Results of 2016 for AVERS Bank: record-breaking profit and growth by key indicators

Despite the difficult economic situation and growing competition in the banking sector, in 2016 AVERS Bank managed not only to prove its stability but also to demonstrate growth by all key financial performance indicators. The results of the year for the bank were summed up at the meeting of the shareholders held on 26 April.

Record-breaking revenue

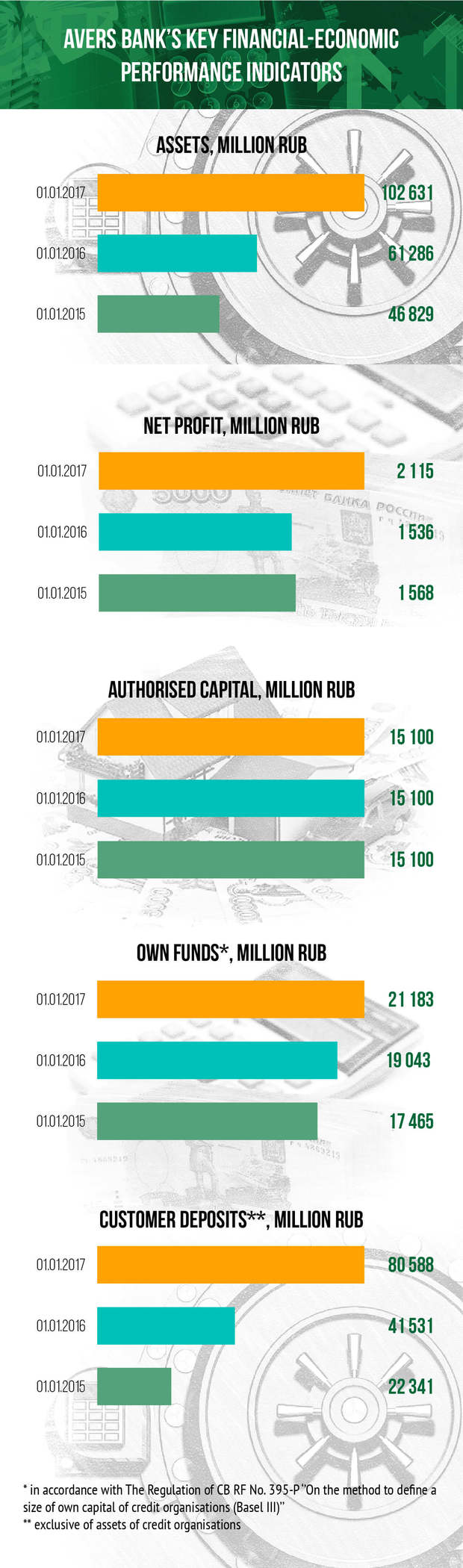

According to the results of 2016, the bank gained a record-breaking net profit at 2,1 billion rubles, which is by 38% more than in the previous year. This result has become the best among the credit organizations of the Republic of Tatarstan. ''We have achieved the planned results in all key areas and ensured the development of the business,'' said Chairman of Board of AVERS Bank Kamil Yusupov.

During 2016, the assets of AVERS Bank were demonstrating an outperformance in comparison with the assets of the banking system of the Republic and the country as a whole. They increased from 61,3 billion rubles to 102,6 billion rubles, or by 67%. The asset growth took place primarily due to an increase in net lending receivables.

The bank's own funds amounted to 21,2 billion rubles. The capital adequacy ratio N1.0 still considerably exceeds the normative value (8%) and is amounted to 28,3%. A large margin of capital adequacy indicates a high growth potential of the bank. In addition, the bank maintains the profitability ratio of assets at a consistently high level – 10,6% in 2016.

We have achieved the planned results in all key areas and ensured the development of the business

Taking into consideration good financial performance indicators, sufficient capitalization and liquidity, high asset quality and their profitability, the international rating Agency Fitch Ratings in 2016 assigned the bank long-term Issuer default rating (IDR) in national and foreign currency at the level of BB- with a stable outlook. Besides, the Fitch Ratings assigned the bank short-term IDR in foreign currency at the level of B, support rating — 5, viability rating — bb-.

Besides, in September 2016, the rating agency Expert RA confirmed the bank's credit rating at the level of A++ ''Exceptionally high (the highest) level of creditworthiness'', rating outlook is stable, which means a high probability of maintaining the rating in the medium term.

Lending continues

In 2016, AVERS Bank actively lent to the real sector of the economy and the population, while trying to preserve the portfolio quality at a high level, traditionally adhering to low-risk credit policy.

Corporate lending continues to take a key place in the structure of the bank's business. Outstanding loans of legal entities for the year 2016 increased by 126% compared to the previous year and amounted to 43,6 billion rubles.

The year of 2016 for the retail lending market has become more favourable compared to 2015. The volume of loans issued by AVERS Bank to the population increased by 30% and amounted to 4,5 billion rubles. The driver of growth was mortgage lending. Further development of consumer lending will be aimed at improving the product line, optimization of decision-making procedure and expansion of sales channels.

Security at a high level

In 2016, the work on modernization of information systems, optimization of business processes and information security enhance was continued. When building the information security system of the bank, it was used a series of documents of the Bank of Russia on providing information security of organizations of the bank system of the Russian Federation. The bank has developed and implemented organizational and technical measures of information security. In the past year, there were additionally introduced modern means of information security.

The bank carries out annual monitoring and analysis of information security system. In 2016, Avers Bank confirmed the compliance with the requirements of the data security standard of the payment card industry and received a certificate of compliance with PCI DSS.

In 2017, the bank will continue implementing projects and activities under the Development Strategy for 2016-2020 in the field of information technology and information security.

Further strategy

Further development of the bank will, as before, be aimed at ensuring balanced development of corporate and retail business, increase in activity volume combined with a relatively low amount of risk assumed.

In June 2016, Board of Directors approved the development strategy of AVERS Bank for 5 years, which takes into account the general macroeconomic challenges and development trends of the banking system of the Russian Federation, development forecasts of the country's economy, the bank's position on the regional market. The goal of the strategy is a steady growth of the bank's business against the background of maintaining high levels of reliability and security of assets, liquidity, profitability of assets and capital and balance of resources attraction.

The key areas of the strategy are development of technology-based bank, focused on good customer service, moderate growth in business volumes, strengthening of market positions at the regional level, improvement of IT architecture.