Kamil Yusupov: ‘We chose a future development strategy’

Intending to increase the volume of its assets, net profit and volumes of crediting of juridical persons and the population by 2021, Bank Avers started the realization of a new five-year development strategy. The chairman of the administration of Bank Avers PLC Kamil Yusupov, who joined the bank in spring 2015, told in his first interview about the results of 2015, five principles of Strategy-2021 and key growth drivers.

Despite the market

Mr. Yusupov, according to the results for 2015, Avers traditionally has become the leader among the banks of Tatarstan concerning its net profit. Can we say that it was quite a successful year?

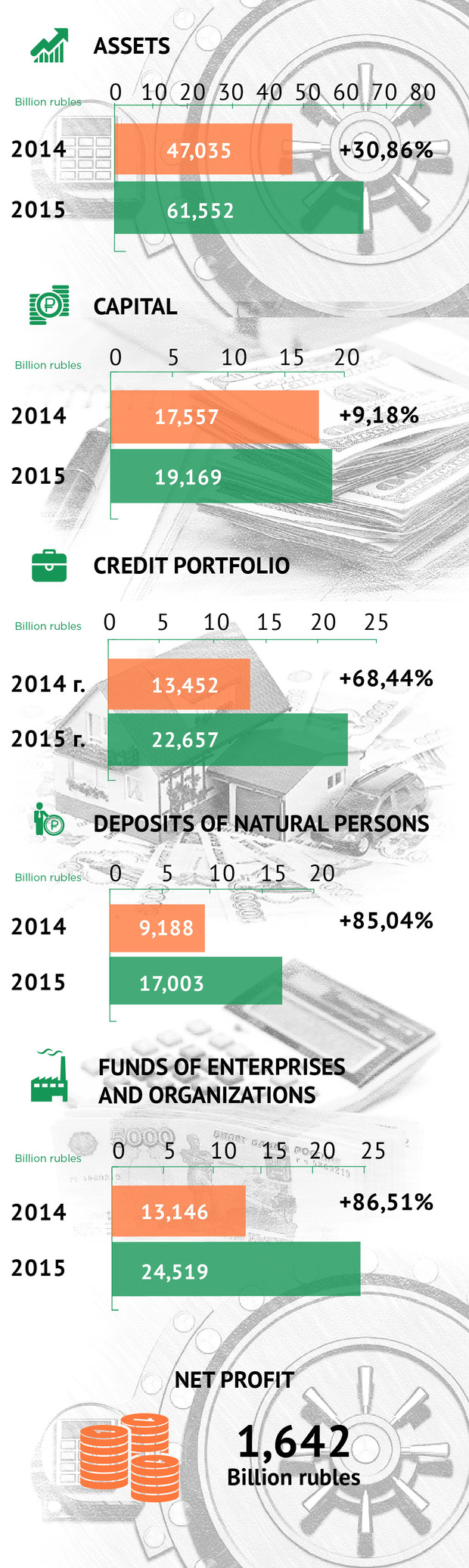

Yes, 2015 became a successful year for the bank. Despite the current situation on the market, the bank demonstrates its stable dynamics in the main indicator. According to the year-end figures, asset growth increased by over 30% to 61,6bn rubles. In spite of the difficult economic situation, the bank managed to reach the estimated level of net profit equal to 1,5bn rubles, which allowed the bank to take the lead among the banks of the Republic of Tatarstan.

The capital of the bank reached about 19bn rubles, so its growth for a year made up 1,6bn rubles. Credit portfolio increased by 68%, that is to say, by 9bn rubles and reached 22,7bn rubles. The level of past-due debts does not exceed 1,5% in general compared with the portfolio of natural and juridical persons, which is a low indicator in comparison with the Russian banking sector.

Last year, all key indicators, which are used to form the ranking, allowed us to take the third place. We were in the three concerning the assets, credit portfolio for juridical persons and volume of borrowed funds of juridical persons among the banks of Tatarstan. Speaking about the positions on banking market of Russia, we cemented our place in the first 100. The bank was not included in the first 100 only last year. Today consolidation is observed in many sectors, including the banking. Shares of the banks that are not in the top-50 has been reducing in recent years. Shares of the banks taking 51th position and further are just 12,5% in the banking system of the country, which is 1,5% less than last year.

What are the most important events for the bank happened last year?

We had been working on the modernization of the back office, information systems and business processes during the whole year in order to make the bank more comfortable for clients. Much work was done. However, it is not correct to speak about it as if it was a super achievement. A++ level of creditworthiness of Avers assigned by RAEX agency was an important event last year. The rating was increased to the level A++ (exceptionally high / the highest level of reliability and service quality). Only 10 banks of Russia have A++ level of creditworthiness of RAEX (RA Expert). In 2015, 8 banks were given better ratings by RA Expert, but nowadays only Avers' level jumped from A+ to A++ level.

