Price of the crisis: Realnoe Vremya examined how much Tatarstan citizens overpaid due to sanctions

Inflation in Tatarstan exceeded 11% last year — this is the highest figure since 2015

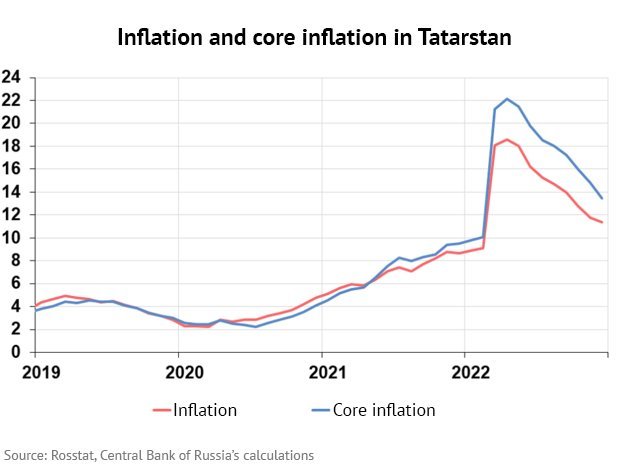

Sanctions have hit the wallet of ordinary citizens. In 2022, inflation in Tatarstan amounted to 11,4%. This is lower than in Russia as a whole, but almost 3 times higher than the target of the Central Bank of the Russian Federation and the maximum since 2015. It could have been even worse, since inflation accelerated to 18,6% in annual terms in April. Whether the authorities managed to prevent a full-fledged financial crisis, which products have risen in price the most, and what to expect from 2023 — in the review of Realnoe Vremya analytical service.

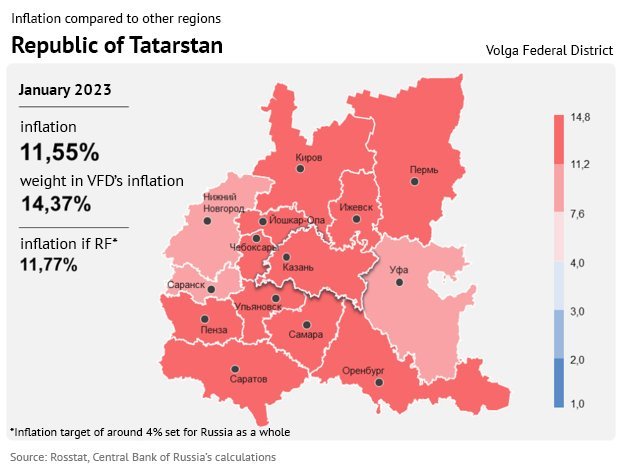

In 2022, inflation in Tatarstan decelerated to 11,4%. This is lower than in the Volga Federal District and in Russia as a whole, but still not the target for the Central Bank of the Russian Federation. Let us remind that in April inflation in the republic accelerated to 18,6% in annual terms.

But already in January 2023, inflation in Tatarstan went up again and amounted to 11,55%. This is still lower than in the Volga Federal District (11,71%) and in Russia as a whole (11,77%), and it is explained by the regulator by an increase in public transport fares and an increase in the demand of residents of the republic for some areas of foreign tourism in conditions of limited supply.

According to the forecast of the Bank of Russia, annual inflation in the country as a whole will decrease in 2023 and in the spring of 2023 may briefly fall below 4% due to the base effect. Taking into account the current monetary policy, it will decrease to 5-7% in 2023 and return to 4% in 2024.

“In December, the growth of prices for food and non-food products slowed down. Such price dynamics is particularly associated with high crop yields. Restrained consumer activity also affected — Tatarstan residents preferred to postpone large purchases," Marat Sharifullin, the manager of the Branch — National Bank for the Republic of Tatarstan of the Volga-Vyatka Main Directorate of the Central Bank of the Russian Federation, commented earlier.

Thanks to a record harvest in 2022, grain has fallen in price. This made it possible to reduce the costs of livestock enterprises for feed and grain processors for raw materials. As a result, the annual growth in dairy products, bakery products, and pasta slowed down in Tatarstan last year. The increase in gasoline prices in December also began to slow down due to export restrictions, as a result of which supply began to exceed demand in the domestic market.

The analytical service of Realnoe Vremya studied which products showed the greatest growth over the year. It turned out that margarine, fresh cucumbers, onions, rice, cookies, baby food, salt and beef rose the most by February 2023.

Cabbage, potatoes, buckwheat, beets, carrots, chicken eggs, pork, wheat flour, chicken and millet have fallen in price.

Maximum inflation since 2015

“By the results of 2022, inflation in Russia amounted to 11,9%, which has been the highest value since 2015 and almost 3 times higher than the target of the Central Bank of the Russian Federation," says Olga Belenkaya, the head of the Macroeconomic Analysis Department of Finam. “However, this is significantly lower than the April forecast of the Central Bank (18-20%) and most market forecasts of that period.”

