Withstanding the sanctions: rating of Russian regions on economic development

The analytical service of Realnoe Vremya studied the economic indicators of the regions for 2021-2022 and compiled the top of the strongest and most affected regional economies.

The past 2022 year has become one of the most difficult for Russia from an economic point of view. The country was hit by a flurry of sanctions, the logistics chains that had developed over the years were destroyed, international companies one by one left the country's market. How the regional economy coped with the crisis that broke out, which regions suffered the most, and whether we should expect improvement in 2023 — in the rating of the analytical service of Realnoe Vremya.

Despite the deterioration of external conditions and increased sanctions pressure, the Russian economy demonstrated stability in 2022. The decline in GDP following the results of the most difficult second quarter turned out to be less than forecast estimates and amounted to -4,1% compared to the same period of the previous year. According to the Russian Ministry of Economic Development, the lowest point of the economic downturn was passed in the fourth quarter. By the end of 2022, the decline in GDP is estimated at -2,9% compared to the level of 2021. But the final figures will appear only at the end of the first quarter of 2023.

The analytical service of Realnoe Vremya analysed the forecasts of gross regional product (GRP) volumes and compiled the top 10 strongest economies of the country on their basis, as well as on the basis of open data.

Our rating includes Moscow, St. Petersburg, Moscow Oblast, Khanty-Mansiysk and Yamalo-Nenets districts, Republic of Tatarstan, Krasnodar and Krasnoyarsk Territories, Sverdlovsk Oblast, and the Republic of Bashkortostan. Traditionally, the most diversified economy in Moscow is in first place, St. Petersburg is in the second place, and Moscow Oblast is in the third. Tatarstan retained the sixth place, the GRP of the republic increased to almost 3,7 trillion rubles. In prices comparable to 2021, the growth of Tatarstan's GRP was only 0,6%.

The Sverdlovsk and Moscow regions, Yamalo-Nenets Okrug, St. Petersburg, Krasnodar Krai, and Moscow suffered the most in our top 10 largest economies. Krasnoyarsk Krai, Khanty-Mansiysk Okrug, Tatarstan and Bashkiria grew.

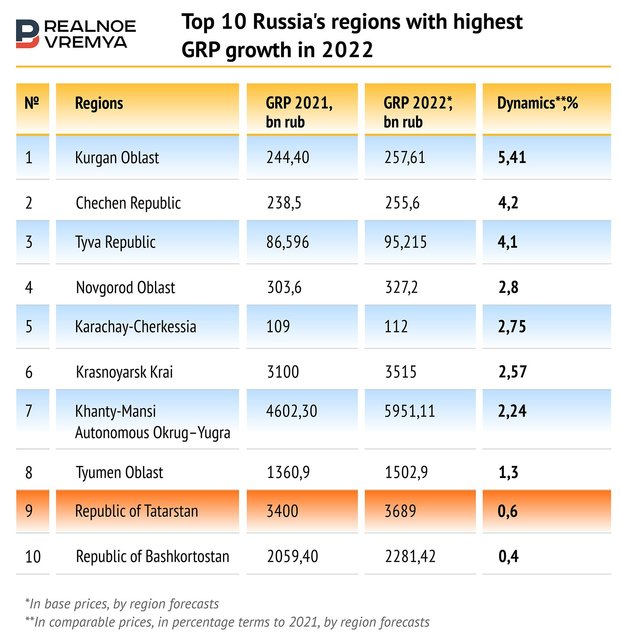

Kurgan Oblast, Chechen Republic, Tyva, Novgorod Oblast, Karachay-Cherkessia, and the Tyumen Oblast also demonstrated GRP growth.

In the vast majority of regions, there was a drop in the gross regional product and, accordingly, a reduction in the economy.