In October, a routine audit of the Bank of Russia was executed. And we successfully passed this inspection. What comes next? The first quarter and the first half of the year will be difficult for the financial system and the economy as a whole. But we will work. We have many tasks ahead.

The execution of the five-year development strategy of the bank will end in 2016. Is there any prepared document forecasting the further development of the bank?

The board of directors approved a new development strategy of the bank till 2021. It can be characterized as a strategy of a medium-sized corporate bank. We refused the statements about ambitious growth. Banks tried to be in the first ten and hundred at the beginning and mid of 2000. We remain in a conservative paradigm. It means a conservation of balance between quality and asset protection and growth of bank. Growth is to be constant, not spasmodic. We will continue crediting the real sector of the economy. Tatarstan is the basic region for us. We will augment our share in both the corporate sector and retail here. We will aspire to make our service as accessible as possible for our clients.

Strategy of the future

What are the main principles of the new strategy?

The centre of macroeconomic analysis and short-term forecast has elaborated monitoring. The strategic profile of a bank is estimated according to five criteria: quality and asset protection, balanced business growth, balanced structure of borrowed resources, liquidity and profitability.

Asset protection depends on the size of the authorized capital and the size of the equity of a bank, which, in Avers, are equal to 15,1m rubles and 19,2 rubles respectively. In terms of standards set by the Bank of Russia, we have a big reserve. H1 indicator means that the bank has enough equity and demonstrates asset protection – it is about 35%. It is a very high level. It shows that the bank has a great growth potential even with the current volume of equity. But the size of assets did not save from licence revocation, bankruptcy, inability to meet its obligations. Return on capital employed is also an important indicator for the bank. It depends on the size and quality of assets both concerning risks taken and profitability. The totality of these indicators allows to estimate the efficiency of the work of a bank. Now profitability of the capital of the bank exceeds 10%, which is return on capital employed. We are going to support profitability of equity at 10% further on.

Balanced structure of borrowed resources is another important criterion. Resources borrowed from juridical persons have a good specific weight in the structure of borrowed resources of Avers, including current accounts, which allow to make the funding base cheaper, and time deposits. The share of funds of natural persons is big enough. The bank plans to enter the bond market with the intention of supporting the equilibrium of resources borrowed. But we will do it when we understand that the cost of the borrowings on this market is not extremely high. Banks, which issue bonds today, place them at 13-15% per annum. We would like to ask where such expensive bonds are to be placed?

About liquidity and profitability of a bank. The fact that it fulfils all liquidity standards of the Central Bank even more than enough illustrates its high liquidity. In 2015, Avers' net profit was 1,5bn rubles. We confirmed the result of 2014. We understand that the next five year won't be easier. It is a good and an ambitious task to maintain those positions that we formed due to the efficiency of the business.

Are funds of natural persons the most expensive resource?

Nowadays the resources borrowed on inter-bank market are the most expensive ones, while the formation of the account balance and current accounts of natural persons are a cheap resource. This is why the expansion of clientele is our goal.

There is another task connected with it. We intend to increase the share of fee income – payment and cash service of natural and juridical persons, bank guarantee, clients' currency future banking, foreign exchange operations and transactions of bank cards from 20 to 30% by 2021.

How will the bank grow by 2021 as a result of the realization of the strategy?

The bank plans to grow 2,5 times more regarding the assets. Now its assets number 61,6bn rubles; they should reach 150bn rubles by 2021. Average annual increase will make up about 20%. Speaking about the last five years, we demonstrated a growth every year that exceed 40%, while the banking sector increased by 20% on average. All analysts share the opinion that the growth of the banking system of Russia in the next five years will be at 8-10%. We want to preserve the same margin from the dynamics of the sector that we demonstrated previously.

As for net profit, we plan to reach 2bn rubles annually. It is a more moderate growth compared to other indicators. Fight for large clients will worsen during the consolidation of the banking sector, worsening external economic situation and reductions of investment possibilities. This fight has been lasting for the last five years and was illustrated in the reduction of interest margin. It is a difficult task to show net profit growth in these conditions.

The volume of credit portfolio in the structure of assets will be maintained at 45%. The portfolio of natural persons will increase from 3,5bn rubles to 11-12bn rubles. Reached last year, the result and the growth that the bank is demonstrating confirm the right choice of the business model development. We might be sure that this gradual growth will continue during the next 5 years, the bank will be able to increase its main indicators and augment its share on the banking market of Tatarstan.