‘Perennial price anchor for petroleum’ is $27 a barrel

Oil prices repeat the nosedive on the of the dissolution of the Soviet Union but may go lower

Today Brent Crude oil has cheapened to $37 a barrel. For the last quarter of the century, petroleum reached this indicator three times: in August – September of 1990, in April – June of 2004 and at the bottom the recent crisis in December of 2008. What is happening today? Albert Bikbov, the economic columnist of Realnoe Vremya, shares his thoughts.

When oil prices weren't high

At the beginning of 1991, prices fell to the habitual mark of $20 a barrel (with inflation, $20 corresponds to today's $36,4). In other words, we speak about the price that existed on the eve of the dissolution of the Soviet Union.

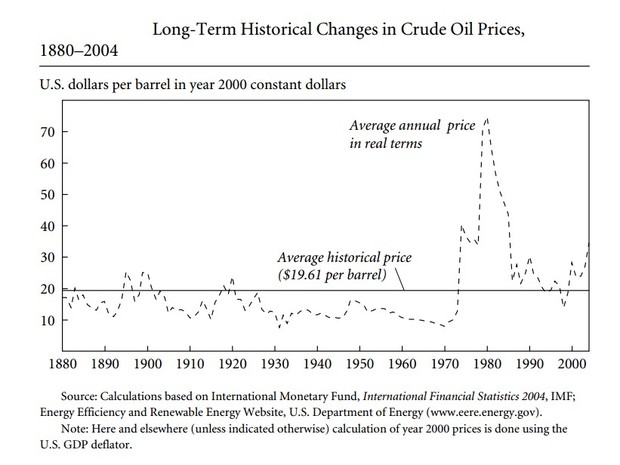

However, there is a worse graphics, which is borrowed from Yegor Gaidar's famous book called Collapse of an Empire: Lessons for Modern Russia (ISBN 0-8157-3114-0).

And if we look at crude oil prices in long-term historical changes (from 1880 to 2004), in 2000 they amounted to $19,61 a barrel. In today's prices, taking into account the inflation of the dollar, this 'perennial price anchor for petroleum' will be $27 a barrel.

Consequently, still there are limits of the fall in petroleum. It was said about even $20 a barrel…

At present, the stressful scenario for our economy, which was calculated by the Central Bank of the Russian Federation, starts from an average $35 a barrel in 2016. With this parameter of the risky scenario for 2016, by the end of 2016 the economy is expected to decrease by 2-3%, investment recession will continue, inflation will slowly reduce to 7%, real salaries will decrease, which can be compared with the rates in 2015 (it was almost 10% for January – October 2015) while unemployment is growing.

Rubles is decreasing after petroleum, and petroleum is decreasing due to…

The economists of Bank of America added fuel to the fire: they calculated the dollar value for budget performance with different oil prices. If oil price will drop to $35 a barrel (risky scenario of the Central Bank of Russia), the dollar is to cost about 94 rublesfor the Russian budget performance with the maximal deficit of 3%.

It is obvious that the dollar for 94 rubles absolutely doesn't correspond to the inflation of 7% forecasted by the Central Bank. The excessive weakening of the ruble will significantly worsen the situation of the economy. This is why neither the Ministry of Finance nor the Central Bank will go to these lengths intentionally. The Ministry of Finance will have to significantly reduce expenses about by 1,5 trillion rubles (which is equal to the budget sequestration by 10-11%).

But if oil price will return to its long-term perennial indicators (as we calculated, it is about $30 a barrel), the stressful scenario, which from a bogeyman story becomes a reality, will need to be calculated again. According to the calculations of the same economists of Bank of America, the Russian budget is beating with the dollar for 100 rubles. It is doubtful whether the authority permits it, and here the figures of the budget sequestration can reach 12-13%.

The logic used by analysts for explanation of the weakening of the ruble is maintained: ruble is decreasing after petroleum, petroleum is decreasing due to surplus offers (OPEC countries don't want to reduce the export quotas, Iran enters the market after being released from sanctions, the USA might remove an embargo on petroleum export for the first time for many decades, and the benefit is that petroleum production has doubled this year due to the development of shale technologies) and lack of demand (here deceleration of the Chinese economy plays the major role, but there are less important factors, for instance, this winter is going to be mild) Plus there is a quite real perspective of tightening of monetary policy in the USA in future: next year the Federal Reserve Centre is going to raise the rate that will make dollar more expensive in respect of all currencies, and the ruble, obviously, is not an exception.

So the situation on the markets demonstrates that even the current stressful scenario may be optimistic soon.