‘Let’s wait until March’: Tatarstan Ministry of Finance expects to make up for lost revenue

The first review of the Tatarstan economy in January brought surprises — petrochemical revenues significantly fell short of the average monthly base level of 5.4-5.8%, stopping at 3.1% of the annual target. According to the Ministry of Finance, the Tatarstan fuel and energy complex (including chemistry and petrochemistry) transferred 170.9 million rubles in income tax, which is 3-4 times less than in the trade, construction and banking sectors separately. However, Deputy Finance Minister of Tatarstan Alla Anfimova assured that the January reduction in fees did not affect the replenishment of the consolidated budget, which collected 22.5 billion rubles. Petrochemistry will recoup in March, she believes.

Back in the top five richest regions of the country

At a morning press conference, the leadership of the Ministry of Finance of the Republic of Tatarstan for the first time announced the results of the implementation of the consolidated budget 2024. January monitoring showed that the republican treasury turned out to be still richer than the budgets of other regions of the Russian Federation. But here the petrochemical revenues noticeably sank. With an average monthly income level of 5.4-5.8% for all types of taxes (the minimum required to fulfill the annual collection plan), revenues from petrochemical enterprises fell to the level of 3.1%.

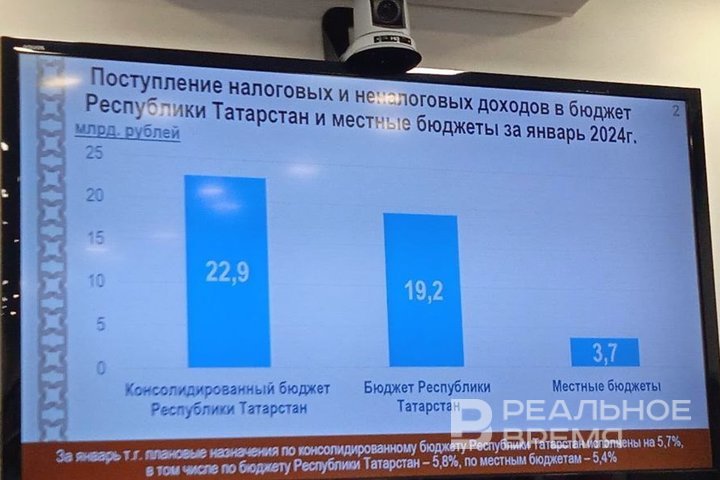

The full dynamics of revenue receipts to the consolidated budget of the Republic of Tatarstan was presented by Deputy Minister of Finance of the Republic of Tatarstan Alla Anfimova. According to her, the treasury received 22.9 billion rubles from all sources, and Tatarstan ranked fifth in the country by this indicator. Moscow (202.2 billion rubles), St. Petersburg (61.7 billion rubles), and the Moscow Region (53.7 billion rubles) were ahead. Tatarstan slightly lost to the Krasnodar Krai (23.2 billion rubles). From this rating, one can guess that the republic remains a donor to the federal budget. In total, 71.2 billion rubles in taxes were collected from the territory of the Republic of Tatarstan, of which 48 billion rubles were transferred to the federal budget, Alla Anfimova said.

According to the Ministry of Finance of the Republic of Tatarstan, 19.2 billion rubles were credited to the republican treasury in January, and 3.7 billion rubles were credited to local budgets. The figures themselves are, of course, impressive, but an objective indicator of economic “well-being” is the average monthly fees. As Alla Anfimova explained at the very beginning of the press conference, usually the average monthly fees range from 5-6% of the annual plan. The annual plan has been approved at 401 billion rubles this year. In January, revenues to the republican budget amounted to 5.8%, and to the local budget — 5.4%. In other words, public finances feel good, as usual, despite the special military operation, the dollar exchange rate and the high Central Bank rate.

Oil and gas revenues will sink until March

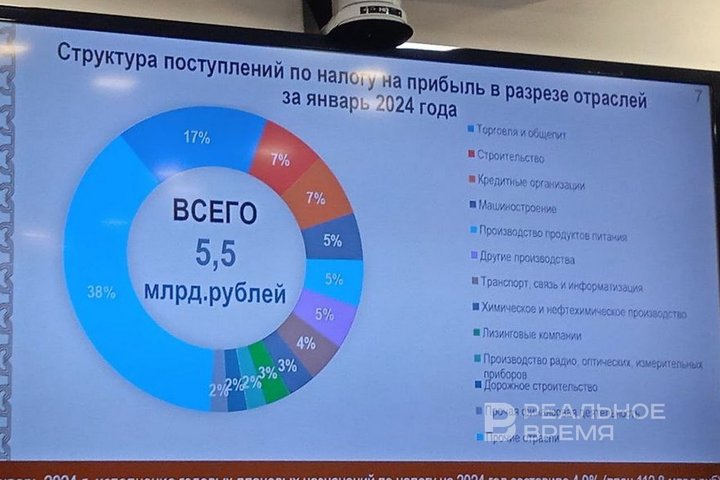

Nevertheless, there were some alarming trends in the dynamics of state revenues. It turned out that income tax charges are noticeably inferior to personal income tax: according to Alla Anfimova, 5.5 billion rubles were received for income tax in January, or 4.9% of the annual plan, while 7.5 billion rubles, or 5.5% of the plan, were received for personal income tax. Income tax has become the second profitable source of revenue to the budget, whereas it was the main one by the results of 2023. According to Alla Anfimova, trade, construction and banking enterprises flourished in January. Their income tax deductions ranged from 900 million to 700 million rubles. Petrochemical and chemical enterprises turned out to be beyond the threshold of 300 million rubles. She explained the low fees by the deferred mechanism for transferring income tax — enterprises pay according to the results of the first quarter.

“The profit situation is as follows: in January, oil industry enterprises, in particular Tatneft, do not pay income tax. Due to that Tatneft pays according to the actual profit received in March, we expect the main revenues from the oil industry in March," she explained. At the same time, the deputy minister added that, in general, budget execution “is within the average norm," therefore, there is no concern about petrochemical revenues.

She could not name the projected amount of income tax charges for the first quarter. “I can't name a specific amount, because everything will depend on macro indicators — the dollar exchange rate and oil prices. It's premature to say anything yet," she said.

Benefits should be returned by taxes

She also spoke positively about federal innovations with a single tax account. Let us remind that last year, deputies of the State Council of the Republic of Tatarstan sounded the alarm due to collapsed income tax receipts. Instead of 7.5 billion rubles, the republican and local budgets received only 5 billion rubles, since the money did not return to the region.

According to Alla Anfimova, the balance is positive this year and there are no more comments on this topic. Despite the restructuring of the economy, the Ministry of Finance continues to discuss the provision of tax benefits to investors.

Answering a question from Realnoe Vremya, Alla Anfimova said that calculations are underway on the effectiveness of providing tax benefits to the United Metallurgical Company, which is going to build a pipe rolling workshop in Almetyevsk. She did not name specific parameters, as the project is in the initial stage of discussion. “The main position of the Ministry of Finance of Tatarstan is that tax incentives should be effective," the speaker said. “But how is efficiency measured? The basic principle is that the benefits do not exceed the receipts that are planned to be received," she concluded.