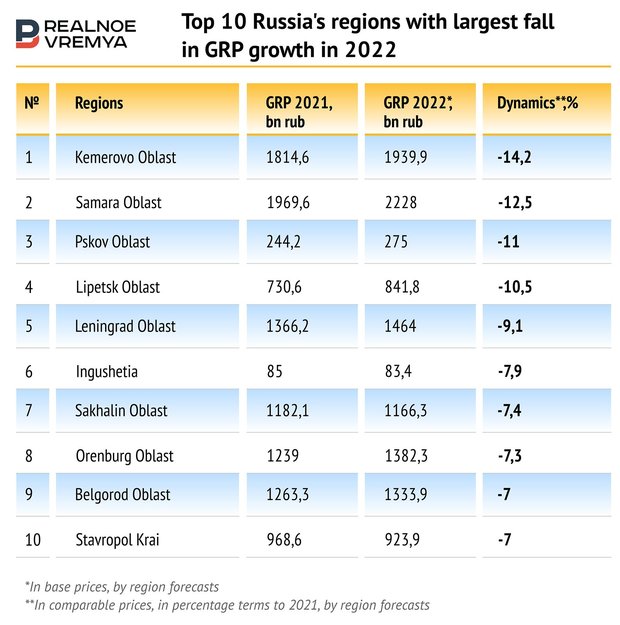

The main contribution to the reduction of GRP in 2022 was made by sanctions, the withdrawal of foreign companies, the contraction of consumer demand due to a surge in inflation and a decrease in real incomes of the population, as well as the rupture of logistics ties, the slowdown in wholesale trade and related sectors — transportation and storage — against the background of a reduction in foreign trade turnover.

“If there is growth, it is at the level of statistical error”

“I doubt that GRP is growing. According to various estimates, our GDP will drop by 3-5% this year. It's already officially. With such ranges of falling GDP, there can be no growth in the gross regional product. If there is growth, it is at the level of statistical error," Rustem Shayakhmetov, an economist, PhD, head of R-Invest, is sure. “When we are told about the growth of 1-2%, it is not a fact that it happened. This is included in the margin of error.”

The situation in the Russian economy, according to the expert, is very difficult: “In the first half of 2022, we were saved by exports, but it declined.” The entire world economy is suffering from sanctions against Russia. And the recession that has already begun in the West is quite serious, which may become the basis for easing sanctions against Russia.

In the first half of 2023, according to Shayakhmetov's expectations, there will definitely be a deterioration in the economy, but Russia has its own reserves: “If they are used, we will not feel it much. Now everything depends on domestic demand," he is sure. “Before the special military operation, 35% of GDP was formed by exports, and in Europe it is about 12%. The US has the same amount. China's share of exports in GDP is also declining. If they turn over the pyramid of our economy and take measures to increase domestic demand, then it is likely that everything will be fine. Due to the acute shortage of labour, under any circumstances, one should not expect an increase in unemployment. The main problem for the population is the low level of wages, which largely determines domestic demand.”

Blogger and economist Albert Bikbov is sure that in 2022 there were flowers, grains will be in 2023. “Sanctions are a tool in the long run," he explains. “And oil and gas sanctions have been imposed only this year.”

Expensive oil and state defense orders are the main drivers of GRP growth

Olga Belenkaya, the head of the Macroeconomic Analysis Department at Finam, reminded that Rosstat has not yet published a GDP estimate for 2022. However, as well as the assessment by regions.

“The heterogeneity of economic dynamics of the regions last year could have intensified due to the structural restructuring of the economy associated with the special military operation, the rupture of many economic ties of Russia with traditional foreign trade partners, primarily with the European Union, and the reconfiguration of logistics and foreign trade directions to the East," explains Belenkaya.

Another driver of regional growth was the state defense order — this applies to regions with developed defense industry potential. Regional programmes to support industry and entrepreneurship were operating in Moscow (industrial production increased by 9,1% in 11 months of 2022).

For southern regions, such as Krasnodar Krai, significant factors for the economy were a record harvest and the growth of domestic tourism due to the termination of direct flights with Europe, as well as the resumption of the federal programme of tourist cashback. “At the same time, the suspension of airports in Crimea, Anapa and Gelendzhik negatively affected the flow of tourists to these regions," she notes.

Olga Belenkaya attributed Karelia to the regions affected by the sanctions (woodworking has seriously been affected there), as well as all regions (for example, Kaluga Oblast and Kaliningrad Oblast) with a high contribution of the automotive industry. The departure of foreign partners and the termination of the supply of imported components led to the shutdown of production. Also, the traditional metallurgical regions in the European part of Russia — Kursk Oblast, Lipetsk Oblast, and Vologda Oblast — could be under pressure due to Western sanctions.

Range of forecasts for 2023 has become even wider

“The decline of the economy depends on the specialisation of the region. For example, Khanty-Mansiysk Okrug is an oil region. Yamalo-Nenets Okrug is primarily gas. Oil production increased last year, while gas production fell very much. The fall of St. Petersburg is rather a story about logistics and transport. Due to that trade with Europe collapsed, the ports of the North-West suffered first of all," comments Marsel Salikhov, PhD, researcher at the Department of World Economy and World Politics at the HSE University. “Sverdlovsk Oblast is metallurgy. Metallurgists have suffered greatly, because now an embargo has been imposed on metal supplies to the EU, and this was a key market. And the strengthening of the ruble also crushed them. Metallurgists constantly complained that they were unprofitable. Metallurgy has reduced production volumes in Russia by 5-6%.”

