Warehouse rentals soar above the market in Kazan

Volume of industrial real estate commissioning in Tatarstan has decreased by 14%, but rental rates jumped by 6% in the summer

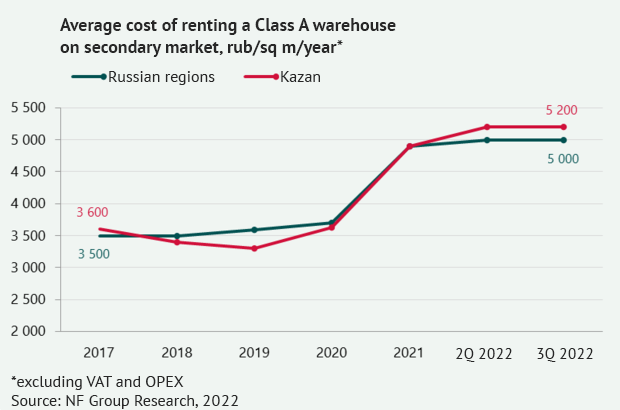

Tatarstan has outstripped the rest of Russia's regions in terms of growth rates of rental rates for warehouse real estate. The rental rate for ready-made class A areas has increased by 6% to 5,200 rubles/sq. m/year triple net at an average level of 5,000 rubles/sq. m/year. “Some owners are raising excessively aggressively. There is not yet such a thing that they demand Moscow rates of 1000-1200 rubles per square metres a month, but they are already offering 660-650 rubles," market participants told Realnoe Vremya. Alabuga SEZ alone is dumping, which offers a loyal rate of 95 rubles per square metre for its residents.

Summer jump by 6%, or How Tatarstan breaks away

After a rapid recovery of rental rates after the pandemic, the owners of Tatarstan logistics parks have set themselves up for a new record. According to the results of 9 months of the year, the rent in the secondary warehouse real estate market reached a historic peak and was fixed at 5,200 rubles/sq. m/year triple net. This is by 6% higher than the average in other Russian regions. Such data was provided to Realnoe Vremya by analytics of NF Group (ex. Knight Frank Russia).

As follows from the comparative chart of experts, rental rates in the republic began to break away long before the summer. At the end of 2021, the average rental price stabilised at the level of 4900 rubles/sq m/year after a general rapid growth in 2020-2021. Unlike most regions, Tatarstan experienced another surge in growth. As follows from the chart of NF Group, rental rates then “did not calm down”, but rose by another 6% to the average values. It is only on this trajectory that the rates levelled off and have been held at this level for the last three months. It is still unclear whether we should expect a traditional surge in prices by the end of the year.

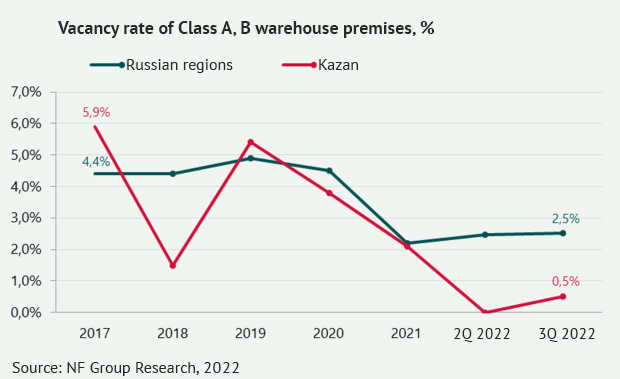

According to Elena Stryukova, the authorised representative of the Russian Guild of Managers and Developers in Tatarstan, the managing partner of Perfect Red, the average rate for vacant blocks in Class A is 614 rubles per square metres a month (+17% by the beginning of the year); in class B — 370 (+5% by the beginning of the year) rubles per square metres a month. According to her, since the beginning of the year, the vacancy rate in Kazan warehouse complexes has decreased from 12,2% to 2,5%. In new warehouse projects, the rental rate can reach 900 — 1,000 rubles per square metres a month, including VAT.

With the withdrawal of a number of international companies from the Russian market, the share of vacant premises in the capital region has increased. But Tatarstan, and Kazan in particular, has not been affected by the recession. According to the expert, the current demand significantly exceeds the available supply and this situation has been developing for the last 2 years. “So, even if some blocks are released, they will be immediately rented by companies from the 'waiting list'," she noted.

