Hit the bottom: real estate market starts to grow

Residential property deals collapsed in 2022, however, prices for flats broke records

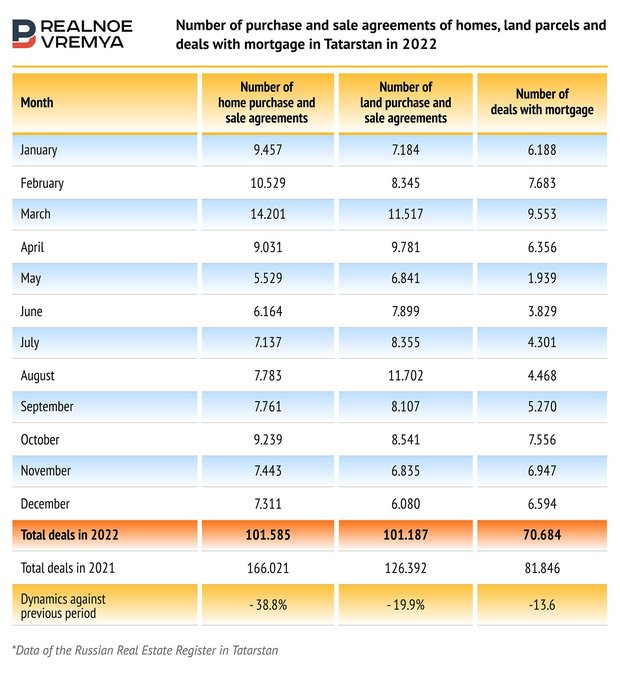

Despite expectations and forecasts, Tatarstan’s real estate market survived the crisis in 2022 in a relatively stable way. The catastrophe experts predicted in spring didn’t happen. Though the market decreased in number of deals, developers compensated for the fall with a rise in housing prices. The number of purchase and sale agreements of residential property, according to the Russian Real State Register’s open data, reduced by 38.8% compared to the same period last year, the number of purchase and sale agreements of land parcels did just by 19.9% and the number of deals with a mortgage shrank only by 13.6%. Read in a traditional review of Realnoe Vremya’s analytic staff if the exorbitant prices for new homes will reduce, if one should wait for a rise in the market of countryside property and what trends will set the pace in 2023.

According to the Russian Real State Register, home sales decreased most in Tatarstan in 2022. The number of home purchase and sale agreements decreased by 38.8% last year — to 101.585 deals (166.021 deals in 2021). And if there was still seen growth in March compared to the last year and there were concluded 14.201 deals (12.468 deals in March 2021), in April and May 2022, a fall started to be notable — 9.031 deals instead of 16.397 in April and 5.529 deals instead of 11.161 in May. The real estate market didn’t manage to recover by December — the Russian Real State Register registered 7.311 home purchase and sale agreements during the last month of 2022, whereas in December 2021, there were 19.376 deals of this kind, or 2.7 times more.

The segment of land parcels survived the year in a relatively stable way. Though the number of deals also reduced compared to the previous year — almost by 20%.

The crisis didn’t bypass the mortgage either, but it was backed by almost zero rates for new homes. The period from May to July was the toughest for the mortgage. So the Russian Real State Register reads that 1.939 mortgages were registered in May, 3.829 in June, 4.301 in July. Then, according to the statistics, there was seen growth caused a high season in the real estate market and rumours about the cancellation of the preferential mortgage for new-builds. But the mortgage didn’t any manage to reach the numbers of March 2022 in number of deals registered.

Number of deals in new home market dropped only by 3%

By Perfect RED’s estimate, the number of deals in the new home market reduced just by 3% compared to 2021 — to 17.935 equity investment agreements signed in the republic. At the same time, if we compare the number of deals signed from 2015 to 2017, we will see 12.8% growth. During this period, there weren’t any external factors in the market that would stimulate sales such as heating sales with news about the rise in prices after the launch of escrow accounts (in 2018 and 2019), a preferential mortgage with almost no interest rate and currency fluctuations. And this happened amid a fight against the crisis of 2015 and 2016 caused by the events in 2014.

