Russia seeking to replace dollar in oil settlements with Iran and Turkey

Russia is likely to follow Iran in its decision to move away from the US dollar as a currency in the country's imports. However, the attempt to ''isolate the Americans'' proposed by Iranian leader Ali Khamenei is easier said than done, as it requires significant adjustments in many sectors.

Russia is considering replacing the US dollar in crude oil payments on deals with Turkey and Iran, says Oilprice.com. Russian Minister of Energy Aleksandr Novak said that there was ''a common understanding'' that the country should move towards the use of national currencies in its settlements. ''There is a need for this, as well as the wish of the parties. This concerns both Turkey and Iran – we are considering an option of payment in national currencies with them.'' Nonetheless, the decision required certain adjustments in the financial, economic and banking sectors, emphasised the minister.

As for Iran, the country decided to drop the dollar as a currency in its imports at the end of February. According to a directive from the Iranian Ministry of Industry, Mine and Trade, local traders are now forbidden to place import orders in US dollars. As Iran has no access to dollar transactions due to the sanctions, ''removing it as an import payment currency would make life easier all around''. Last year, the central banks of Iran and Turkey signed a bilateral deal to trade in national currencies.

Last November, Supreme Leader of Iran Ayatollah Ali Khamenei urged President of Russia Vladimir Putin to join him in switching from the dollar as a transaction currency to ''isolate the Americans''. He characterised joint efforts to dump the American currency in bilateral trade as the best way to beat US sanctions against the two countries. Moscow, which is also bearing the sanctions burden, is now in negotiations with Tehran on using national currencies in settlements.

Although sceptics say that dropping the dollar is easier said than done, Stephen Brennock, an analyst at PVM Oil Associates, considers that the advent of cryptocurrencies can facilitate the move away from the dollar as an international oil trade settlement currency. In December 2017, the expert said in a note that ''cryptos could help commodity-producing countries to switch from the dollar to cryptocurrencies to reduce their dependence on the greenback''. It would also curb their exposure to dollar movement risks and the effects of sanctions, which typically feature cutting off access of the target country to international funding, he added.

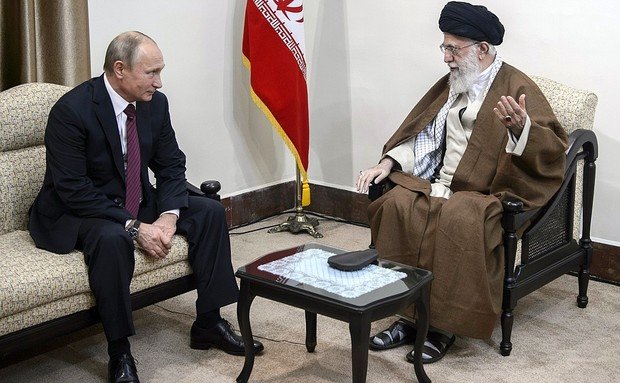

In November 2017, Iranian leader Ali Khamenei urged Vladimir Putin to switch from dollar as transaction currency. Photo: kremlin.ru

In November 2017, Iranian leader Ali Khamenei urged Vladimir Putin to switch from dollar as transaction currency. Photo: kremlin.ru