There are no free spaces

What triggered the summer jump in rates? Most experts are inclined to believe that the main reason for the increase in rental prices was an acute shortage of high-quality space in the republic. According to Konstantin Fomichenko, the partner, regional director, director of the Department of Industrial and Warehouse Real Estate of NF Group, the higher rental cost in Tatarstan is partly explained by the existing shortage of high-quality warehouse space.

The total volume of high-quality supply in Tatarstan is about 951 thousand square metres. But this year the owners have introduced fewer facilities. “According to the results of 9 months of 2022, 83,4 thousand square metres of warehouse space were commissioned in the Republic of Tatarstan, which is by 14% less than the same indicator for the whole of 2021," the source said.

According to Elena Stryukova, the total supply of high-quality industrial and warehouse real estate in Kazan is currently represented by 17 objects and amounts to about 434 thousand square metres. There are also 9 own logistics complexes with a total area of 256 thousand square metres and 9 industrial parks with a land area of 789,3 hectares. The two largest warehouse complexes are Biek Tau and Q-Park.

In the first half of 2022, the market of production, warehouse and logistics complexes was replenished with new facilities:

- At the end of June, one of the largest pharmaceutical holdings in Russia, Protek, opened its largest logistics centre on 33 Krutovskaya Street in Kazan. The area of the object is over 15 thousand square metres. Investments amounted to 1,9 billion rubles. Protek pharmaceutical holding includes the distribution business of Protek Integration Centre JSC, the pharmacy chains Rigla, Bud Zdorov!, Zhivika, and the production assets PharmFirma Sotex, Protein Contour, and Rafarma.

- In June, the construction of the new elevator Sviyazhsk-ZernoProduct was launched on the territory of the Sviyazhsk Interregional Multimodal Logistics Centre (SMMLC). The investor is a resident of SMMLC — August-Agro company. The design capacity of the elevator will be 112,5 thousand tonnes of one-time grain storage. The cost of the project is estimated at 2,4 billion rubles.

- ASG investment group of companies has announced the start of construction of Vostok industrial park. The park is planned to be located between the M7, Mamadyshsky and Voznesensky tracts under construction. The project provides for the placement of light industry facilities of a low hazard class, logistics, distribution complexes on this territory. Wholesale trade facilities, construction hypermarkets and administrative offices will also be located on the site. The territory of the park is 173 hectares, according to preliminary calculations, the project will generate at least 17 thousand new jobs.

- KazanExpress is completing the construction of the first building of the new fulfillment centre warehouse within the framework of the Sviyazhsk Interregional Multimodal Logistics Centre. The Tatarstan marketplace declares the construction readiness of the facility — 90%. According to the company, the completion of construction works is planned in the third quarter of 2022. The usable area of the facility will be 120 thousand square metres. The first stage of the new logistics centre will provide more than 3 thousand jobs. In the future, it is planned to build 7 more warehouse buildings with a useful area of 1 million square metres.

- A new small block with an area of 1500 square metres was built on F. Amirkhana Street as part of Ringo. It has already been rented out.

According to the results of the first nine months of 2022, 83,4 thousand square metres of warehouse space were commissioned in the Republic of Tatarstan, which is by 14% less than the same indicator for the whole of 2021. The main part of the completed construction occurred at the end of the 3rd quarter of 2022, when two additional warehouse buildings Synergy-2 were introduced in Alabuga SEZ with a total area of 75,8 thousand square metres. Thus, the total volume of high-quality supply in Tatarstan is 951 thousand square metres.

According to Perfect RED, over the past 5 years, the share of tenants working in the e-commerce segment has increased from 18% to 38%.

Secondary market dominates in Kazan, in Yelabuga and Zelenodolsk — new housing

Another characteristic feature of the Tatarstan industrial real estate market is that new warehouse resources are actively developing in Zelenodolsk and Yelabuga, while secondary real estate dominates in Kazan. It was Yelabuga that accounted for the bulk of the completed construction this year. At the end of the third quarter, two additional warehouse buildings Synergy-2 were commissioned in Alabuga SEZ with a total area of 75,8 thousand square metres.

Before that, in 2020-2021, one of the largest industrial facilities was built in Tatarstan — Ozon and Wildberries distribution centres with a total area of 38 thousand and 100 thousand square metres, respectively. Online trading has played a significant role in the development of this market — 43% of all transactions in the republic were concluded with the participation of e-commerce players. Up to 35% of the total supply of the region is used for the own needs of end users and about 15% is built in the built-to-suit format (construction of warehouses for the needs of a specific customer — editor's note). The rest of the space is offered on the market speculatively.

