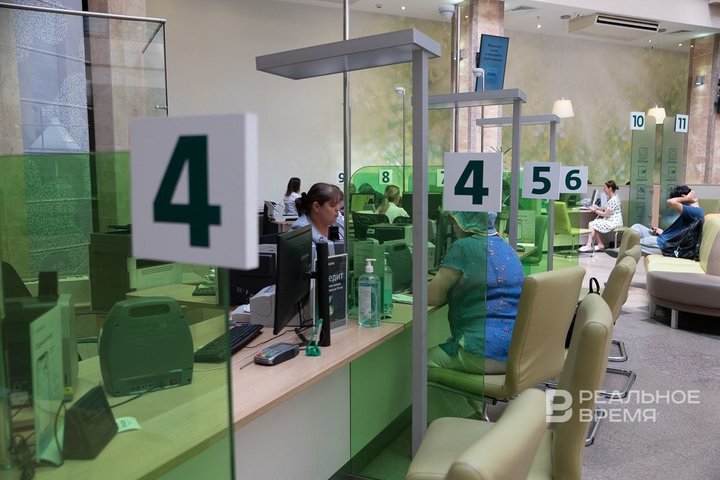

New measures against fraudsters and strict control over money transfers

Changes in laws and regulations that will affect the lives of citizens and businesses in Russia starting from June 2025

Starting from the beginning of summer, Russia has introduced restrictions on money transfers and strengthening control over the movement of funds. New anti-fraud measures will also be implemented: if a cash withdrawal appears suspicious to the bank, the card will be blocked. Failure to submit a timely notification about the start of a business will result in a fine, and lifting a self-imposed credit ban will become more difficult. These and other legislative changes and new regulations taking effect from June are covered in the report by Realnoe Vremya.

Transfer amounts has been limited

Amendments to the federal law “On Countering the Legalisation of Criminally Obtained Incomes” have come into force. They set a maximum limit on money transfers without opening a bank account. Previously, Russians could transfer up to 15,000 rubles without providing any documents. To send larger amounts, a simple identity check (a passport was sufficient) was required, with no obligation to open an account. However, the rules are changing: those who have passed a simple identity check but have not opened an account will now be allowed to send no more than 100,000 rubles.

Cards to be blocked for suspicious cash withdrawals

ATMs will be able to limit cash withdrawals in cases of suspected fraud. From 1 June, new anti-fraud measures have been introduced in Russia, aimed at making it more difficult for criminals to access citizens' funds and reducing the number of scam incidents. Credit institutions now have the right to suspend suspicious transfers and restrict cash withdrawals. If the system detects signs that a client is being coerced into withdrawing money, ATMs will be allowed to dispense no more than 50,000 rubles per day. This restriction will remain in place for 48 hours.

Money transfers to come under tighter control

With the start of summer, the Federal Tax Service will impose even stricter oversight on transfers between individuals. If tax authorities consider the incoming funds to be income, additional taxes may be charged. Transfers that may fall under suspicion include regular payments, compensation for services rendered, or proceeds from the sale of property. Transfers to friends and relatives, repayment of private loans, or gifts will not raise concerns, inspectors assure.

Individuals or organisations without official income but frequently receiving large sums will come under special scrutiny. Transactions resembling payments for consulting, resale, or other services will now be treated as taxable activities. Current regulations prohibit making payments without receipts, using personal bank cards for business purposes, or disguising regular payments as one-off transactions, among other things. To avoid claims from the tax authorities, it is essential to retain all supporting documentation.

Lifting a self-imposed credit ban to become more difficult

From June, the procedure for lifting a self-imposed ban on obtaining credit is becoming more complicated. It will now require the use of an enhanced qualified electronic signature (UQES). Previously, it was possible to revoke the ban simply by confirming with a password or via an SMS code. UQES is the most versatile type of signature. It can be used both for personal matters and for interactions with government authorities. It gives a document full legal force without any additional conditions.

The processing time for applications to lift the credit ban is two days, and the record of the removal of the ban will appear in the credit history the day after the decision is made. Since 1 March of this year, citizens have had the option to impose a self-ban on entering into consumer credit (loan) agreements with credit and microfinance institutions. The restriction also applies to bank account agreements that allow payments despite insufficient funds (overdrafts), as well as agreements involving the issuance of credit cards.

SIM cards may now be transferred only to close relatives

As of 1 June 2025, new regulations have come into force under which the transfer of SIM cards to third parties is allowed only with restrictions. This is another measure aimed at reducing incidents of fraud. From now on, a SIM card registered to an individual may only be transferred to immediate family members, as defined by the Family Code. This includes parents, siblings (including half-siblings), grandparents, children, and grandchildren.

