Self-prohibitions on loans and car registration without compulsory motor third-party liability insurance — new laws in March

Novelties that will change the lives of citizens and businesses in Russia from the first month of spring

Vehicle registration will become easier for car owners, and the recycling fee will be mandatory. It will not be possible to build a private house without an escrow account, and undeveloped land plots will be seized. Russians will be able to impose a ban on issuing loans to themselves and banks will be required to provide only truthful advertising about loans. In addition, the country will increase pensions for the military and prohibit the sale of energy drinks to children. Since March, laws have come into force in Russia that will affect developers and home buyers, creditors and borrowers, car owners and landowners, that is, many categories of citizens and businesses. Read more about the changes in legislation in a report of Realnoe Vremya.

Buyers of energy drinks will be required to provide documents

From 1 March 2025, it will be prohibited to sell non-alcoholic energy drinks to children, including energy drinks. The same rules will apply to sales as to alcohol. If the seller has doubts about the age of the buyer and whether he has reached the age of majority, he has the right to demand documents for verification. In addition, since 1 March, the sale of energy drinks has been prohibited in buildings where educational, medical, cultural and sports institutions are located. It is also possible to ban the sale of such drinks, for example, during mass events.

The same restriction will apply to the sale of dangerous household goods with gas. For example, we are talking about lighters and cylinders for refilling them. The seller will require documents from buyers whose age he doubts.

Military pensions will be increased

Since 1 March 2025, pensions of Russian military personnel have been indexed. The increase will be calculated based on the inflation rate and will amount to 9.5%. After indexation, the average military pension will reach 43,000 rubles. The last time military pensions were indexed was on 1 October last year by 5.1%. Since 1 March 2025, military personnel have started to receive increased payments. In addition, from this month they will receive additional payments for January and February.

New requirements for individual housing construction and land development

Since 1 March 2025, a law has come into force that limits the period for developing land plots to three years within the boundaries of populated areas. For plots where construction is planned, after the expiration of the three-year period, another five years are allocated to construct and register the building. Since March 2025, a number of new requirements regarding individual housing construction have come into force.

Apartment finishing according to the developer's standard

Since 1 March, apartment finishing may not comply with technical regulations; it has been allowed to be carried out according to the developer's own standard. However, this standard must comply with the requirements of the Russian Ministry of Construction. A draft of such requirements is already ready. For example, the deviation of walls can reach up to 8 mm if the height of the walls is 3 metres. Splashes and smudges during painting are allowed if they are not visible from a distance of more than 2 meters. When gluing wallpaper, bubbles and divergences in joints are allowed, also not visible from a distance of 2 metres.

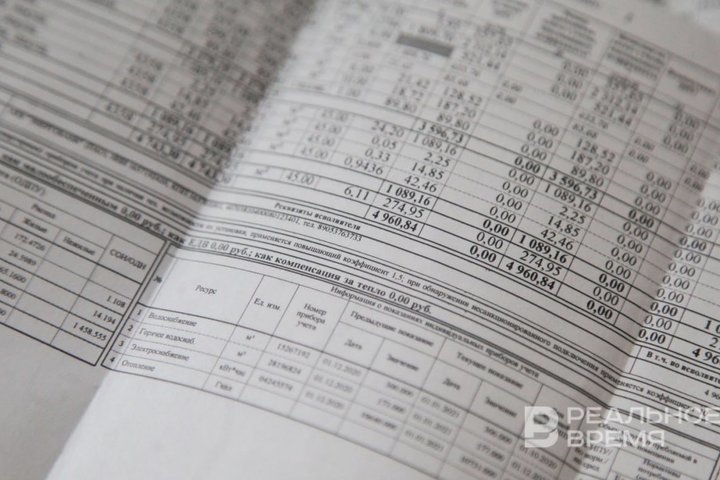

Regions will be prohibited from splitting heating fees

Since 1 March 2025, regions will not be able to switch to a form of heating payment in which payments are split over a year. Payment can only be taken for the actual service in those months when heating was supplied to apartments. Previously, the country's subjects had the right to choose any of these options. The innovation is explained by the need to increase the transparency of heating service payments. In the case of distributing funds throughout the year, owners had a question about what exactly they were paying for. Now apartment owners will be able to control the amount on the receipt based on the readings of metering devices. In regions where the payment method of equal monthly instalments is chosen, everything will remain as is, but further changes will be limited.

Additions to risk coefficients for mortgages will be reduced

Since 1 March, the Central Bank has reduced the surcharges to risk coefficients for some mortgage loans. In particular, this concerns loans for new housing with a down payment of 20-30% for borrowers with a DNI of less than 70% (DNI is the ratio of monthly loan payments to their average monthly income). As reported by the press service of the Bank of Russia, this is being done taking into account the easing of imbalances in the housing market. In the future, from this 1 July 1, the Central Bank plans to introduce macroprudential limits (MPL is the maximum share of risky loans in the structure of all loans of a particular bank) on the issuance of mortgage loans to borrowers with a DTI of over 80%. The regulator also plans to limit the issuance of mortgages for a term of over 30 years, the share of which has increased from 10% to 20%. Banks are increasing the term of loans in order to reduce the average monthly payment hedgehog, but in the long term the borrower may face difficulties in servicing the debt, explains the Bank of Russia.

Self-prohibition on issuing loans

Since 1 March, Russian citizens will be able to set a ban on issuing loans at once in all banks and microfinance organisations. It will be possible to restrict not only remote, but also in-person applications. The innovation will help to protect yourself from illegal actions of fraudsters, as well as from your own ill-considered credit activity. You can set a self-prohibition through the State Services portal, by 1 September, such a service will also be provided in the Multi-Functional Centre through a standard application. The procedure is free, in addition, it will not affect your credit history in any way. If a citizen lifts the ban after a certain time, this will not negatively affect the approval of an application for a subsequent loan.