Most participants in the warehouse real estate market agree that the most acute shortage of space is observed in Kazan. Here, over the past 2 years, industrial and warehouse territories have been released for renovation by residential complexes. Warehouses in the area of Rodina Streets have been almost completely withdrawn, and now their owners are preparing to move to Portovaya Street.

“Indeed, there is a shortage of production and warehouse space in Kazan. There is no such phenomenon in office premises," said Marat Mazitov, the director of the Melita-Arenda Technopark. “We've just met with a representative of a Moscow company that is preparing to open a branch. This meeting confirms that there is a big deficit in Kazan. Nonresident companies are ready to rent space on the second and third floors if there are lifts, since everything is occupied on the first floors!”

Are the locations taken over by Ozon and Wildberries suppliers?

The interlocutor of the publication believes that the acute shortage is caused not by the renovation of territories in Kazan, but by the hype demand of suppliers of Ozon and Wildberries marketplaces. “If two or three years ago there were almost no such entrepreneurs, now they are seizing small premises in Kazan from 50 metres to 1200 square metres. It was the participants of e-commerce that spurred the demand for warehouses in Kazan. After all, in order to deliver the goods to the distribution warehouse in Ozon and Wildberries, entrepreneurs must pack the goods in their warehouses according to international standards," Mazitov explained. According to him, since the beginning of the year, rental rates for warehouses in Kazan have increased by even more than 6%.

“Now regional furniture distributors are starting to enter Kazan, but not everyone can find suitable warehouses," confirms the broker for warehouse real estate of Delovye Linii company. In his opinion, the peak demand of Ozon and Wildberries suppliers for warehouses in Kazan is already over. These market players have already settled in different parts of Kazan, their needs are met. So now the largest federal companies are showing the greatest activity: “They are looking for warehouses for rent and cannot find suitable areas in the format.”

According to the expert, the sharp increase in rental rates is due to that many retailers are starting to return to Kazan after the coronacrisis:

“But there is nowhere to stop — everything is busy. I get three or four requests a week for the lease of warehouses with an area of 50 square metres," says the broker. “Preference is given to places along the M 7 road, in the Kirovsky district of Kazan. The zones in the Volga Region have ceased to interest, since there is no exit to the federal highway.”

Who is raising aggressively

According to him, some owners of industrial and warehouse premises “are raising rates excessively aggressively — there is not yet such a thing that they put up at Moscow rates of 1000-1200 rubles / sq m a month, but they are already offering 660-650 rubles.” Basically, such a price tag is presented by the owners of new warehouses and position these complexes as Class A. As a rule, they are built in industrial parks. “I think that the rate is not increased, it is quite adequate to the cost of construction. Because the cost of construction is growing," the expert believes.

Another factor in the increase in rental rates was the renovation of industrial zones. “This is due to the construction of residential complexes. We can say that they are aggressively seizing the territory of the city, including warehouses and production facilities are being demolished. The owners of these premises are forced to give up their positions, receive compensation, but give up the plots. And their tenants have to look for other areas. Someone moved to the Kirovsky district of Kazan or Zelenodolsk district. “Now they have started to leave Portovaya," commercial real estate brokers in Kazan say. No one can predict what will happen next.

Yelabuga price tag — from 95 rubles per square metre

Against this background, the Alabuga SEZ is strongly “dumping” rental rates. According to the press service of the special economic zone, storage areas are offered for residents at a rate of 95 rubles per square metre.

“We are interested in manufacturers not leaving the Russian market and are ready to provide all opportunities to potential residents in the form of production facilities and benefits," the company told Realnoe Vremya.

At the moment, there are about 180 thousand square metres of finished production areas in Alabuga. In addition to this, another 200 thousand square metres of production facilities will be put into operation next year. The SEZ also builds warehouses in the built-to-suit format and finances projects up to 50% of CapEx (capital expenditures). An example is the construction of the plant for the production of PAN-precursor of Umatex company (Rosatom State Corporation), where Alabuga became a key partner by investing 3 billion rubles. The need for new areas for residents is still high.

“Even before commissioning, 80% of the premises were booked by investors and residents. Already today, all the areas are reserved," the press service of the zone's management company reported. “We see the demand and understand how relevant the conditions provided by Alabuga are for investors. Ready-made production areas are a large window of opportunity for domestic manufacturers to start implementing projects where they only need to get their own equipment and start producing products.