There is also a layer of very poor regions that are heavily dependent on transfers from the federal centre. “And if the Ministry of Finance gives them more money, there will be growth. If the Ministry of Finance reduces subsidies, the region will show a drop. They are very much dependent on the support of the federal budget. For them, this is the main factor, for them it is not so important what happens inside, it is important how much money will be given from Moscow," the expert explains.

The uncertainty is related to the special military operation, mobilisation, sanctions and other factors that are difficult for economists to predict.

“I am in the camp of those people who expect a small minus: problems still remain. In 2023, most likely, there will be problems with oil, and a reduction in exports of oil and petroleum products is expected. Oil production may also decrease by 3-5%. Gas production will fall. Based on these factors, it is difficult to expect an improvement in the country's economy," he explains. “Some optimism is due to that Western companies that worked in Russia have already left, and there is no one else to leave. Optimism today is based on the fact that we are already at the bottom. Now it's time to get up.”

In 2023, the raw material regions associated with oil and gas, as well as economically developed regions of the country will suffer more: Moscow, Moscow Oblast, St. Petersburg, and Leningrad Oblast. Strong regional economies are suffering from a reduction in demand, there is an outflow of population, people are leaving Russia. According to the expert, the less economically developed and poorer regions of the country will feel the best, because the federal budget is “swelling” today.

“We are already seeing a certain boom in some poor regions from that payments are being made to mobilised and contractors. People get, by their standards, huge money, start spending it, building houses, buying cars," he cited as an example.