Self-prohibition can be set for consumer loans, issuance of credit cards and cards with an overdraft. There is no self-prohibition on secured loans, such as mortgages and car loans, as well as on educational loans and sureties. As explained by the Bank of Russia, the risks of fraud in the latter are minimal.

Advertising of loans will become more truthful

From the first month of spring, borrowers will be warned about the need to assess their financial capabilities in advertising of consumer loans, credits and mortgages. The warning must occupy at least 5% of the advertising space on a billboard or banner on the Internet. If the advertisement is on TV or radio, the duration of the warning should not be less than 3 seconds. It is assumed that the warning will sound as follows: “Assess your financial capabilities and risks” or “Study all the terms of the loan (loan).”

Foreign agents will be required to open special accounts

Since 1 March 2025, all financial flows of citizens with the status of a foreign agent has been concentrated in a special account. We are talking about income from the sale or rental of housing, interest on deposits, dividends, payment for intellectual activity, etc. Absolutely all payments will be received into a special account opened exclusively in authorized banks. According to the new law, a foreign agent is obliged to open such an account within 15 days after receiving this status, but he will be able to use the money from the account only after the status is removed from it. In addition, by a court decision, the state will be able to write off fines and mandatory payments from these special accounts.

Clergy will visit hospitals according to the rules

Since 1 March, 2025, visiting patients in medical institutions by clergy must meet certain requirements described in the order of the Ministry of Health. First of all, they say that only representatives of “centralised religious organizations” will be allowed into hospitals. Representatives of traditional religions will be able to visit patients “for worship services, other religious rites and ceremonies” not only in regular wards, but also in the intensive care unit. According to the new rules, inpatient medical institutions must appoint a person responsible for organizing such visits, as well as allocate a special room for holding religious services and prayers.

As for the restrictions, the document stipulates the need to comply with the anti-epidemic regime and the interests of third parties, that is, the ceremony should not interfere with others. In addition, it is prohibited to visit patients who are in infectious boxes during quarantine.

Simplified procedure for registering cash registers

Since 1 March 2025, changes to the procedures for using cash register equipment (CRE) come into force. In particular, this concerns the registration of cash registers, the use of cash registers in markets and the issuance of checks in catering establishments. Cash registers can now be registered in a simplified manner, and from 1 September, the function will be available through the public services portal. Amendments also come into force, according to which the terms for the provision of services by the Federal Tax Service for registering CRE are reduced twice — from 10 to five working days. According to the new rules, failure to provide access to cash register equipment during an inspection will be considered grounds for unilateral deregistration of this cash register equipment by the tax authority.

Only some sellers will be able to work without cash registers at retail markets. These include individual entrepreneurs and organizations on a single agricultural tax with a trading area of up to 15 square metres at a fair or exhibition, if the goods are transferred immediately; individual entrepreneurs on the patent tax system when trading at weekend fairs; until 1 September, agricultural consumer cooperatives when selling at markets.

Individual entrepreneurs engaged in the field of education and sports will also see changes. Since 1 March 2025, those who have a license for educational activities are exempt from using cash register equipment if it is the main one. Trainers registered as an individual entrepreneur, also if this type of activity is their main one.

Restaurant checks will be presented before payment

Restaurants and cafes will have to issue checks before payment, and not after, as is done now. The new calculation rules are primarily aimed at making the activities of catering establishments more transparent for the tax authorities. In addition, it is assumed that they will help businesses avoid fines and inconsistencies and adjust the accounting system data so that the statistics of restaurants and cafes correspond to reality. Thus, since 1 March, 2025, waiters or cashiers have been obliged to first generate a cash receipt and only then accept payment. Now, such a practice is widespread when a visitor is brought a preliminary bill with a list of dishes and the total amount, limited only to it. But it is not a fiscal document that records the fact of sale to the tax authorities.

New procedure for registering a car

Amendments to the law on state registration of new and used vehicles have come into force on 1 March 2025. The main changes are as follows:

- OSAGO insurance is not required for registration,

- the 10-day period for deregistration is cancelled,

- a mandatory recycling fee is introduced.

The main thing is the exclusion of the OSAGO insurance from the list of mandatory documents. This means that in order to register a car, you do not need to immediately buy insurance. This is explained by the fact that after registration, the car may not be used immediately, but may be kept, for example, in a garage. At the same time, do not forget that the OSAGO insurance is a mandatory document for operating a vehicle.

Since 1 March, in order to deregister a car, you don’t have to wait for 10 days, as before. For example, when selling a car, the opportunity to re-register the documents will appear immediately. You can deregister a vehicle through the state services portal or through a notary. In case of theft, you won't have to wait for 10 days either, you just need to report the car to the State Traffic Safety Inspectorate, and it will be automatically deregistered.

Another advantage of the innovation is that when selling, the car owner will be able to terminate the MTPL contract faster, thereby saving money.

Payment of the recycling fee have become mandatory since 1 March, otherwise the owner of a vehicle imported from abroad will be denied registration. It should be reminded that since 1 January, 2025, the recycling fee rates increased for all types of vehicles. The base rate for passenger cars is still the same 20,000 rubles, for light commercial vehicles, lorries, buses, trailers and semi-trailers — 150,000 rubles, but the coefficients have increased. Since the new year, for a passenger car with an engine capacity of 1.5 litres, the coefficient has been equal to 33.37, that is, 20,000 will have to be multiplied by this figure. However, this is relevant for those cases when the car was purchased abroad and sold within a year, which is considered commercial activity. Individuals who bought a car for personal use and its engine capacity does not exceed 3.0 litres are not affected by indexation. However, in this case, the car cannot be sold within 12 months.