Depositors will be charged 20–30% more tax than a year earlier

Experts attribute this to the high key rate and the obligation of banks to report to the tax authorities

This year, significant changes in tax legislation have come into force in Russia, including those affecting the taxation of income from deposits and accounts. The main thing deposit holders need to know is that the threshold for applying the increased tax rate has been lowered from 5 million to 2.4 million rubles per year. In addition, experts forecast a significant increase in the total amount of tax compared to last year, when depositors in Tatarstan alone paid 2.9 billion rubles, and across Russia — 111 billion rubles. Read the details in the Realnoe Vremya report.

Russians have deposited almost 60 trillion rubles in banks

The total volume of personal accounts and deposits in Russian banks reached 59.4 trillion rubles. These are the Central Bank’s figures as of May 1, meaning that in April alone the amount increased by more than one and a half trillion. The Bank of Russia attribute the growth to the indexation of social payments starting April 1 and the earlier disbursement of child benefits and pensions (funds were transferred in advance due to the May holidays).

However, if we examine the statistics over recent years, it becomes clear that the growth of Russians’ savings has been closely linked to the sharp increase in the Central Bank’s key rate — up to 20% in 2022, 16% in 2023, and 21% in 2024.

Thus, in recent years, the total amount of deposits and accounts (excluding escrow) has grown significantly:

- As of January 1, 2023 — 36.8 trillion rubles (+5%);

- As of January 1, 2024 — 45.1 trillion rubles (+23%);

- As of January 1, 2025 — 53.7 trillion rubles (+19%).

Overall, over the course of the year (from May 1, 2024 to May 1, 2025), the volume of deposits increased by 23% — from 47.9 trillion to 59.1 trillion rubles (excluding escrow).

Most deposits in Volga region — held by residents of Tatarstan

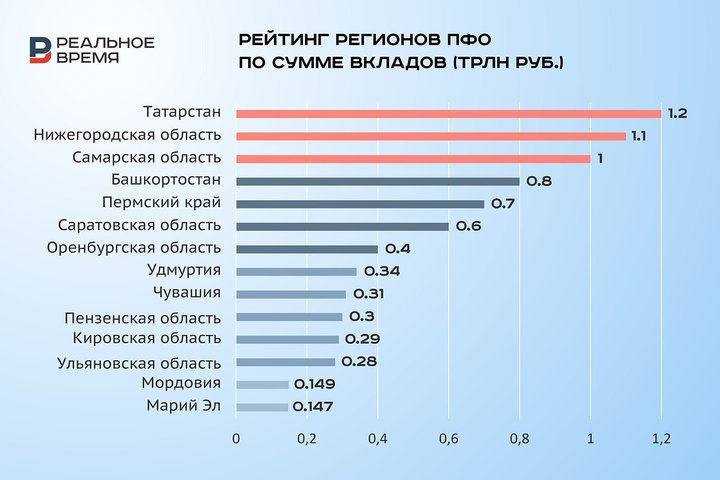

As of May, residents of the Volga Federal District held 7.5 trillion rubles in bank accounts, with the largest share of savings belonging to Tatarstan residents — 1.2 trillion. Moreover, the amount of deposits in the republic grew faster than across Russia — by nearly a third (+28%) over the year, rising from 0.9 trillion to 1.2 trillion rubles.

In second place by total deposits are residents of the Nizhny Novgorod region with 1.1 trillion rubles, followed by Samara region residents with 1 trillion. The top five regions in terms of savings also include the population of Bashkortostan (788 billion) and Perm Krai (656 billion).

What tax on deposits will Russians and Tatarstan residents pay?

As deposits gain popularity in Russia, forecasts for the amount of tax depositors will have to pay on their income are also rising. In 2025, the Finance Ministry expects to collect twice as much under this item as in the previous year — 251.49 billion rubles (in 2024, the target was 108.55 billion, but according to the Federal Tax Service, 111 billion was actually collected). In 2026, the volume of personal income tax on interest income from deposits (account balances) is projected at 262.14 billion rubles, and in 2027 — at 173.34 billion.

