Why Russia needed 'secret' $3bn bonds

In the expert’s opinion, not comeback of Russian capitals but protection of stricter sanctions is the point

In 2018, Russia will issue anonymous bonds with the volume of $3 billion. According to President Vladimir Putin, it's needed to help the capital return to Russia whose outflow has been over $300 billion in the last 5 years. The experts surveyed by Realnoe Vremya think not comeback of Russian capitals but protection of stricter sanctions is the point.

$3 billion for secret investors

President Vladimir Putin told about the issue of 'secret' bonds to repatriate capital to Russia at a pre-New Year meeting with entrepreneurs in the Kremlin on 21 December. The tool will appear in 2018 already, this issue was discussed by the government and the Central Bank. And now parameters of the issue need to be discussed. The issue volume can total $3bn.

According to Putin, very big businesses that are nervous because of a possible expansion of western sanctions turned to the Russian jurisdiction asking to find a mechanism to return money – it became unsafe to hold capitals abroad. The new set of sanctions can affect a bigger number of Russian companies. In addition, the ban on purchasing federal bonds of the Russian Ministry of Finance by American investors s under discussion. Minister of Finance Anton Siluanov said nowadays big part of federal bond buyers were foreigners.

Several experts suppose if Americans are forbidden to invest in Russian state papers, it will lead to their mass sale and provoke the ruble's fall. Others think it's an exaggeration because the share of American companies among federal bond purchasers is not so big.

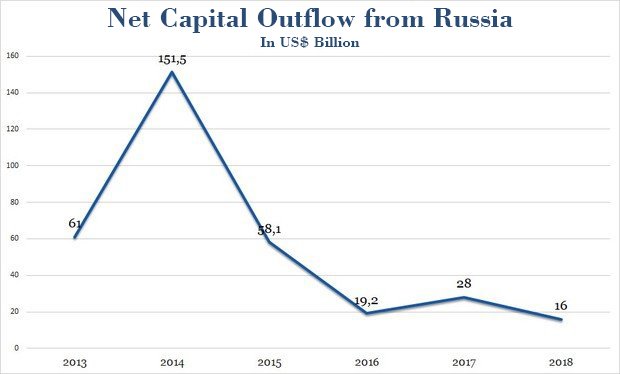

Anyway, the bond issue should smooth the consequences of the net capital outflow from Russia, which has just increased in recent time. According to the Central Bank's data, $28bn went in less than a year, it is 3,4 times more than last year. In December, Central Bank Chairwoman Elvira Nabiullin made a forecast on capital outflow in 2018: it can amount to $16 billion, though earlier it was estimated at $10 billion. In 2016, the Central Bank says $19,2bn left Russia and the record outflow was in 2014 – over $151bn.

Watering hole during great drought

Business asked the Kremlin to enable to return money to Russia anonymously. This is why it is supposed that new state bonds can be different from standard. It will be possible not to reflect them in Clearstream and Euroclear international accounting systems, thanks to which authorities of foreign countries won't know about bond purchasers.

'Secret' bond rates are likely to coincide with the market – otherwise, there won't be any sense in these papers, according to the experts. With the Central Bank key rate's current level, the rate of new obligations can total 6,5-7%. In general, the experts think the new tool is needed to them to protect from the ban on purchasing Russian state bonds by foreigners.