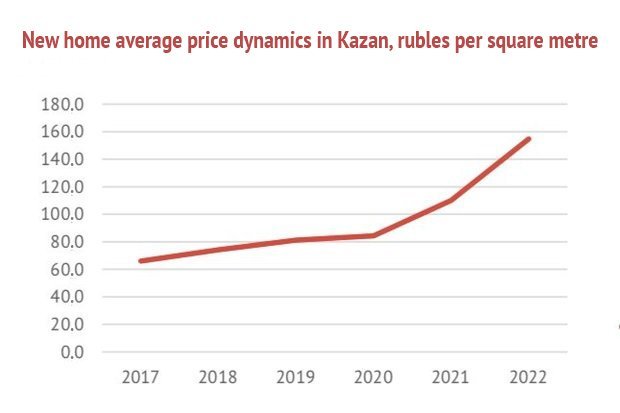

In 2022, the growth in the price of a square metre in the new housing market was 41% compared to 2021 and 91% compared to 2019. Losing 3% in number of deals, the market got 41% in price growth and, consequently, rise in revenue in rubles (88% of deals in rubles compared to 2019), the expert notes.

Fall in resale property market was 38%

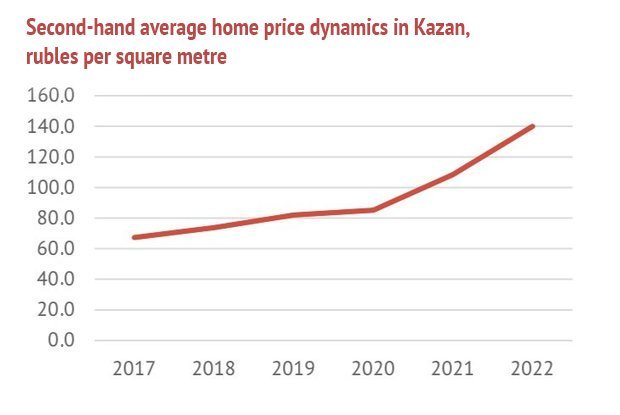

The second-hand home market in Kazan suffered more: the reduction in number of deals against 2021 was 38%. However, comparing the data with calmer 2019, the number of deals in 2022 was 20% more.

The price of a square metre in the resale housing market grew more moderately than in the new home market, says Prokhorova. In 2022, the second-hand home price rise was 29% against 2021 and 71% against 2019. This factor also allows judging about a 106% rise in number of deals in rubles against 2019.

The mortgage was the growth driver of the price and one of the key factors of the high demand like in 2005-2008. Low old home mortgage rates and the addition of preferential programmes to new home rates increased the share of mortgage deals in the new housing market to 78%, while the second-hand market got a huge growth of deals among those willing to improve their living conditions.

The size of the home loan and loan term went up in mortgage year after year. So in five years, from 2018 to 2022, the loan term rose from 16 to 23 years, while the average home loan did from 1.7 million to 3.4 million.

In Yulia Prokhorova’s opinion, the price and demand for real estate in 2023 will mainly depend on geopolitical factors and the prices for resources (oil and gas). In case of stagnation of the foreign situation, one should wait for stagnation in the housing market too in the next two or three years and then a transition to a new growth cycle. The number of deals might fall in 2023. In the second-hand home market, the prices will likely be corrected comparably with 2009, decreasing by 7-12%. Big developers will keep the prices at the level of 2022 because the reduction in sales is equalised by the higher price for flats. There can be hidden offers on flats that will reduce the price for end consumers.

“However, in case of new risks regarding the short-term devaluation of the ruble, we can again see a hike in the price and in the long term we will see the economy and the real estate market to collapse. But even in such a worst-case scenario, the demand for real estate will come from the buyers who will keep remaining money in square metres in the absence of any alternatives in the investment market,” the expert concluded.

“The market didn’t die but lived, though poorly”

“The year was tough enough for the real estate market,” Vice President of the Guild of Realtors of the Republic of Tatarstan, Director of NLB-Nedvizhimost Andrey Saveleyv disagrees with her. “The mortgage seriously dropped in 2022 too, especially in spring. The mortgage was absolutely not accessible in April and May. Then the situation improved, but the number of mortgage deals is anyway lower than in 2021.”

Prices for real estate in the new housing market won’t increase in 2023, he believes. The prices can fall because developers cannot lower the prices factored in the financial model. All developers work in project financing. Therefore the price fall will be disguised as various marketing offers.

