Consumer market in Tatarstan goes into a plus

The republic's retail trade turnover has reached 635,6 billion rubles, or by 6,8% more than a year earlier

The retail market has “digested” the sanctions and feels much better than in the first half of 2022. Retail trade turnover in Tatarstan has increased to 635,6 billion rubles, while non-food retail, which suffered the most from sanctions last year, also showed a significant increase of 5,4%. Food retail has grown by 8,3%. Whether the market recovery will slow down the devaluation of the ruble and whether the trend for consumer savings is relevant — in the review of the analytical service of Realnoe Vremya.

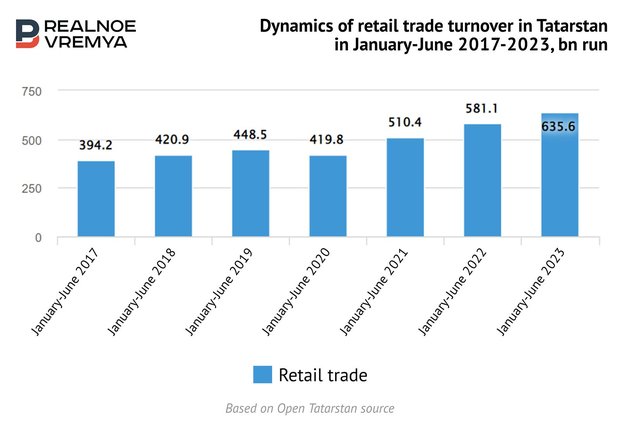

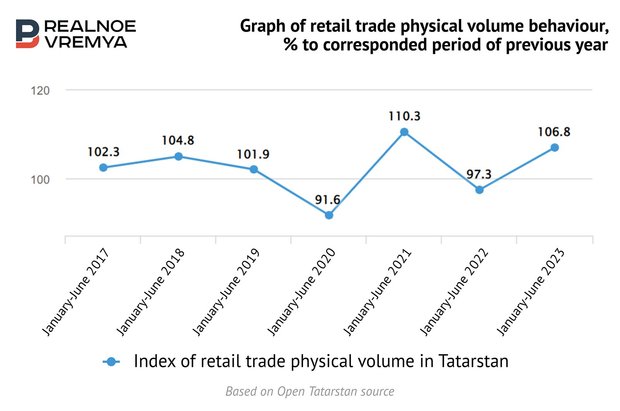

The volume of retail trade turnover in Tatarstan in the first half of 2023 reached 635,6 billion rubles. It grew in comparable prices by 6,8%. A year earlier, due to the mass withdrawal of international companies from the Russian market, retail showed a drop of 2,2%, including non-food one — 5,2%.

This year, the turnover of food trade in the republic increased from 218 to 297,2 billion rubles (+ 8,3%). The turnover of non-food retail increased from 216,8 to 338,4 billion rubles (+5,4%). Retail trade turnover per capita increased from 123,463 to 158,876 rubles.

Also in Tatarstan, the provision of retail space per thousand of the population has increased — from 898,1 sq. m. m to 939,8 sq. m, the number of consumer services facilities increased from 6,290 to 6,543, but the number of retail enterprises decreased from 17,390 to 16,513.

Since 2017, the retail trade turnover in Tatarstan has increased 1,6 times in absolute figures — from 394,2 to 635,6 billion rubles.

During this time, retail experienced bad times twice — in 2020 and in 2022, and then showed active growth. At the same time, in 2023, the market showed less noticeable recovery dynamics than in 2021.

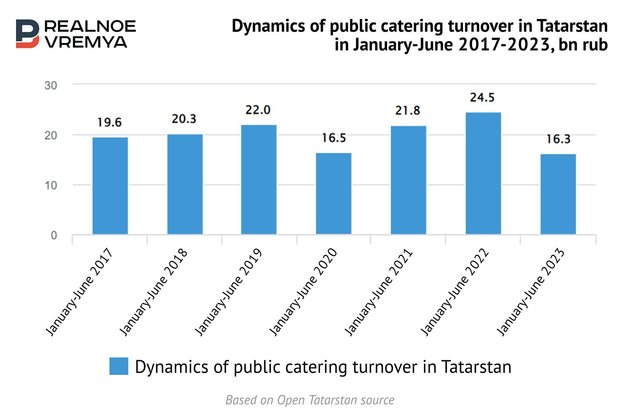

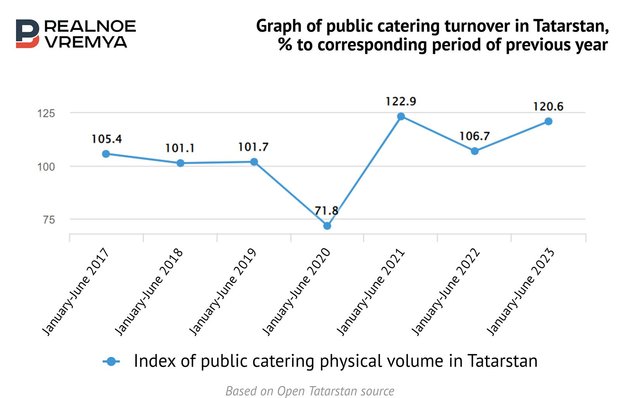

In the first half of 2023, the turnover of public catering decreased. A year earlier, they amounted to 24,5 billion rubles, and from January to June 2023 — 16,3 billion rubles.

