Forecast of minus 60: what banks will lose licences

Clearance in the sector hasn’t ended: 404 banks have closed since 2013, but the share of loss-making and inefficient banks only has grown

Expert RA named the number of banks that can lose their licences in 2018 – it's 60. Medium-sized and captive players and as well as the banks that are linked with one region or sector are in the risk zone. In addition, there are several candidates to close among the 50 biggest crediting organisations. Realnoe Vremya tells the details.

Clearance has future

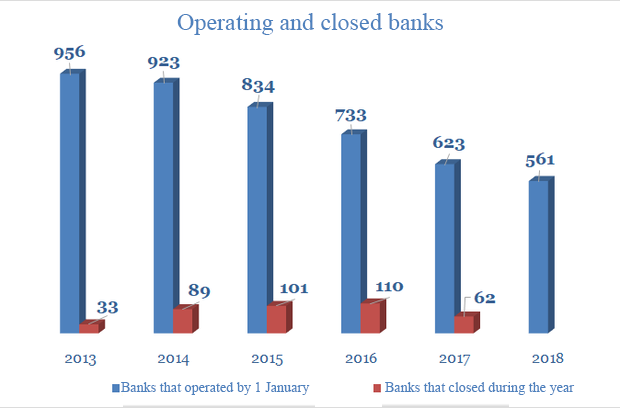

The number of operating banks in Russia has reduced by almost 40% in the last 5 years: they amounted to 923 by 1 January 2014, 561 have closed by early 2018. But the clearance in the sector hasn't ended. In Expert RA's opinion, this year at least 60 crediting organisations can leave the market. In addition, there are at least five banks among the 50 biggest banks in respect of which there is a high chance of applying regulatory actions.

The high pace of licence revocation, as the agency thinks, will maintain considering weak prospects of the sector and operational environment in which one has to work. The current economic model of banks is in crisis: the development of business is restrained by a deficit of quality borrowers and capital level that needs to be sent to cover growing risks.

It already brought to a surplus of low-income assets that affect the ability of many banks to generate income. As a result, the share of loss-making banks with an ineffective business model has grown from 13% in 2018 to 25% in 2018. So the recovery process of the sector, which began 5 years ago, can't be considered complete, thinks Expert RA.

The problem of the business model that ran its course often rises in front of medium-sized banks – it means their presence in the market will reduce in the future. The banks that won't be able to switch to riskier credit policy and create an adequate level of reserves will be in the risk zone.

''In the most unstable position will be captive banks with a weak corporate management as well as credit organisations with an elevated dependence of business on one source of income, a narrow group of clients or an economic situation in one region or sector,'' the agency writes.

For instance, the restrictions to grant guarantees to state contracts, which are planned to be imposed by the government and the Central Bank, can bring to the separation of about 30 banks from the main business this year. And the final division of the market between the major players will be a result of the constriction of the group of medium-sized banks. Now about 49% of all assets of the banking sector (41,51 trillion out of 85,19 trillion rubles) are concentrated now in the five biggest establishments, while the first 20 banks account for 72% of common assets.

The analysts conclude that ''in these circumstances, the presence in the market will be safe for structures with a diversified model, conservative risk management and stable positions in key regions of activity''.

Minus 404 banks

The intensive clearance of the banking sector began in 2013 after Elvira Nabiullina joined the Central Bank. Its major stage was in the 2015-2016 – 211 banks left the market during this period (mainly because of the regulator's decision).

Last year, the paces of licence revocation reduced. But the crediting organisations in the top 15 in terms of the size of their assets started to have problems – Otkritie FC, Binbank and Promsvyazbank. Now they are all rehabilitated with the Banking Sector Consolidation Fund. Otkritie and Binbank are planned to be united – it's expected to happen in 2019. It was decided, in turn, to create a captive bank on the basis of Promsvyazbank to service the defence and industrial complex.

Very Nabiullina said late last year the clearance from chronically weak players with a doubtful business model did not end – according to her, this process will take another 1-2 years. The Central Bank managed to revoke licences of nine banks for two and a half months in 2018.

Head of Validation Unit of Expert RA Stanislav Volkov thinks the further departure of some banks can play into others' hands – but only in certain cases, not in general. ''For instance, the reduction of the category of medium-sized banks will probably lead to firmer positions and market power of some remaining players. But considering that the share of medium-sized banks isn't big now, this effect can come to the surface only in specific regions,'' says Volkov.

Yury Yudenkov, docent of RANEPA and specialist in the regulation of monetary and crediting system, agreed with the evaluation about the banks that were in danger – it's medium-sized, captive establishments as well as the banks with a badly diversified resource base.

''I have a pessimistic view. One can't lend somebody from the street – one's own category of clients is given money anyway. You eliminate the medium-sized, more mobile segment, eliminate intermediaries, and there is nobody to work in the market with their clients. As for small banks, they run a risk of 'disappearing as a class' in general,'' he says.