According to his forecasts, the demand in the old housing market will grow, since new homes became not affordable for many. But prices for old homes won’t rise. However, prices in the countryside market will perhaps increase a bit in 2023, as the price of a square metre is much lower there.

Also, the situation with the mortgage will improve this year. “Additional mortgage programmes in the countryside real estate market are launched now. And I anyway hope that a preferential programme will be invented in the old housing market too. Such talks are already heard, the mortgage in the second-hand housing market is expensive enough,” he thinks.

Savelyev expects 2023 to be easier. “Judging by our analytics, the bottom is behind. There is going to be stabilisation until April and May, and then we are going to see high demand for homes,” he forecasts. “This year, the key rate of the Central Bank and the launch of new mortgage products will influence the real estate market. For instance, the launch of the Islamic mortgage. Tatarstan, for instance, offered an analogue of the Islamic mortgage for rural property. It is offered to include home improvements and furniture to the mortgage. This can also influence the demand. By the way, the payouts made to mobilised men will also be spent on the real estate market. Yesterday I talked with a mobilised man who is on holiday now. He is planning buying a flat.”

It was tough in 2022 but there was no catastrophe. “The market didn’t die but lived, though poorly,” the expert lights. “If the key rate didn’t return, it would have been a catastrophe.” According to him, there was registered a price growth in some Russian regions in 2022. For instance, in Izhevsk, prices grow because the construction and housing delivery scale isn’t like in Tatarstan. “On the other hand, about 60% of delivered homes haven’t been sold nowadays. There is an oversupply,” Savelyev says. “There are a lot of flats that have not been sold, while the number of people who need to improve their living conditions isn’t falling. I did big research last year: 85% of the population of Kazan need to buy or improve their living conditions. But only 30 of these 85% can afford buying a home. More than half of the population of the city cannot afford it. Housing is not accessible for them.”

Price growth put and end to the effect of preferential programmes

“The market continues developing under the impact of late 2022 factors — Putin’s mortgage at 8% a year extended until 1 July 2024 with a limit of 6 million rubles; the family mortgage that families with two children under 18 have been able to get since 2023 and the rural mortgage at 3% a year with a limit of 6 million rubles,” enumerates Director of Etazhi-Kazan Marat Gallyamov.

Price fluctuations in early 2022 didn’t notably hit the market of countryside housing in comparison with new blocks of flats. It is the price of a new finished house 80-85sq m in size with a parcel of 0,06ha today. If one has one’s own parcel, a finished house will cost 4.5-5 million rubles.

“Yes, countryside projects lack infrastructure. But the issue is already on the authorities’ agenda, while the countryside housing market itself is stepping aside from chaotic development,” notes the director of Etazhi-Kazan. “Organised settlements put the market in order, they are built in one style according to approved layouts with sites for schools and kindergartens, leisure areas. Otherwise, the countryside housing market will develop with fits and starts, with often up-and-down cycles.”

Investors are gone — mobilised people are in

“Despite the special military operation and all turmoil, 2022 was not bad for the real estate market. Even if not these political events, it would be wrong to compare 2022 with 2021. 2021 was anyway characterised by speculative demand. Investors prevailed in the market. Real estate was rather an investment tool than solution to objective life problems. This is why if we have a look at the last seven years, we will see that 2022 was good enough,” thinks Anastasia Gizatova, real estate expert, head of Happy Home realty agency.

The demand for land parcels, according to her forecasts, will also stay this year. “We expect several land parcel programmes, support of house construction. The market of self-builds in general is showing a record growth today,” she notes. “If we look at the delivery of housing in Tatarstan, we will see that not new-builds and blocks of flats but cottages and houses built by people themselves or small developers who aren’t even paid attention and do not receive state support helped to save previous housing delivery records.” The self-build market will be in demand in all pricing diapasons in 2023 too, the land market will also be one of the most stable.”

“Today it is very hard to make any forecasts because nobody expected that such news awaited us on 24 February 2022, nobody knew that coronavirus would be in 2020, and even if it came, it in contrast got the real estate market going,” Anastasia Gizatova recalls. “Everything is going to be smooth if any rumours and horror stories saying that cash will be forbidden, there will be problems with cash withdrawal and monetary reforms or the market will receive a lot of money from people mobilised in the special military operation do not appear.”