However, the index of public catering physical volume, according to Tatarstan Statistics, increased by 20,6% in the first half of the year. That is, according to official statistics, catering in Tatarstan is actively growing.

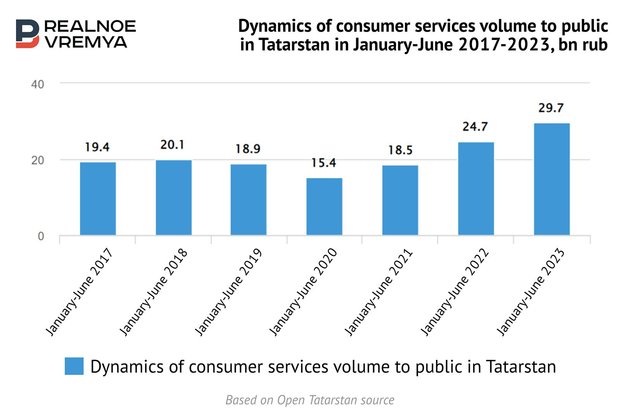

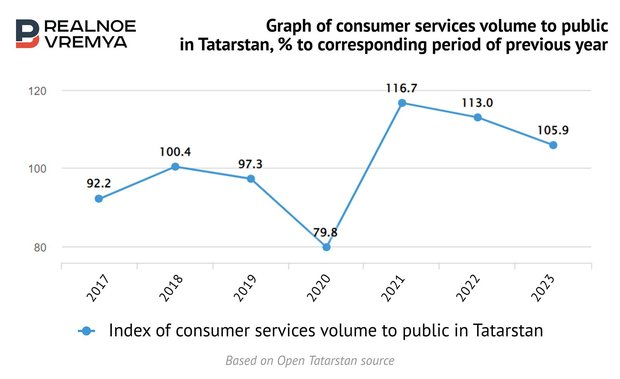

In consumer services, the situation is reversed. The volume of consumer services to the population in Tatarstan amounted to 29,7 billion rubles. A year earlier, it was 24,7 billion rubles.

According to Tatarstan Statistics, in the first half of the year it grew by 5,9% compared to the corresponding period last year.

Consumers continue to save

In retail trade in 2023, the trend towards consumer savings continues due to the stagnation of the purchasing power of the population, the shift of consumption to lower price segments and the postponement of the purchase of durable goods, analysts of the NKR rating agency believe.

In 2022, retail trade turnover grew actively in the first quarter (by 13-20%), and the effect of post-pandemic recovery in 2021 was also affected. This was followed by a sharp deceleration to 7-9% and a slowdown to 1-3% by the end of the year.

The largest drawdown in turnover was observed in the non-food segment due to sanctions and a reduction in imports. In food retail, the dynamics remained positive, but the growth rate decreased by almost 3 times compared to 2021 — from a maximum of 23% in March to 7% in December, experts say. The positive indicators of food retail are explained by a smaller import component in the commodity nomenclature.

Further stagnation of retail trade turnover in 2023 seems inevitable. In many product categories, for the second year in a row, there has been a sharp decline in the quality of products sold due to the replacement of previously imported goods with domestic analogues or goods supplied from “friendly jurisdictions”.

A restraining effect on non-food retail is also exerted by longer use (including due to repairs) of goods, a reduction in the cost of non-essential goods, and the deferred effect of hype purchases in the first quarter of 2022.

A decrease in the average receipt in food retail entails a change in sales formats: consumer demand will be met more often in stores within walking distance or through one-time wholesale purchases. To retain the buyer, the role of loyalty programmes, seasonal discounts, bonuses, cashback will increase. Besides, retail chains may increase the share of their own brands (with cheaper goods) in the assortment, analysts of the NKR predict.

The turnover of online commerce will be supported by more favourable price offers compared to traditional formats. Most of the non-food products of parallel import are sold on online sites, so they are favourably distinguished by the variety of the assortment. These factors, in turn, will lead to a reduction in the number of specialised offline stores. The share of online commerce in turnover in monetary terms increased from 3% in 2015 to 8% in 2022, and the growth may continue, according to the NKR analysts

Rosstat is optimistic

This year, changes are taking place from several sides — the supply is growing due to “parallel imports”, import substitution and replacement of Western brands with products from countries that have not joined the sanctions. The most typical example is the import of cars from China, which took 70% of the imports of the automotive industry.

