‘The creation of independent payment system will be discussed at BRICS Summit in Kazan’

What financial and technological initiatives will be considered at the main site of the association

New proposals will be announced on the development of a multipolar technological and financial world, as well as on determining Russia's role in this process this autumn in Kazan, on the eve of the BRICS Summit. Ravil Akhtyamov, a columnist for Realnoe Vremya newspaper, digital economist, writes in his article about what these proposals may be.

Independent payment system and cooperation in the field of digital economy

In my opinion, some financial and technological initiatives may be considered at the BRICS 2024 summit. First, it is the creation of an independent settlement payment system within the framework of the BRICS, which would be based on the most modern technologies such as digital currencies and blockchain. The system should be comfortable for states, the population and businesses, not require serious costs and be outside politics.

I propose that the Russian government extend the special regime to special economic zones or special administrative regions, register banks or fintech companies there for mutual settlements in cryptocurrencies. To harmonise the relevant legislation with the People's Republic of China and other BRICS countries. Such measures would help solve problems with the transfer of payments to China.

Secondly, it is possible to consider an initiative to develop a mechanism for the Pool of conditional foreign exchange reserves, primarily in terms of the use of currencies alternative to the US dollar.

Thirdly, it is the deepening of cooperation in the field of digital economy, information and communication technologies and innovations. An extensive set of tasks, including the development of electronic commerce, the introduction of artificial intelligence, the processing of large amounts of data and the Internet of Things, assistance in the organisation of technology startups.

How can the BRICS countries ensure their technological independence?

To achieve the financial sovereignty of the BRICS countries, the following methods can be used:

- Development of technological solutions providing access to strategic resources and creation of a single technology bank at the BRICS site.

- Conducting joint geological exploration, development of technologies, financial instruments, formation of a knowledge base and competencies, technological and human potential.

- Preparation and approval of an intersectoral strategy to ensure energy stability and achieve sustainable development goals.

- Transfer of competencies and knowledge exchange with partners. For example, the creation of independent e-government systems, the use of advanced developments to ensure energy and food security.

- Formation of a common strategy to meet the needs of the BRICS countries and partner countries with natural resources and technologies.

Ways to achieve financial independence of the BRICS countries

To achieve the financial sovereignty of the BRICS countries, the following methods can be used:

- The expansion of the use of national currencies in mutual settlements. This will help reduce the dependence of economies on fluctuations in the exchange rate of reserve currencies and commodity prices.

- Creation of a single financial space based on the New BRICS Development Bank (NDB) and a Pool of foreign exchange reserves. This will allow developing countries to attract cheap loans and give them the opportunity to abandon the services of the World Bank.

- Participation in the reform of the structure of the International Monetary Fund. The BRICS countries propose to reform the quota system at the IMF in such a way that developing countries have at least a small weight in decision-making.

- The development of a system of mutual multilateral settlements that will allow international financial flows to be directed to the development of priority industries at the interregional level.

- Cooperation in the field of new financial technologies and information security in the financial sector.

It is important to note that the creation of a monetary and financial union requires detailed discussion, which can cause disputes and dissatisfaction in a number of countries.

BRICS states' international settlement system under sanctions: digital ruble

The BRICS countries (Brazil, Russia, India, China and South Africa) are discussing the possibility of abandoning the dollar in international settlements. BRICS conducts trade worth $260 billion without the US dollar. The alliance also calls on other developing countries to abandon the dollar and make cross-border payments in national currencies.

Dedollarisation is actively gaining momentum. For example, Egypt, South Africa, Nigeria, Ghana, Cameroon, Senegal, Algeria and Saudi Arabia have begun withdrawing their national gold reserves from the United States.

The main idea of creating such a supranational currency is aimed at simplifying foreign trade settlements and minimising the risks associated with settlements in US dollars or euros.

However, a complete abandonment of the dollar is unlikely at the moment, since the United States still retains a dominant position in global financial markets.

Instead of creating a single currency, the BRICS countries are discussing the launch of a supranational unit of account in which the cost of commodity supplies can be expressed. At the same time, the BRICS unit of account will not become a currency in the usual sense. It will be used only by participants in foreign economic activity.

