Avers Bank draws conclusions for 2015

According to the year-end results, the bank became the most profitable bank in Tatarstan

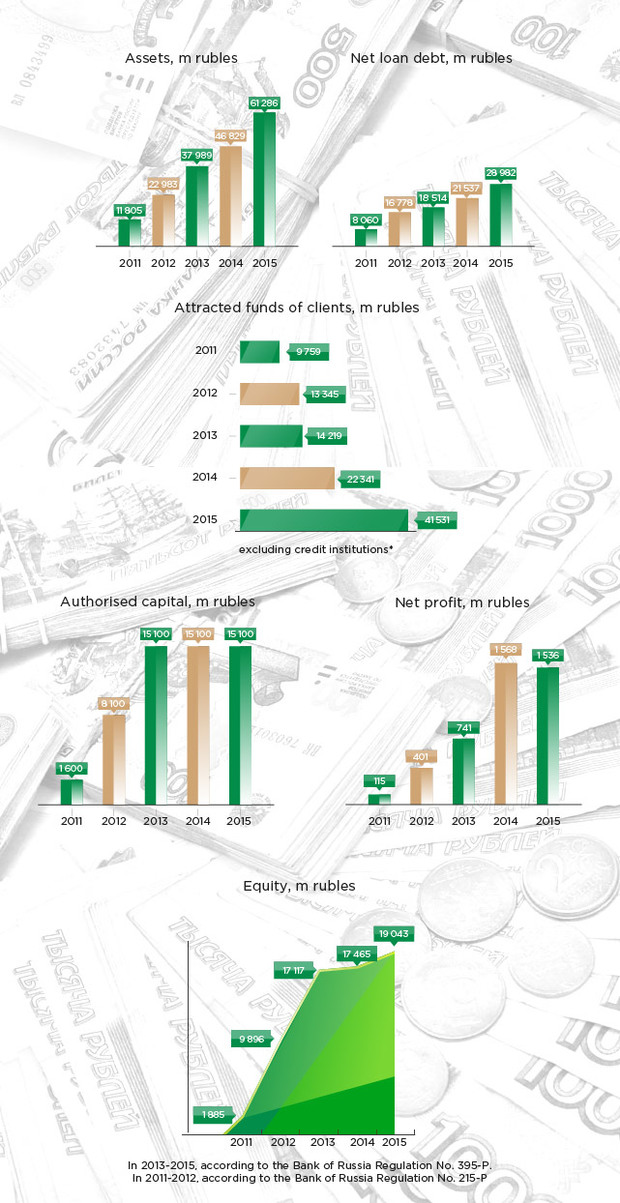

Avers Bank managed to preserve high indicators of business effectiveness and increase the number of assets almost by a third in the conditions of the unstable Russian economy and financial system

Maintaining its leadership

Estimating the results for the last year, the chairman of the administration of Avers Bank Kamil Yusupov noted the bank is taking the lead concerning its profit and demonstrating the third best result in relation to the volume of assets and equity in Tatarstan.

Last year, Avers increased its number of assets by 31% or 14,5bn rubles. The total volume of assets at the beginning of 2016 was 61,3bn rubles. The bank's equity grew from 17,5bn rubles to 19,0bn rubles in 2015. As the year-end results demonstrate, the bank gained a net profit equal to 1,5bn rubles.

A++ level of creditworthiness of Avers was assigned by RAEX agency last year. The rating was increased to the level A++ (exceptionally high / the highest level of reliability and service quality).

What is more, the results in 2015 and the previous years allowed the bank to be rated in January-February 2016 and obtain a BB- level of Fitch Ratings.

Effectiveness during a recession

In 2015, crediting was affected by general tendencies to fall in the economic activity in the country, reduction of production growth rates, decrease of demand for credit products in the banking system. Despite this fact, Avers managed to not only preserve but also increase its credit portfolio, which grew by 67% and reached 22,8bn rubles. Loans to juridical persons, which exceeded 19bn rubles at the beginning of the year, form a significant part of the portfolio.

In retail crediting, the bank adapted the conditions of crediting and launched a new production line corresponding to the conjuncture of the market in 2015. The bank obtained a right to subsidize incomes on social mortgages provided within the scope of the state crediting subsidization. On 1 January 2016, the credit portfolio to natural persons was 3,4bn rubles.

Last year, a strong clientele and reliable reputation allowed the bank to increase its financial indicators, in spite of the difficult economic situation in the country. The 2016 will be uneasy too, but the bank is well prepared for work in new conditions. The assets of the bank increased by 59% or, more precisely, 36,4bn rubles for the first quarter of 2016 and reached 97,7bn rubles; its net profit for the first quarter of 2016 was 0,4bn rubles.

Further strategy

In December 2915, the board of directors adopted a development strategy of Avers for the nearest five years. It takes into account general macroeconomic challenges and trends of the development of the Russian economy, the position of the bank in the regional market and defines the main development vectors for these 5 years. It is a growth of business volumes that outstrip the market and maintenance of the financial results and reliability of the bank at a high level. Adaptable bank aimed at quality client service is the orientation in the coming years for Avers that will actively work on augmentation of its share in the banking market of Tatarstan.