|

PLACE IN THE RATING |

REGIONS |

GRP 2022, BN RUB |

GRP 2021, BN RUB |

DYNAMICS, % |

|

1 |

Moscow |

26 236,00 |

23 323,00 |

-2,10 |

|

2 |

Saint-Petersburg |

6 847,70 |

7 149,00 |

-4,11 |

|

3 |

Moscow Oblast |

6 682,80 |

6 100,00 |

-5,30 |

|

4 |

Khanty-Mansi Autonomous Okrug |

5 951,11 |

4 602,30 |

2,24 |

|

5 |

Yamalo-Nenets Autonomous Okrug |

5 825,00 |

3 900,00 |

-4,40 |

|

6 |

Republic of Tatarstan |

3 689,00 |

3 400,00 |

0,60 |

|

7 |

Krasnoyarsk Krai |

3 515,00 |

3 100,00 |

2,57 |

|

8 |

Krasnodar Krai |

3 498,00 |

3 300,00 |

-3,00 |

|

9 |

Sverdlovsk Oblast |

3 193,60 |

2 700,00 |

-5,40 |

|

10 |

Republic of Bashkortostan |

2 281,42 |

2 059,40 |

0,40 |

|

11 |

Rostov Oblast |

2 228,87 |

1 950,84 |

-4,80 |

|

12 |

Samara Oblast |

2 228,00 |

1 969,60 |

-12,50 |

|

13 |

Irkutsk Oblast |

1 975,91 |

1 753,86 |

-4,40 |

|

14 |

Kemerovo Oblast |

1939,8638 |

1814,646 |

-14,20 |

|

15 |

Nizhny Novgorod Oblast |

1912,8 |

1730,6 |

-6,00 |

|

16 |

Perm Oblast |

1600 |

1400 |

-5,00 |

|

17 |

Chelyabinsk Oblast |

1 503,72 |

1 597,47 |

-3,40 |

|

18 |

Tyumen Oblast |

1502,9 |

1360,9 |

1,30 |

|

19 |

Primorsky Krai |

1491,4795 |

1283,4466 |

-1,90 |

|

20 |

Novosibirsk Oblast |

1470 |

1525,1 |

-5,70 |

|

21 |

Leningrad Oblast |

1464 |

1366,2 |

-9,10 |

|

22 |

Orenburg Oblast |

1 382,32 |

1238,99041 |

-7,30 |

|

23 |

Belgorod Oblast |

1333,9 |

1263,3 |

-7,00 |

|

24 |

Sakhalin Oblast |

1166,3 |

1182,1 |

-7,40 |

|

25 |

Volgograd Oblast |

1144 |

988,7 |

-1 |

|

26 |

Khabarovsk Krai |

1139,6572 |

983,1161 |

-1,40 |

|

27 |

Saratov Oblast |

1067,6 |

984,8 |

-2,20 |

|

28 |

Republic of Kalmykia |

1008,9379 |

950,0902 |

0,12 |

|

29 |

Voronezh Oblast |

1008,254 |

1100 |

-2,5 |

|

30 |

Murmansk Oblast |

997,6 |

916,5 |

-4,90 |

|

31 |

Stavropol Krai |

923,8727 |

968,5598 |

-7,00 |

|

32 |

Udmurt Republic |

909,829 |

790,68 |

-6,50 |

|

33 |

Altai Krai |

909,8 |

772,6 |

-2,00 |

|

34 |

Republic of Dagestan |

879,6141 |

815,0879 |

-0,90 |

|

35 |

Tula Oblast |

842,5 |

780,1 |

-5,20 |

|

36 |

Lipetsk Oblast |

841,7621 |

730,6269 |

-10,48 |

|

37 |

Komi Republic |

806,4 |

760,2 |

-0,60 |

|

38 |

Omsk Oblast |

767,7 |

730,9 |

-3,62 |

|

39 |

Kursk Oblast |

746,7145 |

686,623 |

-4,40 |

|

40 |

Republic of Crimea |

705,84 |

615,0879 |

-2,60 |

|

41 |

Yaroslavl Oblast |

686,6 |

688 |

-1,20 |

|

42 |

Tomsk Oblast |

672,5352 |

636,545 |

-1,30 |

|

43 |

Arkhangelsk Oblast |

671,41344 |

632,38625 |

0,12 |

|

44 |

Tver Oblast |

657,8 |

550,2 |

-3,80 |

|

45 |

Vladimir Oblast |

638,333 |

612,9783 |

-1,40 |

|

46 |

Kaluga Oblast |

634,8 |

559,2 |

-5,00 |

|

47 |

Trans-Baikal Krai |

605,8222 |

517,345 |

-2,50 |

|

48 |

Ryazan Oblast |

576,683 |

503,3678 |

-1,20 |

|

49 |

Amur Oblast |

536,8 |

484,3 |

-0,20 |

|

50 |

Bryansk Oblast |

502,11 |

447,872 |

-2,50 |

|

51 |

Tambov Oblast |

499,0533 |

448,0458 |

-0,30 |

|

52 |

Ulyanovsk Oblast |

478 |

484,6 |

-1,36 |

|

53 |

Kirov Oblast |

455,018 |

452,7031 |

-4,20 |

|

54 |

Smolensk Oblast |

397,4322 |

398,539 |

-0,28 |

|

55 |

Chuvash Republic |

372,7 |

352 |

0,30 |

|

56 |

Republic of Karelia |

360 |

380 |

-4,60 |

|

57 |

Republic of Khakassia |

352,516 |

283,004 |

-5,70 |

|

58 |

Oryol Oblast |

347,0502 |

310,8926 |

-4,20 |

|

59 |

Ivanovo Oblast |

341,06 |

308,88 |

-6,10 |

|

60 |

Novgorod Oblast |

327,2 |

303,6 |

2,80 |

|

61 |

Magadan Oblast |

318,5 |

316,4 |

-4,10 |

|

62 |

Republic of Mordovia |

303 |

299,8 |

-3,00 |

|

63 |

Kamchatka Oblast |

284,8327 |

277,6148 |

-0,60 |

|

64 |

Pskov Oblast |

274,988 |

244,176 |

-11,00 |

|

65 |

Republic of Buryatia |

269,5398 |

254,4726 |

-5,30 |

|

66 |

Kurgan Oblast |

257,61 |

244,40 |

5,41 |

|

67 |

Chechen Republic |

255,6 |

238,5 |

4,20 |

|

68 |

Kostroma Oblast |

235,49 |

225,90 |

-4,24 |

|

69 |

North Ossetian Republic |

230,7466 |

207,8798 |

-2,00 |

|

70 |

Republic of Mari El |

230 |

214,026 |

-1,00 |

|

71 |

Kabardino-Balkarian Republic |

188,9581 |

169,8523 |

-1,80 |

|

72 |

Republic of Adygea |

175,7 |

159,3 |

-2,40 |

|

73 |

Karachay-Cherkess Republic |

112 |

109 |

2,75 |

|

74 |

Republic of Tyva |

95,215 |

86,596 |

4,10 |

|

75 |

Ingushetia |

83,36 |

86 |

-7,90 |

|

76 |

Jewish Autonomous Region |

75,47 |

68,02 |

-3,20 |

The rating was compiled on the basis of open data from regions, so those subjects of the Russian Federation that did not disclose their GRP are not included in it.