“This January, the acceleration of inflation continued — in a month, the consumer price index increased by 0,84%, the maximum monthly growth since last April. Adjusted for seasonality, the annual inflation rate for the first time since 2022 exceeded the target level of the Central Bank of the Russian Federation of 4%, reaching 4,78%. According to the regulator, this is due to the accelerated rise in the price of fruit and vegetable products, as well as the resumption of price growth for a number of non-food products that are most sensitive to the weakening of the ruble in recent months (household appliances, electronics), the analyst explains. “At the same time, the acceleration of price growth was also noted for components less dependent on the ruble exchange rate, for example, services, which continued in the first two weeks of February.”

In annual terms, inflation is now hovering near 11,8%, in March it is expected to fall sharply — to 4%, and then, in April-May, below the target 4%, which is explained by a purely statistical effect — the exit of the highest inflation values of last year from the calculation of the base. This will be a temporary phenomenon, then annual inflation will start to rise again and by December, according to the estimates of FG Finam, it may amount to 6,6-6,8%, which so far fits into the forecast of the Central Bank of the Russian Federation of 5-7%.

At the same time, this forecast is based on the assumption of relatively restrained dynamics of consumer demand, gradually recovering after the drawdown of last year. But the main risks of exceeding the forecast of the Central Bank of Russia for inflation are associated with the ruble exchange rate, excess of budget expenditures over planned values and pressure from the labour market, where, with low unemployment in a number of sectors, there is an increase in the shortage of labour.

Central Bank is quite pragmatic in forecasts for 2023

“In 2022, it was possible to contain inflation with competent and timely measures of monetary and fiscal policy. The correct monetary policy is, first of all, a one-time increase in the discount rate from 9,5% to 20% at the end of February 2022, as well as a simultaneous ban on foreigners leaving assets in Russia and the introduction of obligations for all Russian companies to sell 80% of foreign exchange earnings," explains blogger and economist Albert Bikbov.

At the beginning of March last year, a ban on the sale of cash currency to citizens was also introduced, and it was possible to withdraw currency from accounts only up to $10 thousand. Thus, according to the expert, the demand for the currency was stopped, which affected the stabilisation of the ruble and reduced the pressure on the price tags for imported goods. The super-tough actions of the Central Bank made it possible to bring down the exchange rate that jumped up, curb the demand for currencies, strengthen the ruble and, due to the high key rate, close the space for speculation and bring down the demand for money, which suddenly became very expensive. In the end, the whole situation in the monetary sphere was eventually returned to its previous indicators, to prevent rampant speculation and inflation, and to stop the panic.

“Fiscal policy and, first of all, the suspension of the budget rule supported the ruble exchange rate and, accordingly, reduced inflationary pressure. Oddly enough, the collapse of imports (largely due to sanctions) contributed to a drop in demand for the currency, and the strengthening of the ruble affected the price tags," he says.

Albert Bikbov considers the Central Bank's forecast for inflation in the range of 5-7% “quite good from the point of view of logic”. Despite rampant budget spending in the first quarter of 2023, the Central Bank does not reduce the key rate and maintains a cautious tight monetary policy, the expert notes.

If another record harvest in agriculture is achieved in 2023, this will make an even greater contribution to curbing inflation. “Do not forget about the 'base effect', because last year inflation was high at the beginning of the year due to shocks, but by the end of the year everything was stopped. And this year's comparison will be with the stormy 2022. So the Central Bank is quite pragmatic in its forecast regarding the rate of decline in inflation," the economist believes.

A full-fledged financial crisis did not happen

“A significant restraining effect on prices in Tatarstan in 2022 was caused by an increase in the supply of agricultural goods and crop production. This became possible due to more favourable climatic conditions relative to 2021 and the expansion of acreage for some agricultural crops," commented Vladislav Bukharsky, a leading analyst of the Expert RA sovereign ratings group. “The volume of crop production increased 1,6 times relative to the level of 2021 in the region in monetary terms at comparable prices in 2022. As a result, product prices turned out to be lower than expected, and the reduction of raw material costs of a number of processing enterprises allowed to slow down the growth of prices for certain food products.”

It was possible to contain inflation in 2022 thanks to a strict interest rate policy, which helped to stop a full-fledged financial crisis, and the rapid adaptation of retail companies and manufacturers of consumer goods to new conditions, the expert believes. A surge in inflation was in March-April 2022. Since May, prices had not only not increased, but decreased in some categories until December.

According to Vladislav Bukharsky, if the current situation persists and there are no new significant sanctions, a return to inflation in the range of 5-7% in 2023 is quite possible. The main condition is that the costs do not get out of control. “But we see that the government and the Ministry of Finance are trying to maintain the budget order to the maximum," the analyst concluded.