The upper (international) level of digital payments will use the infrastructure of the BRICS Digital Bank and the BRICS Pay payment system. The digital yuan (e-CNY) will be used as the digital currency of central banks.

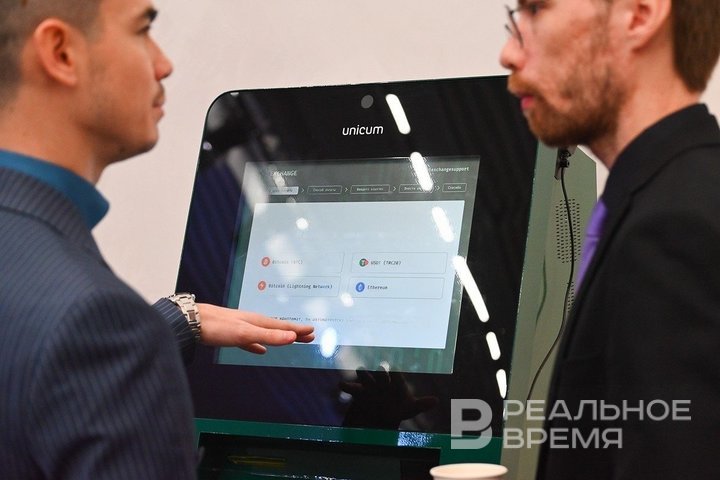

In the context of tightening sanctions pressure, the Russian Federation has the opportunity to use the national digital currency for settlements with the BRICS countries. In the near future, the creation of a blockchain-based BRICS Pay international settlement system is planned. A decentralized multi-currency mechanism will allow bypassing Western sanctions, strengthen the economic influence of the international association and accelerate the emergence of a supranational currency.

BRICS Pay is an international payment system that offers banks and other financial institutions an internet banking and mobile banking platform.

System features:

- It allows the user to manage their account around the clock from any computer or mobile device, pay for various services and goods, transfer funds, pay taxes and much more.

- It is based on blockchain technology.

- It gives the opportunity to make calculations using digital financial assets: BRICS tokens — NSRT and digital currencies of the BRICS countries.

The purpose of the system is to reduce the cost and complexity of international payments, as well as to provide a safe and reliable way to pay for goods and services.

BRICS Pay is a joint venture of the BRICS countries (Brazil, Russia, India, China and South Africa). The pilot project was launched in South Africa in early April 2019. It is expected that BRICS Pay will have been fully operational by 2025.

The project of a single digital currency would be more relevant, given the experience of Brazil, China, and now Russia in creating a digital national currency.

The most promising is the creation of the payment system of the BRICS+ countries based on the basket of digital currencies of the central banks (CBDC) of the BRICS+ member countries.

Digital ruble and Kazan

The digital ruble is the third form of the ruble that the Bank of Russia is going to issue in addition to cash and non-cash rubles. It is a unique electronic code that is stored in an electronic wallet on the Central Bank's platform.

In August 2023, the first stage of testing the digital ruble started in Kazan. In the capital of Tatarstan, 20 people have the opportunity to use the digital ruble, but they can spend it only in one of the catering establishments where the appropriate infrastructure is built.

13 banks participate in the pilot project: Alfa-Bank, Ak Bars Bank, VTB, GPB and others. All of them have branches in Tatarstan.

To date, about 600 wallets in digital rubles have been opened, and so far users can make transfers to each other and pay for purchases at 30 retail outlets. It is expected that the population will have access to digital rubles no earlier than 2025.

Kazan also has the Regional Development Center “Kazan”, a division of the Central Bank of the Russian Federation, established in August 2017 as part of the implementation of the IT Development Strategy.

The main purpose of the center's activities is the creation, development, testing and documentation of systems that ensure the processing of payment and accounting and operational information, information on issue and cash transactions, and cash circulation in the Bank of Russia. From the description, it can be concluded that Kazan is actively involved in the creation and implementation of the digital ruble project, as well as in strengthening the technological and financial sovereignty of the country.

Tatarstan