The tax itself was introduced in 2021, but in practice Russians began paying it only in 2024, as they had been exempt from the levy in 2021–2022. Therefore, this year depositors will pay it for the second time, but under new rules that came into effect in 2025. The tax applies to income from deposits earned in 2024 and is charged only on the portion exceeding the non-taxable threshold.

The non-taxable income is calculated as follows: 1 million rubles multiplied by the highest key rate set by the Bank of Russia on the first day of each month during the calendar year. For example, in 2024 this rate was 21%. The formula is the following: 1 million rubles × 21% = 210,000 rubles (a year earlier, the non-taxable income was 150,000). Tax is paid only on the portion of a citizen’s total deposit interest income for 2024 that exceeds 210,000 rubles. For instance, if a depositor earned 250,000 rubles in interest, only 40,000 rubles would be subject to taxation.

This year, a new five-tier progressive personal income tax scale came into effect in the country. Instead of the previous two rates of 13% and 15%, there are now five: 13%, 15%, 18%, 20%, and 22%, depending on income level. However, the tax rates on deposit income have remained unchanged at 13% and 15%. Only the threshold for applying the higher rate has been lowered — previously it was 5 million rubles, now it is 2.4 million rubles. Thus, a depositor who earns less than 2.4 million rubles in interest over the year will pay tax at a rate of 13%, while income exceeding this amount will be taxed at 15%, without further progression.

“The calculations will be completed in August 2025”

Citizens will not need to submit information about their deposit income to the tax authorities themselves — this will be done by the banks on their behalf. Additionally, the data will be displayed in the Personal Taxpayer Account. The tax on income from deposits must be paid no later than 1 December 2025. Tax notifications can also be received through the Personal Taxpayer Account, its mobile version (the Individual Taxes app), or via the Gosuslugi portal.

Interest on escrow accounts and ruble deposits with a rate of no more than 1% throughout the year are not taken into account when calculating the tax. If income is received in foreign currency, it will be converted into rubles at the official Central Bank exchange rate on the date of actual receipt.

For the first time, 1.8 million Russians paid the deposit tax in 2024. Explaining the increase in personal income tax exceeding the growth rate of the wage fund, tax authorities reported that it was “related to the growth of dividends (+26%), and income from interest on deposits received in 2023 (+111 billion rubles),” according to the Federal Tax Service’s 2024 report.

In Tatarstan last year, more than 33,000 residents paid tax on income from interest on bank deposits received in 2023. The total amount of tax collected was 2.9 billion rubles.

In response to a query from Realnoe Vremya regarding the projected tax revenue in the republic this year and the number of depositors expected to pay tax, the Federal Tax Service office for the Republic of Tatarstan said:

“Growth of personal income tax from these sources will be significantly exceeded”

Meanwhile, experts are convinced that this year the amount of revenue from the deposit tax in Tatarstan, as well as across Russia, will be significantly higher.

The interviewee is convinced that, for the same reason, the number of taxpayers under this category in the republic will also increase. Although last year their number slightly exceeded thirty thousand people, she said: “Yes, but at that time the tax authorities did not have access to this information, whereas now banks are obliged to report on all individual deposits. Therefore, the increase this year will not be due to a rise in interest amounts on deposits, but rather to a growth in the number of dividend recipients, as there will be more information about the people who receive them.”

This view is shared by Viktor Timokhin, director of Audeks PLC, an audit and consulting company, who also believes that this year higher revenue from the deposit tax is expected:

At the same time, even those depositors who wish to withdraw their funds from bank accounts should bear in mind that the interest withdrawn will still be included in the tax base calculation, the expert explained. “Therefore, I believe that compared to last year, the growth of personal income tax from these sources will significantly exceed expectations for the budget. It is difficult to calculate precisely, but since the key rate remained fairly high during the first 4–5 months of this year, I think the interest attributable to 2025 will amount to approximately a 20–30% increase compared to the previous period,” the speaker concluded.