Russia may resume development of Shtokman gas field

One of the world’s biggest gas deposits is meant to help the country enter the top five of LNG exporters

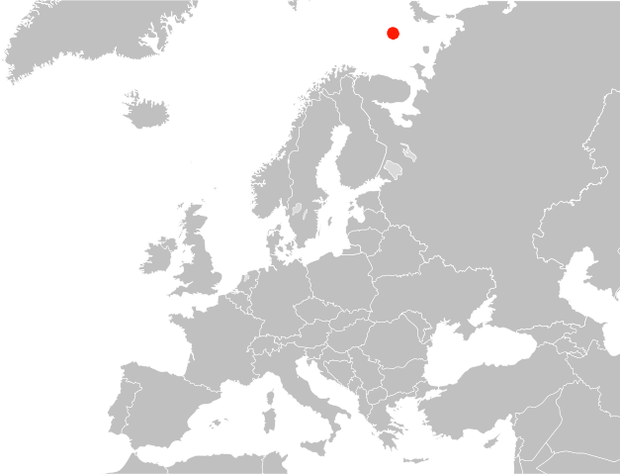

Shtokman gas field was discovered in 1988, but since then the project has stuck at the initial stage due to numerous obstacles and inconsistencies. However, it can be back on the table now, as the Kremlin aims to reach its ambitious energy goals.

The Ministry of Energy of Russia counts on the Shtokman gas field to be put onstream by 2035 to reinforce Russia's LNG ambitions of becoming a top 5 exporter, says Oilprice.com. The news was announced by Deputy Minister of Energy Pavel Sorokin at the latest session of Gas Exporting Countries Forum. The field's reserves are estimated at 3,9 trillion m3 (135 trillion ft3) of gas and 56 million tonnes of condensate.

Shtokman was found in 1988 but stayed untouched until the early 2000s when Gazprom started to consider commissioning it in earnest. Initially, it was supposed to make Shtokman the Russian LNG flagship. Total and Norsk Hydro joined the project and received 25% and 24% stakes in it respectively. However, expenses turned out to be unreasonably high due to a number of complicating factors, such as remoteness from continent, heavy Arctic conditions and complex logistics solutions.

Besides, the question was to find a buyer for Shtokman LNG. At the beginning of the project, the shareholders supposed to export gas to the United States, but as the time went on, America no longer seemed to need Russian supplies to satisfy its demand. At the same time, Europe's gas demand started to stagnate. Gazprom attempted to reorient the project and make it a traditional pipeline-destined one, with most of its output feeding into Nord Stream, but the company didn't succeed. By 2013, Norsk Hydro had left the shareholding structure. Total, which was supposed to design the first phase and build all the relevant facilities, returned its 25% stake to Gazprom in 2015, although the French company stated its willingness to return to the project.

Years after the project was put on hold, the most important question — who could become a potential consumer of the field – remains unanswered. If Gazprom exports Shtokman LNG to Asia Pacific, both shipping and transportation costs would surpass those of Yamal and other Russian LNG plants due to the field's remote location. In case of orienting the project towards Europe, the company will compete with its own Baltic LNG, a natural gas liquefaction plant in Leningrad Oblast.

Thus, Oilprice.com assumes that Russia's drive to reach its target of 83 million tonnes of LNG per year by 2035 will largely omit Shtokman, which may remain the world's biggest ''trapped'' field in the next years ahead, at least until a suitable market outlet is found.