Olga Agafetova, Federal Tax Service: ‘They evade taxes and launder money through front companies’

The representative of the Office of the Federal Tax Service of Russia in Tatarstan on what responsibility nominee directors of companies bear and how to avoid it by law

The fake management of the company can turn into excessively large debts, or even a prison term, tax authorities warn residents of Tatarstan. Today, many citizens agree to become nominal heads of companies for a very modest salary supplement, unaware of the serious risks they take on themselves. A fictitious director faces a fine of up to 500 thousand rubles, community service or imprisonment for up to 5 years. Olga Agafetova, the head of the Taxpayer Registration and Accounting Department of the Federal Tax Service of Russia in the Republic of Tatarstan, tells more about the consequences of dysfunctional “entrepreneurship” in the author's column for Realnoe Vremya.

Scammers find citizens in need of money

What are nominee managers for? Such scheme is beneficial to dishonest businessmen who through such “would-be companies” evade taxes and launder money obtained by criminal means. For their frauds, fraudsters find citizens in need of money, who are offered to become founders and heads of organisations for a reward.

Convinced of the legality of their actions, people provide their passport data and sign documents, actually having no idea for what purpose these organisations are created. After some time, citizens find out that they are the heads and founders of companies — multimillion debtors, to whom creditors and regulatory authorities make demands.

State registration of legal entities and individual entrepreneurs is a mandatory and responsible procedure. Great attention is paid to the issues of ensuring the reliability of information in state registers. Particular attention is paid to cases of doing business through front persons, the heads of such firms are individuals only formally — these are the so-called nominee directors. That is, the persons whose information about the founders, participants of the organisation or their leaders are included in the Unified State Register of Legal Entities by misleading them or even without their consent.

From a fine to imprisonment up to 5 years

People, because of ignorance of the law and for the sake of getting, as it seems to them, “easy” earnings, agree and become accomplices in a crime for which serious administrative responsibility and criminal prosecution are provided.

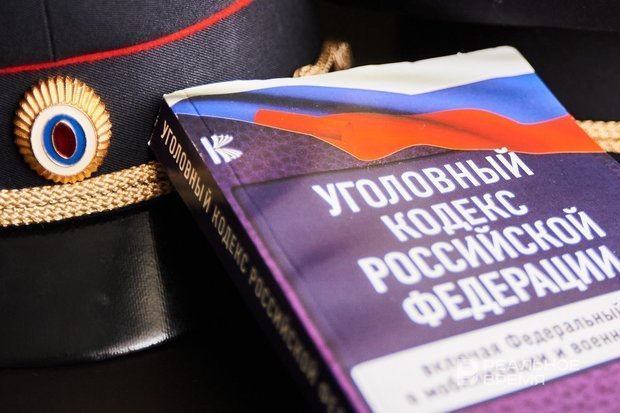

The legislation provides for criminal liability under articles 173.1 and 173.2 of the Criminal Code of Russia for the use of front persons when registering an organisation, as well as for entering information about front persons into state registers. A fictitious manager who had no real intention to manage a limited liability company is such a person. In this case, a fictitious director faces a fine of up to 500 thousand rubles, community service or imprisonment for up to 5 years. The presence of a criminal record will leave a dark mark in the biography of the “entrepreneur” for life, with such a “label” it is impossible to get a promising job in a large company, state and municipal authorities and others.

Criminal liability for the nominee director may occur during the period of organisation operation. Having no real opportunity to manage, he, nevertheless, must comply with the requirements established by law.

If, for example, an organisation headed by a fictitious head does not pay salaries to employees, he will be responsible under Article 145.1 of the Criminal Code of the Russian Federation. Here are a few more articles on which nominal managers can be prosecuted:

- violation of labour protection rules that caused death or serious harm to human health by negligence (Article 143 of the Criminal Code of the Russian Federation);

- evasion of taxes and fees from the organisation (Article 199 of the Criminal Code of the Russian Federation);

- malicious evasion from repayment of accounts payable (Article 177 of the Criminal Code of the Russian Federation);

- evasion of payment of customs duties levied from the organisation (Article 194 of the Criminal Code of the Russian Federation).

Administrative responsibility of officials is also provided for the submission of false information to the registration authority. The repeated commission of such an administrative offense, as well as the submission to the registration authority of documents containing deliberately false information, entails disqualification for up to 3 years in relation to officials.

Damage to the budget will have to be reimbursed

The Office of the Federal Tax Service in the Republic of Tatarstan urges citizens to be vigilant, not to transfer their passport data to third parties and not to sign an application for state registration if you do not plan to manage an organisation and participate in its activities. If you are a participant or, for example, the CEO of a legal entity, then from the moment of state registration you become responsible for the activities of the organisation.

Even if you are a figurehead, you are considered to be working and cannot receive unemployment benefits.

Also, if, under the leadership of the nominee director, the PLC causes damage to the budget or other creditors, it will have to be reimbursed in full.

Do not forget that the head is responsible for all the actions of the organisation in civil, tax, labour and other legal relations. Fines for possible violations are imposed not only on the PLC itself, but also on the director.

Doing business through front persons, as well as being a front person, is a violation of the law. If you still got into such a life situation and became a victim of fraudsters, in order to avoid further negative consequences for yourself and your loved ones, as well as if you have information about people who carry out services for the fictitious registration of legal entities, contact the law enforcement and tax authorities of Tatarstan.

Citizens who have realised their criminal act, the legislation on state registration allows them to withdraw the application for state registration of a legal entity sent to the registration authority. To do this, it is necessary to send an objection to the registration authority of the interested person regarding the upcoming state registration of amendments to the charter of a legal entity or the upcoming entry of information into the Unified State Register of Legal Entities in the form P38001.

If an organisation is already registered in the name of a citizen, then in order to prevent the use of the company in scheme operations, it is necessary to provide an individual's statement about the unreliability of information about him or her in the Unified State Register of Legal Entities in the form P34001.

Reference

The author's opinion may not coincide with the position of the editorial board of Realnoe Vremya.