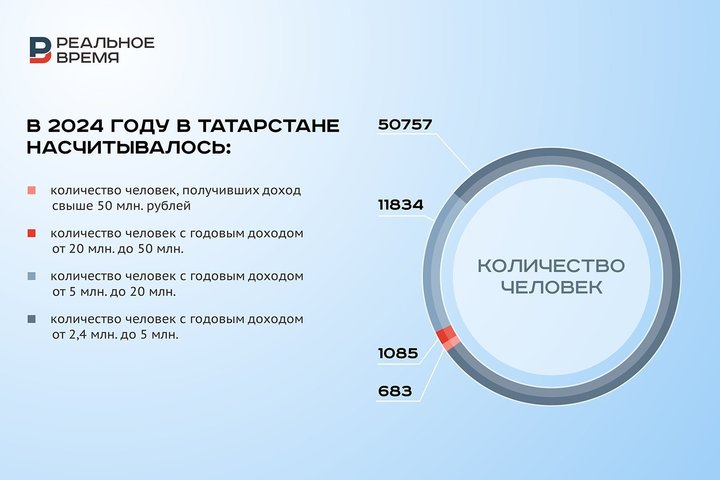

According to data from the tax service, in 2024, Tatarstan had 683 individuals earning over 50 million rubles, 1,085 individuals with annual incomes between 20 and 50 million rubles, 11,834 people earning between 5 and 20 million rubles, and 50,757 people with annual incomes ranging from 2.4 to 5 million rubles.

“The number of wealthy individuals in our region is steadily growing. In 2023, there were 30 billionaires in Tatarstan, while by the end of 2024, that number had risen to 37,” said Marat Safiullin, the head of the Federal Tax Service for the Republic of Tatarstan, at a briefing dedicated to the 2025 tax declaration campaign.

Is that really a lot?

But to what extent can the growth of PIT revenues influence the overall replenishment of the budget?

“The main contribution to budget revenues comes from VAT,” says Natalia Nikolaeva, financial director of the consulting firm Leonat. “Therefore, even if revenues from the increased PIT rates grow, this will not make a particularly large contribution, because not many people receive higher salaries. The majority of the population falls under the 13% rate, while the higher rates apply mainly to top managers of large companies and similar individuals.”

There is, of course, another approach — to “pull” the higher rates down to lower incomes, as has already happened when the threshold for the 13% rate was lowered from 5 million to 2.4 million rubles. However, Natalia Nikolaeva believes this is unlikely to happen again, and that lowering the threshold to 2.4 million rubles per year, or 200,000 rubles per month, was logical. A salary of 200,000 rubles is very high for Tatarstan, she emphasised, since this is not Moscow, St Petersburg, or Yekaterinburg, but an agricultural republic with an average salary of 70–80 thousand rubles.

According to Viktor Timokhin, director of Audit and Consulting Company Audex PLC, the effect of introducing the progressive PIT scale will become apparent later — by the end of the calendar year, when a clearer picture of budget revenues will emerge.

Will income be concealed — or not?

Natalia Nikolaeva believes that PIT revenues from higher rates will grow over time, but not rapidly:

“Business owners will most likely raise dividends rather than salaries. Dividends, unlike PIT, are taxed at a flat 13% and are not subject to the progressive PIT scale.”

Viktor Timokhin also believes it is unlikely that higher tax rates will be applied to incomes lower than 2.4 million rubles per year. He explains the halving of the income threshold subject to the “mild” 13-percent tax in 2025 by the fact that it was not introduced all at once — a transitional period was provided so that the changes would not be too abrupt and taxpayers could adapt to them.

“In developed countries today, there is a noticeable shift toward taxing individuals more heavily, and Russia is no exception. I agree with this approach — I believe it is fairer than, for example, moving companies with revenues over 60 million rubles from the simplified tax system to VAT.”

Timokhin doubts that wealthy taxpayers will be able to evade the increased rates, as he believes Russian tax authorities have already learned to administer the process effectively and to monitor financial flows with competence.