At the same time, consumer demand is recovering, which is facilitated by the “overheated” labour market, budget payments, accelerating credit growth, and the realisation of deferred demand.

According to Rosstat, in June, retail trade turnover in Russia increased by 10% (YoY), exceeding the consensus forecast of Interfax (+8,6% YoY). For food products, retail trade turnover in comparable prices increased by 5% (YoY), for non-food products it jumped by 15,1% (YoY).

“Retail trade turnover at the end of June approached the level of two years ago, although it is still by 0,3% lower than in June 2021, and the gap for non-food products is 2,5%," says Olga Belenkaya. “Rosstat measures retail trade turnover minus inflation, however, it seems that in practice, in the context of a sharp change in the structure of the consumer market, it is difficult to accurately measure product price deflators.”

According to the Ministry of Economy, the total turnover of retail trade, catering and paid services to the population by the end of June is already by 2,3% higher than the level of June 2021.

In the second half of the year, consumption growth may slow down somewhat — as the sharp weakening of the ruble exchange rate is transferred to consumer prices, as well as due to the tightening of monetary policy by the Bank of Russia, which should somewhat cool the growth of lending, Belenkaya predicts.

In addition, the Ministry of Finance intends to take control of the growth of government spending, which may lead to a reduction in budget momentum. But while wages are growing at double-digit rates (at least according to Rosstat), and unemployment is at a historic low, consumer demand can hold steady enough, she believes.

Budget expenditures on the special military operation helped to go into the plus

“A significant increase in budget allocations, the production of defense products, salaries for contractors and mobilised, payments to the wounded and families of the dead have increased the incomes of a significant part of the population," commented Rustam Shayakhmetov, an economist and head of R-Invest. “Besides, personnel shortage has become a catalyst for wage growth. And the growth of monetary incomes of the population increased consumer demand, as a result of which there was an increase in retail trade turnover.”

Mordovia became the leader in terms of retail turnover growth in the first half of this year in the Volga Federal District — 14,3% compared to last year, Tatarstan is the second — 6,8%, Orenburg Oblast is the third — 6,7%.

The current situation confirms the expert assessments of a significant part of economists who said that accelerated economic development is possible if Russia's gold and foreign exchange reserves are directed to the development of innovative and infrastructure projects, increasing domestic demand of the population, the expert notes.

“At the same time, it should be taken into account that the increase in Russia's industrial production by two-thirds is provided by the military-industrial complex and only by one-third by consumer demand," Shayakhmetov emphasises.

If budget allocations in amounts comparable to the costs on the special military operation are redirected to the development of innovative sectors of the economy, to increase salaries for state employees, then the economy will continue to grow. If not, it will begin to stagnate, he is sure.

Growth of retail can be stopped by the devaluation of the ruble

“Last year, we saw a massive withdrawal of foreign companies and foreign suppliers from the Russian market, which, of course, had a negative impact on retail trade, where foreigners often played a leading role," says blogger and economist Albert Bikbov. “It was not possible to replace such an outcome immediately, more or less this process unfolded and will unfold this year. Although there are examples of quick substitution like Vkusno — i tochka.

Some of the dropped foreign companies and suppliers were replaced by Russian players, some by foreign ones. A classic example is that after the almost universal closure of car factories with foreign participation and the supply of imported cars, it was possible to replace this gaping void with Chinese cars and cars imported through parallel imports, Bikbov cites as an example.

“In the first months after the start of the special military operation, Russians switched to a savings model of behaviour, which is absolutely natural for periods with high uncertainty. If it was difficult to save on products, then people began to postpone the purchase of durable goods until better times, until the situation becomes more or less clear," the economist notes. “In grocery retail, the movement of citizens to purchase products of the medium or low price segment has also begun. Citizens' savings have started to grow, which is typical of troubled times.”

According to Bikbov, the devaluation of the ruble against the world's leading currencies can also negatively affect the development of retail: “We have seen a sharp drop in the ruble recently. In particular, the ruble exchange rate has already reached 100 per dollar," he notes. “This will lead to an increase in prices for imported goods, which still play an important role for Russian consumers. But what does a person do when an imported product sharply increases in price? They reduce its consumption! This should have a negative impact on the overall retail turnover figures.”

Grocery retailers are already expanding the “economy” line

“We would not rush to conclusions about a significant retail recovery," Maria Kolomiets, the junior director for corporate ratings at Expert RA Agency, disagrees. “In grocery retail, we note the restrained influence of the price factor — grocery retailers, according to our analysis, are actively investing in prices and expanding the shelf in the economy price segment.”

In non-food retail, consumers today can increase purchases due to the fear that it will be impossible to purchase a particular product later, she believes. In the food segment, given the shift in demand to discounters and, in general, the transition to economical consumption, the behaviour of buyers is influenced by promotions and special offers.