Expired medicines will no longer be sold in pharmacies

An algorithm designed to enforce a complete ban on the sale of expired medicines has been activated in Russia. Pharmacies now use a special monitoring platform integrated with cash registers. Each time a medicine is sold, the equipment cross-checks it against a unified system. If expired or counterfeit products are detected, the sale is immediately blocked. It should be noted that every medicine currently has a unique identification code, which enables the system to accurately verify its authenticity and compliance with regulations.

QR code required for entry into the country

From 30 June, new border crossing rules are coming into force in Russia for citizens of countries with a visa-free regime. This primarily concerns residents of Kazakhstan, Tajikistan, Uzbekistan, Azerbaijan, and several other countries. An exception applies only to citizens of Belarus and children under the age of six, for whom the existing rules will remain unchanged.

According to the new requirements, foreign citizens will be required to obtain a special QR code in advance in order to cross the Russian border. This can be done through the mobile application Gosuslugi RuID. An electronic application must be completed 72 hours before entering Russia, specifying the purpose of the visit and the intended duration of stay. The entry permit received thereafter will be valid for 90 days.

Fines increased for doing business without notification

From 27 June, a law is coming into force tightening penalties for conducting business without notifying the authorised authorities. Officials will be required to pay fines ranging from 7,000 to 12,000 rubles, legal entities from 24,000 to 48,000 rubles, while repeat offences will incur fines of 15,000 to 25,000 rubles and 50,000 to 60,000 rubles respectively. Currently, the amounts are significantly lower.

Changes to the Code of Administrative Offences are aimed at enhancing control over business representatives and preventing negative consequences. The authors of the amendments explained that failure to notify the start of activities could lead to serious outcomes, such as last summer when 417 cases of botulism were recorded in more than ten regions of Russia following consumption of products from unscrupulous manufacturers.

Calls and messages via foreign messengers to be restricted

On 1 June, a ban came into force on communication with citizens and clients through electronic messaging systems of foreign organisations and individuals. The restriction is introduced to protect against internet fraud. It will apply to employees of: government bodies at all levels; the Bank of Russia; state funds; state companies; state and municipal unitary enterprises; publicly owned companies; business entities with more than 50% state participation; banks; and others.

In addition, the ban will affect telecom operators, owners of information aggregators about goods (services), owners of websites for information and advertising distribution with an audience of over 500,000 people per day, and owners of websites and information systems with more than 100,000 Russian users per day. Messaging apps will only be allowed to send information that is publicly accessible and duplicated on the internet. Another anti-fraud measure has been introduced — banks will now be permitted to send SMS messages with codes to clients only after the telephone conversation has ended.

Experiment on electronic document management in ministries

From 2 June 2025 to 30 June 2026, Russia will conduct an experiment in which the government will test the digitalisation of electronic document management processes in federal executive authorities. Participants in the pilot project will include the Ministry of Natural Resources of Russia, the Ministry of Industry and Trade of Russia, the Ministry of Digital Development of Russia, and the Federal Tax Service of Russia.

Following the testing, the government will prepare proposals for necessary changes to the regulatory framework. The ultimate goal is a complete transition of government bodies to digital document management, where documents are created in a unified digital format and do not require manual processing.

New law on local self-government

A new law on local self-government will come into force on 19 June. The document provides for three types of municipal formations: urban districts, municipal districts, and intracity municipal formations in cities of federal significance. A notable feature of the law is that regions with socio-economic, historical, and other specific characteristics have the right to retain a two-tier system of local self-government organisation. Although initially a uniform transition to a one-tier system was set for all Russian regions, following appeals from Tatarstan and other regions, the subjects have been granted the right to independently determine their local self-government model. A unified term of office of five years has been established for all local government officials. Settlements will be able to adopt their own official symbols.

Procedure for handling weapons to change

From 6 June 2025, the procedure for issuing permits for the import and export of weapons to legal entities and individual entrepreneurs will change. The Russian National Guard is updating its regulations. The maximum service time will vary depending on the category of applicant: 10 working days for legal entities; 15 calendar days for legal entities and individual entrepreneurs engaged in hunting activities. Applications and documents can still be submitted in person or through the unified state services portal.

From the same date, the regulations for providing the state service granting organisations permits to store and use weapons and ammunition came into effect. Changes also affect the issuance of permits to citizens for sporting short-barreled rifled firearms at shooting ranges. The procedure for providing the service depends on the applicant. The maximum processing time is 20 working days.